The cryptocurrency landscape is buzzing with anticipation as analysts project a continued bull cycle that could last well into 2025. With Bitcoin (BTC) price forecasts ranging from 0,000 to over 0,000, there’s a palpable sense of optimism. However, looming concerns about a potential recession in the United States threaten to cast a shadow over this promising outlook.

Arthur Breitman, co-founder of the Tezos blockchain, highlights an inherent risk within the crypto ecosystem, referring to its “circular” nature. This concept suggests that many cryptocurrency investments are driven more by speculation than by tangible economic activities. Breitman argues that while decentralized finance (DeFi) systems aim to provide financial services, they often recycle funds within the sector without generating real-world value. “If the only reason people want to buy your token is because they feel other people will want to buy this token, that’s circular,” he explained to Cointelegraph.

The industry’s dependence on speculative buying could undermine its growth potential, contrasting sharply with established stock markets founded on revenue-producing businesses.

Recent events in the crypto world, such as the significant outflows from Solana that exceeded 5 million due to the fallout from memecoin scams, underscore these vulnerabilities. Investors have shown a propensity to seek refuge in more established cryptocurrency options amidst the chaos of meme-driven projects.

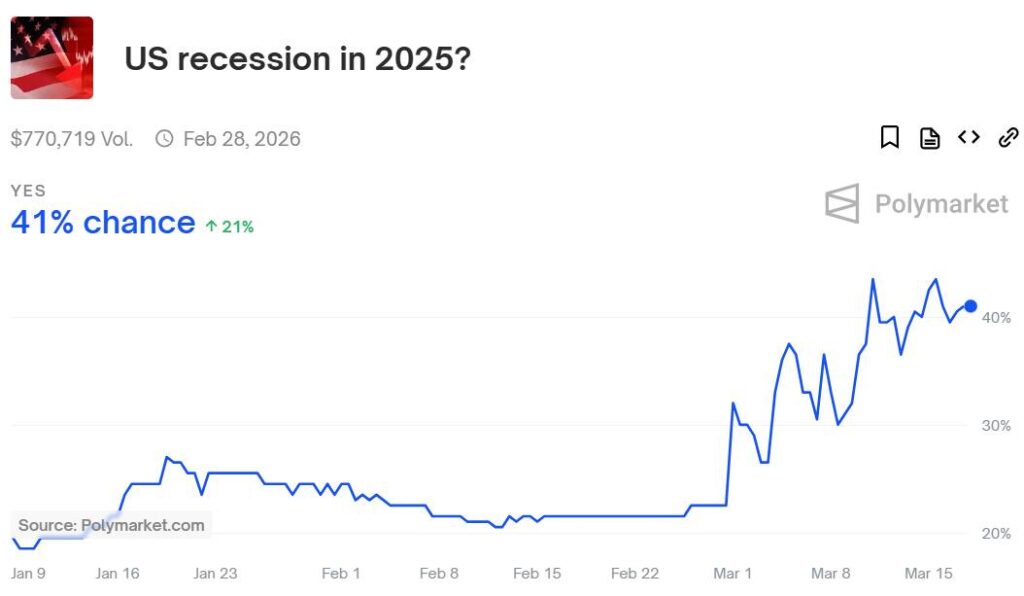

On the macroeconomic stage, concerns about a U.S. recession loom larger, driven by a host of traditional economic indicators. Breitman noted that while positive trends could support the crypto market, caution is warranted as a recession could trigger broad sell-offs similar to what was observed during tech stock downturns. In fact, over 40% of participants in decentralized prediction markets are now anticipating a recession this year, a steep increase from just over 20% a month prior.

As the crypto industry continues to grapple with its internal dynamics and external economic pressures, the coming months will be crucial in determining whether the predicted bull cycle solidifies or falters.

Key Insights on Cryptocurrency Trends and Risks

The landscape of cryptocurrency is continuously evolving, and several factors are influencing its trajectory. Understanding these factors can impact readers’ investment decisions and their overall economic outlook.

- Ongoing Bull Cycle Expected to 2025:

- Analysts anticipate that the current crypto bull cycle will persist until the end of 2025.

- Bitcoin (BTC) price forecasts suggest potential values ranging from 0,000 to over 0,000.

- Concerns Over U.S. Economic Recession:

- The looming threat of a U.S. recession could negatively impact cryptocurrency valuations alongside traditional markets.

- Over 40% of market participants now expect a recession this year, indicating a growing sentiment of caution.

- Circular Economy Risks in Crypto:

- Arthur Breitman, co-founder of Tezos, highlights the “circular” nature of the crypto economy as a significant risk.

- Many projects in decentralized finance (DeFi) finance other DeFi projects without generating real-world value.

- This contrasts sharply with the traditional stock market, which is driven by revenue-generating businesses.

- Impact of Memecoins and Liquidity Issues:

- The recent surge in memecoins has caused significant capital outflows from more established cryptocurrencies like Solana.

- This raises concerns about liquidity within the crypto market, particularly during economic uncertainty.

- Correlation with Tech Stocks:

- The cryptocurrency market exhibits a significant correlation with tech stocks.

- A recession affecting tech stocks may lead to broader sell-offs in the crypto space.

“There’s a lot of bullish winds for the market, but there’s also a lot of traditional recession indicators which have been flashing for a while now.” – Arthur Breitman

Analyzing the Current Crypto Landscape Amid Economic Fears

As the cryptocurrency market approaches a crucial phase, analysts remain cautiously optimistic about a bull cycle that could extend into late 2025, with soaring price predictions for Bitcoin (BTC). However, this positive outlook is tempered by looming concerns over a potential U.S. recession and the industry’s inherent “circular” economy, as articulated by Arthur Breitman, co-founder of Tezos. These factors present both opportunities and threats for cryptocurrency investors and stakeholders alike.

Competitive Advantages: The prevailing sentiment among crypto analysts suggests robustness in the market, with projections for Bitcoin reaching between 0,000 and 0,000. This optimism could attract institutional investors looking for high returns, tapping into a market that, despite recent corrections, appears poised for continued growth. Additionally, the crypto industry’s unique traits—such as decentralization and innovation in finance—serve as a magnet for tech-savvy investors and young millennials, eager for alternative investment avenues. Furthermore, a rising stablecoin supply could indicate a mid-bull cycle, suggesting that the market is not on the brink of a collapse but is merely correcting itself.

Competitive Disadvantages: On the flip side, the fear of a recession in the U.S. poses significant risk, as economic downturns often lead to broader market sell-offs, impacting even the most resilient cryptocurrencies. The interconnection between crypto and tech stocks means that adverse macroeconomic conditions could lead to a mass exodus of funds from cryptocurrencies, especially if investors pivot towards safer assets during volatile times. Moreover, the crypto industry is grappling with its own internal challenges, particularly highlighted by the recent volatility associated with memecoins, which have caused liquidity drain from more established cryptocurrencies like Solana. This raises questions about the sustainability of the entire sector, where speculative trading can undermine investor confidence.

Ultimately, these dynamics could benefit early adopters and savvy investors who are willing to navigate the complexities of the market while thoughtfully positioning themselves. Conversely, less experienced investors who join the fray during exuberant moments may find themselves vulnerable should a recession materialize or if further memecoin drama unfolds, underscoring the necessity for thorough due diligence in these uncertain times.