In a striking display of long-term faith in the Solana blockchain, an anonymous crypto enthusiast has staked a mere 5 cents worth of the Solana token (SOL) for an astonishing 3,000 years. This remarkable event was highlighted by blockchain analytics firm Arkham Intelligence, which noted that the staked amount won’t be unlocked until the year 5138. This unique decision, posted on X, caught the interest of many in the cryptocurrency community, sparking discussions about the bold nature of such a commitment.

“Legacy staking is more than locking assets; it’s a mindset,”

says Vincent Liu, chief investment officer at Kronos Research, emphasizing the value of holding onto assets through various market cycles. Liu suggests that this action represents a belief in the long-term potential of the Solana ecosystem. In fact, he notes that if the staked SOL sees even modest annual growth, the eventual return could be extraordinarily high due to the power of compounding interest over millennia.

At present, SOL is trading around $102, with projections from asset management firm Bitwise suggesting it might leap to between $2,300 and $6,000 by 2030. However, the true worth of the staked SOL when it finally unlocks in 3,000 years is a topic of speculation, as the dynamics of cryptocurrency value can shift tremendously over time.

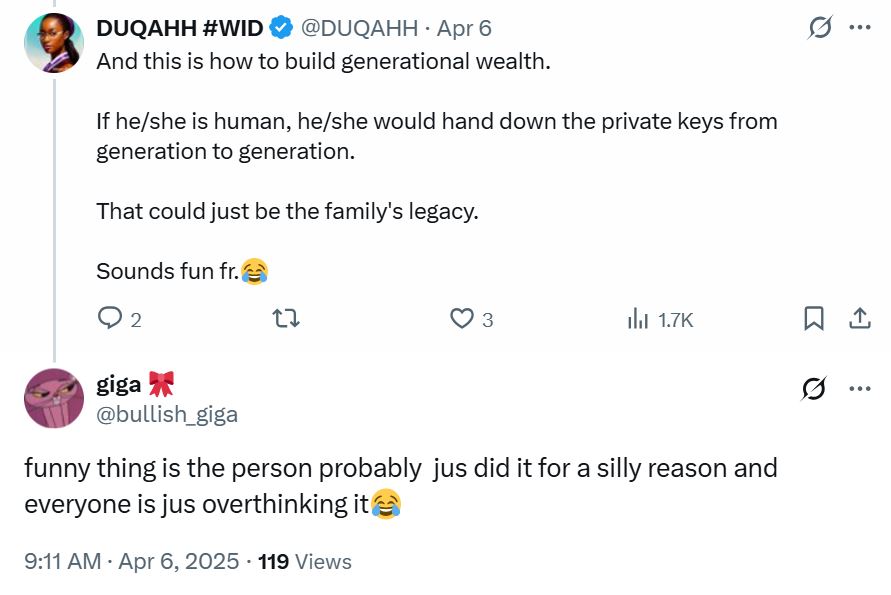

Moreover, this long-term staking strategy has led to various interpretations among community members. Some view it as a metaphor for building generational wealth, while others believe it might simply be a publicity stunt devoid of any tangible long-term strategy.

“What will 3,000 years from now look like?”

muses Kadan Stadelmann, chief technology officer at blockchain platform Komodo. He questions the sustainability of human existence and technology over such a span, adding an interesting philosophical layer to the conversation about the future of cryptocurrencies.

As the crypto landscape evolves, the approaches users take with their assets—like staking—inspire both curiosity and debate, reflecting broader themes of commitment and community trust within the rapidly changing world of digital currencies.

Long-Term Staking in Cryptocurrency

The recent actions of a crypto user staking Solana (SOL) for an extended period raises important considerations about investment strategies in the crypto market.

- Historic Staking Duration: A user staked $0.05 SOL for 3,000 years, indicating a strong belief in Solana’s long-term potential.

- Symbolic Significance: This staking decision is viewed as a message of confidence in Solana’s ecosystem rather than a financial strategy.

- Long-Term Conviction: Experts emphasize the importance of holding assets through market cycles to build long-term legacies in crypto investments.

- Potential Financial Impact: If SOL appreciates at a modest rate, the future worth of the staked amount could be substantial due to the power of compound interest.

- Generational Wealth: Users speculate that such long staking might be aimed at creating wealth that transcends generations.

- Market Comparisons: SOL’s staking rewards are notably higher than other major cryptocurrencies like Cardano (ADA) and Ether (ETH), which could influence user preferences.

- Future of Blockchain: Questions arise about the sustainability and relevance of current cryptocurrencies, like Solana, over millennia.

- Meme Culture: Some consider this 3,000-year staking plan a meme or stunt, reflecting the playful and speculative nature of the crypto community.

- Recent Profitability: Significant profits reported from earlier staking initiatives may encourage similar moves by other investors.

The implications of these points may influence readers considering long-term investment strategies in cryptocurrencies, encouraging them to think beyond short-term gains and consider the evolving landscape of digital assets.

Long-Term Staking: A Bold New Strategy in the Crypto Landscape

The recent news about a crypto user staking just $0.05 worth of Solana (SOL) for a staggering 3,000 years has sparked significant interest within the cryptocurrency community. This unconventional move, analyzed by Arkham Intelligence, has set the stage for a comparative exploration of staking practices across the blockchain space, emphasizing their strategic merits and potential drawbacks.

First, let’s highlight the competitive advantages of this long-term staking approach. By locking in funds for a millennia-long period, the individual showcases strong conviction in Solana’s long-term viability, a sentiment echoed by industry experts like Vincent Liu of Kronos Research. Such a strategy positions this user to weather market volatility and capitalize on compound growth, which could yield astronomical returns if Solana’s value appreciates consistently over the centuries. This long view is particularly appealing as it counters the perennial trend of chasing quick gains that often leaves investors vulnerable to market fluctuations.

In contrast, staking practices in other prominent cryptocurrencies such as Cardano (ADA) and Ethereum (ETH) offer lower initial rewards, usually capped at a maximum of 8% and 7% respectively. While these projects boast robust ecosystems and ongoing development, they haven’t quite pierced the imagination with such audacious staking durations, which raises the question: are mid-term strategies falling behind in an age that increasingly favors bold long-term visions?

However, the long staking period also comes with clear disadvantages. From a practical standpoint, committing funds for 3,000 years could deter many investors who are skeptical about the future of any blockchain platform. Additionally, the unpredictability of technological and societal advancements over such an extended timeline raises concerns about the platform’s sustainability—will Solana even exist in 3,000 years? This risk may have a chilling effect on traditional investors who prefer to play it safe.

Interestingly, this move could benefit younger, risk-tolerant investors or crypto enthusiasts looking to make a sensational statement about wealth generational strategies. For them, this audacious staking could serve as a metaphorical call to arms: a reminder that the true value of crypto investing lies not in quick returns but in the potential for transformative financial legacies. Yet, the strategy could just as easily create problems for those not fully onboard with Solana, leading to potential skepticism or alienation within the broader crypto community.

As we delve deeper into the nuances of staking across different platforms, it’s essential to keep an eye on how such long-term commitments might shift the dynamics of cryptocurrencies in the coming decades. Where do Solana’s ambitious strategies lead? Only time will tell, but the implications could be far-reaching for both investors and the ecosystem as a whole.