The cryptocurrency landscape saw a remarkable resurgence as investment interest surged in cryptocurrency exchange-traded products (ETPs) last week. According to the latest data from CoinShares, global crypto ETPs experienced their third-largest inflow on record, accumulating $3.4 billion during the trading week of April 21–25. This uptick marks the highest inflow level since December 2024 and is just shy of the all-time peak of $3.85 billion recorded in the first week of December.

In this week of growth, Bitcoin (BTC) emerged as the star performer, breaking past the significant psychological price point of $90,000 for the first time since early March. The resurgence in Bitcoin’s value fueled an impressive $3.18 billion influx into BTC ETPs, effectively reversing all outflows seen earlier this month. With year-to-date inflows now totaling $3.7 billion, Bitcoin’s assets under management (AUM) have swelled to an impressive $132 billion, contributing to the overall global AUM of crypto ETPs rising to $151.6 billion.

“The fresh inflows can be linked to concerns over tariffs impacting corporate earnings along with a weakening US dollar, which are shifting investor focus towards safe-haven assets,” explained CoinShares’ James Butterfill.

While the overall sentiment in the crypto ETP space was bullish, Solana (SOL) bucked the trend, experiencing $5.7 million in outflows. Conversely, Ether (ETH) also benefitted from renewed interest, gaining $183 million after a period of eight weeks of outflows. Other altcoins like Sui (SUI) and XRP also saw notable increases, attracting $20.7 million and $31.6 million in inflows, respectively.

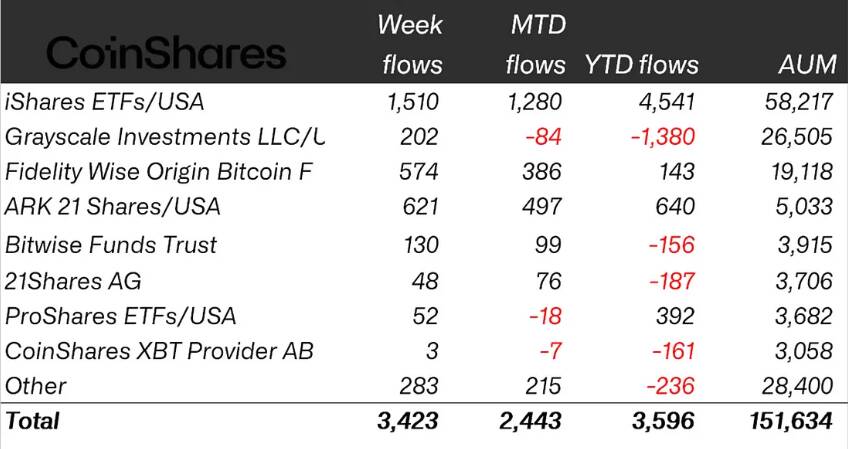

The inflows were widespread across major issuers in both the United States and Europe, with BlackRock’s iShares ETFs leading the charge with $1.5 billion in new investments. Other key players, including ARK and Fidelity, followed with $621 million and $574 million, respectively. Despite this week’s surge, some firms like Grayscale still experienced notable outflows, further reflecting the mixed sentiment among various crypto fund managers.

As the market continues to evolve, these movements indicate a significant shift in investor behavior and confidence in the cryptocurrency market, highlighting the complexities and dynamics of this fast-paced sector.

Cryptocurrency Exchange-Traded Products (ETPs) Inflows Surge

The recent surge in cryptocurrency exchange-traded products (ETPs) inflows reflects renewed investor interest and market dynamics that can significantly impact individual investors and the broader financial landscape.

- Record Inflows

- The crypto ETPs experienced their third-largest inflows on record at $3.4 billion for the week ending April 25, marking a notable rebound since December 2024.

- This level of inflows was just 13% below the all-time high of $3.85 billion recorded in early December 2024.

- Bitcoin Dominance

- Bitcoin (BTC) ETPs attracted $3.18 billion, covering prior outflows and extending year-to-date inflows to $3.7 billion.

- BTC’s prices surpassed the $90,000 mark, generating renewed bullish sentiment among investors.

- Impact of Ether and Altcoins

- Ethereum (ETH) ETPs saw a recovery with inflows of $183 million, ending an eight-week streak of outflows.

- Other altcoins like Sui (SUI) and XRP also reported positive inflows, indicating broader interest in the crypto market.

- Issuer Performance

- Major issuers, including BlackRock’s iShares, ARK, and Fidelity, all reported significant inflows, contributing to the overall growth in crypto ETPs assets under management (AUM).

- Despite the positive momentum, some issuers like Grayscale and ProShares continued to face outflows since the beginning of April.

- Market Influences

- The inflows were influenced by macroeconomic factors, including tariff concerns and a weakening U.S. dollar, driving demand for safe-haven assets like cryptocurrencies.

- The decline in gold prices may have redirected investor interest towards cryptocurrencies as alternative stores of value.

This dynamic landscape of cryptocurrency investments signifies an evolving market that individual investors need to navigate cautiously, balancing potential gains with the associated risks.

Recent Surge in Cryptocurrency ETPs: A Comparative Look

The recent uptick in cryptocurrency exchange-traded products (ETPs) marks a significant moment in the evolving digital asset landscape. With $3.4 billion in inflows during the week of April 21–25, reported by CoinShares, these products are not only attracting attention but also showing resilience amidst shifting market dynamics. This encouraging movement parallels ongoing trends seen in the wider investment community, particularly with traditional asset classes like gold and equities.

Competitive Advantages

The primary appeal of crypto ETPs hinges on their structured investment approach, which simplifies access to digital assets without the complexities of direct ownership. As Bitcoin surpasses the crucial $90,000 mark, investor interest surges, favoring ETPs that allow for broader participation amid rising prices. Companies like BlackRock, ARK Invest, and Fidelity are capitalizing on these trends, capturing the lion’s share of inflows. In contrast to direct crypto investments, these products often benefit from established reputations and compliance frameworks that provide a layer of security for investors wary of volatility in the crypto markets.

Competitive Disadvantages

However, while the inflows indicate a bullish sentiment, not all participants are basking in this glow. Solana ETPs, for example, experienced outflows, signaling potential investor fatigue or loss of confidence in specific altcoin offerings. This disparity may create an uneven playing field, with larger, more established cryptocurrencies like Bitcoin and Ethereum commanding attention and resources, potentially sidelining smaller or emerging competitors. Additionally, concerns over the US dollar’s value and its correlation to crypto prices could present risks for ETP issuers reliant on economic stability.

Who Benefits and Who Faces Challenges?

Investors who seek to diversify their portfolios with exposure to cryptocurrencies without the hassle of custodial issues stand to gain immensely from this resurgence in crypto ETPs. Institutional players particularly benefit as they navigate growing interest from retail investors looking for accessible entry points. However, smaller players within the crypto space, especially those tied to underperforming assets like Solana, may find themselves struggling to attract and retain interest amidst a market that increasingly favors giants. Moreover, companies like Grayscale or ProShares, which have recently faced significant outflows, could encounter difficulties in maintaining investor confidence moving forward.