The cryptocurrency landscape is undergoing a notable transformation as firms and centralized exchanges are increasingly launching traditional investment products, effectively bridging the gap between conventional finance and digital assets. Gracy Chen, CEO of Bitget, one of the largest crypto exchanges globally, highlights this trend, stating that the “line is blurring” between traditional finance and cryptocurrencies as investors increasingly seek flexible offerings that encompass both realms. This shift illustrates a burgeoning “growing synergy” between these two financial paradigms, capturing the attention of various sectors seeking stability and innovation.

“In a volatile market, integration is smarter than isolation,” Gracy Chen remarked, emphasizing the need for the crypto sector to explore traditional financial strategies.

Recently, Securitize and Mantle protocol partnered to unveil an institutional fund that mirrors the structure of traditional index funds. The Mantle Index Four (MI4) Fund aims to offer yield generation on a diverse selection of cryptocurrencies, including popular names like Bitcoin and Ether. This evolution highlights a significant recovery in investor sentiment, which has shifted from fear to a neutral stance—an encouraging sign amid an evolving economic backdrop.

Investor confidence received a boost after US President Donald Trump hinted at reducing tariffs on Chinese goods, marking a fresh approach in trade negotiations.

The push into Wall Street territory reflects a broader trend where cryptocurrency entities seek to capitalize on established financial structures. This movement is not only poised to attract retail investors but also institutional players who are increasingly viewing crypto as a hedge against macroeconomic uncertainty.

In another interesting development, Mantra’s CEO announced the initiation of a process to burn 150 million of his tokens, a move aimed at bolstering the token’s value by tightening its supply. This is part of a strategic effort to foster community trust and may set a precedent for other firms facing similar challenges.

“It’s a first step in rebuilding trust with the community, but far from the last,” commented John Patrick Mullin, founder of Mantra.

Moreover, the staking protocol Symbiotic successfully raised $29 million to launch an innovative economic coordination layer aimed at enhancing blockchain security. This framework will support the staking of various cryptocurrencies, showcasing the adaptability and growth potential within the crypto ecosystem.

Bridging Traditional Finance and Cryptocurrency: Key Developments

The recent developments in the cryptocurrency and traditional finance sectors highlight a significant shift towards integration, providing new opportunities for investors and altering market dynamics.

- Emergence of Traditional Investment Offerings:

- Cryptocurrency firms and exchanges are expanding into traditional finance by offering investment products like institutional funds.

- This trend reflects the increasing demand for flexible products that cater to diverse investor needs.

- Innovative Funds and Yield Generation:

- Securitize partnered with Mantle to launch the Mantle Index Four (MI4) Fund, earning yield on a basket of cryptocurrencies.

- This fund aims to provide exposure similar to traditional index funds, potentially attracting a broader range of investors.

- Changing Investor Sentiment:

- Investor sentiment has shifted from fear to neutrality, signaling a recovery phase in the crypto market.

- This recovery has been influenced by macroeconomic factors, including U.S. trade policy, which can impact investment decisions.

- Mantra’s Token Burn Initiative:

- Mantra’s CEO is unstaking and burning 150 million OM tokens to restore value and build community trust.

- This initiative illustrates efforts to manage token supply and maintain market confidence amid volatility.

- SEC’s Regulatory Oversight:

- The SEC has delayed decisions on several crypto-related ETFs, affecting market speculation and investment strategies.

- As many ETFs await approval, the outcomes may influence the long-term integration of cryptocurrencies in conventional investment portfolios.

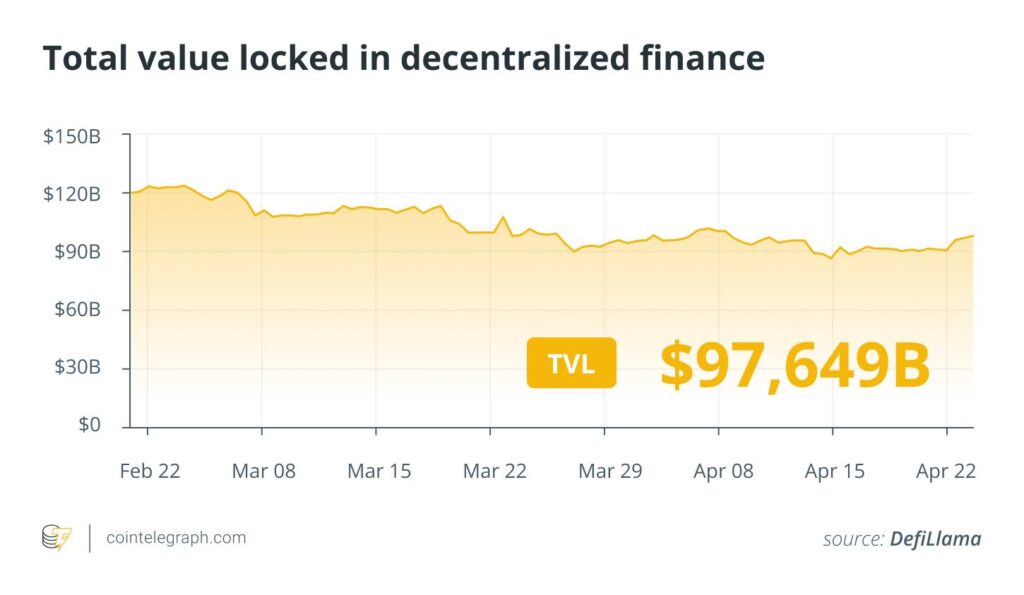

- DeFi Innovations:

- New protocols like Symbiotic aim to enhance blockchain security through innovative staking solutions.

- Such advancements could redefine investor participation and risk management within decentralized finance platforms.

The Merging Landscape of Cryptocurrency and Traditional Finance

As cryptocurrency firms and centralized exchanges delve deeper into conventional investment options, the intrigue surrounding this evolving landscape is palpable. The call for integration between traditional financial systems (TradFi) and the burgeoning crypto marketplace is gaining momentum. This transition presents both competitive advantages and disadvantages for various stakeholders.

On one hand, initiatives like Securitize’s partnership with Mantle protocol to introduce institutional funds can capture the interest of investors keen on blending their portfolios with both digital and traditional assets. This approach mimics established investment strategies, such as index funds, but applies them in a diversified crypto context. Such innovation could lead to enhanced investor confidence, especially as the crypto market exhibits signs of recovery. With sentiments shifting from fear to neutrality, these hybrid investment products could be particularly attractive to both retail and institutional investors looking for a more comprehensive trading experience.

However, the move towards these synergies does pose certain risks. Traditional investors may still harbor skepticism about the volatility and regulatory issues surrounding cryptocurrencies. Firms venturing too far into this uncharted territory without a solid risk management framework could face backlash from clients who prefer the familiarity and perceived stability of TradFi. Moreover, with companies like Bitget positioning themselves as bridges between these worlds, an oversaturation of similar products could create market confusion, potentially leading to investor apathy.

The blurred lines also create challenges for traditional finance entities that might view these advancements as competition rather than collaboration. While some might see the integration of crypto offerings as a chance to innovate and attract new clients, others may perceive these moves as a threat to their long-held market share. The resulting dynamic could lead to heightened competition, with established financial institutions forced to revise their strategies in order to retain relevance in a rapidly evolving landscape.

The rise of retail investors seeking flexibility in product options further emphasizes the necessity for traditional firms to adapt. As both sectors evolve, those who recognize and embrace this merging opportunity stand to gain considerably, while those who resist may risk becoming obsolete.