The cryptocurrency landscape in South Korea has become a focal point of discussion ahead of the imminent presidential election, scheduled for June 3. With a political climate shaped by a recent presidential impeachment and growing interest in digital assets across various demographics, candidates are keenly competing for the support of nearly 10 million verified crypto investors. All three leading contenders have unveiled proposals aimed at creating a more crypto-friendly environment, including the legalization of spot Bitcoin exchange-traded funds (ETFs) and easing current banking restrictions that limit fiat-to-crypto trading options.

“The political sphere has actively embraced [cryptocurrencies] as a key campaign agenda,”

said Park Sung-jun, head of the Blockchain Research Center at Dongguk University. This sentiment reflects a significant shift in public perception, as older generations increasingly invest in digital assets, which had previously been the domain of younger, tech-savvy voters.

Former president Yoon Suk-yeol’s controversial strategies, including a flash declaration of martial law that led to his impeachment, have paved the way for a new political landscape where cryptocurrencies are taken seriously as legitimate economic tools. Notably, Yoon had campaigned on pro-crypto promises, laying the foundation for his successors to tap into this evolving market.

“Things have changed a lot. There were even questions and answers about virtual assets during the presidential debates,”

observed Cho Jaewoo, an assistant professor at Hansung University. This highlights the normalization of cryptocurrency discussions in political discourse, a stark contrast to the skepticism that once pervaded views on digital assets.

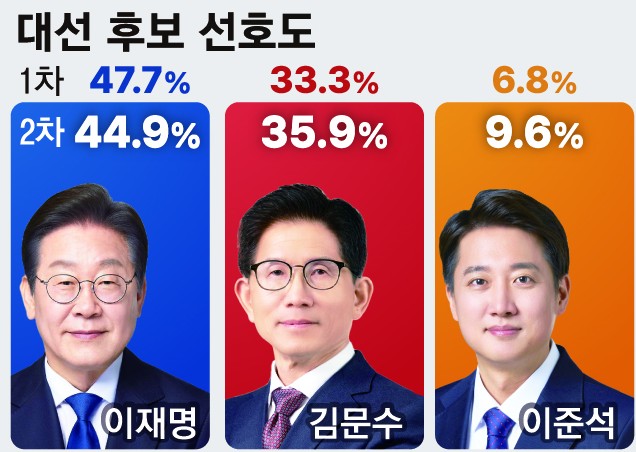

Lee Jae-myung of the Democratic Party and Kim Moon-soo of the ruling People Power Party are among the frontrunners proposing changes that could make it easier for crypto exchanges to operate. Their initiatives aim to dismantle the monopoly held by a handful of platforms, which currently regulate fiat-connected services. Lee has also sparked debate around a potential stablecoin pegged to the South Korean won, which has been met with criticism from other candidates who question its viability based on past experiences with collapsed assets.

As the election date draws near, South Korea’s vast crypto market—reportedly one of the largest in the world—has attracted significant attention. With recent trends showing a surge in older investors entering the digital currency space, candidates are eager to address these emerging issues as part of their platforms. The recent approval of Bitcoin ETFs in the United States further fuels the urgency of similar moves in South Korea, potentially transforming the country’s approach to cryptocurrencies and elevating it as a serious political issue.

Cryptocurrency’s Role in South Korea’s Presidential Election

The upcoming presidential election in South Korea is heavily influenced by the country’s evolving cryptocurrency landscape. Here are the key points that are significant to voters and investors alike:

- Election Context:

- The snap election on June 3 is driven by the impeachment of former president Yoon Suk-yeol.

- Yoon’s controversial martial law declaration led to political instability and his eventual removal.

- Candidates’ Crypto Proposals:

- All three front-runners have committed to pro-crypto policies, targeting a growing base of digital asset investors.

- Proposals include the legalization of spot Bitcoin ETFs and easing banking rules restricting fiat-to-crypto transactions.

- Demographics of Crypto Investors:

- 9.7 million Know Your Customer-verified crypto investors were recorded by 2024, with significant growth among investors in their 30s, 40s, and over 50s.

- 78% of high-value crypto investors (holding over 100 million won) are aged 40 and above, suggesting wider generational appeal.

- Impact of Global Trends:

- Growing momentum in the U.S. regarding Bitcoin ETFs influences South Korea’s policies, pushing local candidates to pledge similar reforms.

- Response to democratization of finance prompts calls for institutional investment in crypto.

- Political and Economic Dimensions:

- Cryptocurrency is shifting from a speculative asset to a major economic and political issue, affecting multiple generations.

- Candidates are seeking to democratize crypto trading to make it accessible for more participants.

- Public Perception Changes:

- Public discussions around cryptocurrency have evolved, with increased engagement noted during debates.

- Voters are moving towards a more informed and neutral perspective on crypto, rather than skepticism.

“Cryptocurrencies… have emerged as a significant economic, social, and political issue in South Korea.” – Park Sung-jun, Blockchain Research Center

Analysis of South Korea’s Presidential Election and Cryptocurrency Trends

The spotlight on cryptocurrency in South Korea’s upcoming snap presidential election represents a significant shift in political dynamics, especially as candidates adapt to an evolving digital asset landscape. Unlike previous elections, where crypto was largely a speculative topic, the current race sees all leading candidates pledging to support pro-crypto measures, underscoring a newfound recognition of the potential economic power of digital currencies.

Competitive Advantages: The primary advantage for candidates embracing crypto policies lies in their ability to attract a diverse voter base. With recent statistics revealing a dramatic rise in crypto investments among older generations—especially those over 40 who hold substantial wealth—candidates can engage not only the younger, tech-savvy electorate but also those newly interested in digital finance as a secure investment. By pushing for the legalization of Bitcoin ETFs and relaxing stringent banking regulations, candidates such as Lee Jae-myung and Kim Moon-soo are positioning themselves as champions of a modern economic agenda, likely swaying undecided voters who see cryptocurrency as an avenue for financial growth.

However, this shift is not without its pitfalls. The outright promises made by candidates could backfire if they fail to deliver once in office. For instance, Lee Jae-myung’s proposal for a new stablecoin raises concerns echoed by rival Lee Jun-seok regarding safety and market protections. Without clear strategies to mitigate risks associated with new financial products, candidates might alienate skeptical voters who recall the disastrous fall of past projects like TerraKRW. This retrospection highlights a delicate balancing act: while pro-crypto policies can energize support, any hint of irresponsibility could just as swiftly lead to political fallout.

Who Benefits and Who Stands to Lose: The shift toward a crypto-friendly platform primarily benefits younger voters and institutional investors looking for clearer regulatory frameworks. The potential for Bitcoin ETFs to offer safer investment vehicles is particularly appealing to older investors, making them prime targets for candidates keen on securing their votes. This demographic shift indicates a growing acceptance of cryptocurrency as a legitimate asset class, which could enhance political strategies and economic policies significantly.

Furthermore, the competitive landscape introduces unique challenges. Candidates must navigate not just their internal party dynamics—like Lee Jun-seok’s separation from the ruling People Power Party—but also public perception regarding cryptocurrency. The incidents involving previous failures, such as the fallout from Yoon Suk-yeol’s controversial martial law decision, iterate the stakes involved in advocating new financial innovations in a politically tumultuous environment.

As we approach the June 3 vote, the interplay between candidates’ crypto promises and the broader implications for South Korea’s socio-economic landscape will likely be a defining element not just for this election, but for future policies in an increasingly digital economy. The question now remains: will these candidates successfully harness the momentum of cryptocurrency to reshape a politically fractured electorate, or will their ambitions falter under the weight of historical skepticism and regulatory challenges?