The world of cryptocurrency continues to evolve, showcasing a growing divide between traditional stock markets and their digital counterparts. Recent findings highlight that cryptocurrency listings are significantly outperforming traditional stock listings, sparking a dialogue around the processes involved on centralized exchanges. A report from CoinMarketCap has revealed that over the past six months, tokens listed on major exchanges like Binance, Coinbase, and others have achieved an average return on investment (ROI) exceeding 80%. This performance stands in stark contrast to the returns on prominent stock indices, including the Nasdaq and Dow Jones.

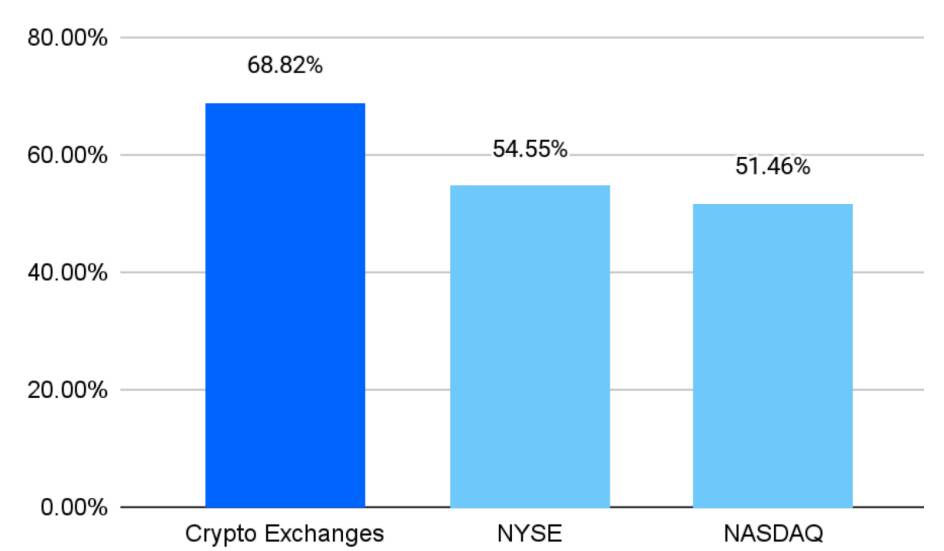

However, the cryptocurrency market is not without its controversies. Changpeng “CZ” Zhao, the former CEO of Binance, has fueled discussions by critiquing the flaws in the token listing procedures following some disappointing performances. Despite this criticism, the numbers indicate a different story, with 68% of cryptocurrency listings on centralized exchanges showing positive ROI, surpassing the New York Stock Exchange and Nasdaq’s performance.

“This data suggests that crypto exchanges have made progress in refining their listing,” the CoinMarketCap report stated.

Investors are drawn to newly listed cryptocurrencies as these platforms provide significant liquidity, often leading to increased demand and favorable price movements. Yet, recent discontent among investors concerning certain token listings may stem from heightened expectations based on past performance. A spokesperson from Binance noted that while an investor’s yearning for impressive returns is understandable, actual outcomes can hinge on broader market conditions.

Adding to the intrigue, allegations of hefty listing fees—like the $330 million claimed by Tron founder Justin Sun regarding Coinbase—have sparked further scrutiny, despite Coinbase’s assertion of zero fees for new listings. In response to the evolving landscape, Binance has introduced a community voting mechanism to decentralize its token listing process further.

As the cryptocurrency market matures, the ongoing effort to refine the listing process could usher in a new era of stability and investor confidence, reshaping the expectations and dynamics of this vibrant financial ecosystem.

Cryptocurrency Listings vs. Traditional Stock Listings

The performance of cryptocurrency listings on centralized exchanges (CEXs) has raised significant interest, particularly when compared to traditional stock listings. The following points summarize the primary insights and potential impacts on readers:

- Outperformance of Crypto Listings:

In the last 180 days, cryptocurrency listings have achieved an average return of over 80%, surpassing gains from traditional stock markets such as the Nasdaq and Dow Jones.

- Positive ROI Statistics:

68% of crypto listings on major exchanges yielded positive returns, outperforming the New York Stock Exchange (54%) and Nasdaq (51%).

- High Demand and Increased Liquidity:

New listings on CEXs draw high investor demand, which contributes to increased liquidity and potentially higher price performances.

- Community Criticism of Listing Procedures:

There have been growing criticisms regarding token listing procedures, with claims of manipulation. Notably, Binance’s former CEO labeled aspects of these processes as flawed.

- Influence of Market Conditions:

The performance of cryptocurrency listings is affected by broader market conditions, indicating that the success of these listings is not solely based on individual tokens.

- Decentralization Initiatives:

Binance has proposed a community voting mechanism for future token listings, promoting a more decentralized approach in the listing process.

“As the industry matures, we’re seeing reduced volatility compared to earlier cycles – a shift that reflects greater stability and long-term sustainability in the crypto market.”

– Binance spokesperson

Understanding these dynamics may impact readers’ investment strategies, highlighting the potential benefits and risks associated with investing in cryptocurrency compared to traditional stocks.

Comparing Cryptocurrency Listings: Performance and Market Dynamics

The cryptocurrency landscape has undeniably begun to diverge from traditional finance, particularly in the arena of new token listings. A recent report from CoinMarketCap reveals that cryptocurrency listings on centralized exchanges (CEXs) have achieved remarkable success, boasting an average return of over 80% in the last 180 days. In contrast, established stock exchanges like the Nasdaq and the NYSE have experienced underwhelming performance, with only 54% and 51% of their listings yielding positive returns, respectively. This significant disparity highlights a competitive advantage for crypto exchanges, particularly for early investors seeking high returns.

Advantages for Crypto Exchanges

One of the primary strengths of cryptocurrency exchanges lies in their ability to generate substantial liquidity rapidly. Newly listed tokens often experience soaring demand right off the bat, partly fueled by the potential for acute price movements. The interest in these listings is persisting, even amidst criticisms regarding potential manipulation during the token listing process. With the industry continuing to mature, exchanges are adapting their strategies to enhance listing quality and investor confidence. A notable example is Binance’s introduction of a community voting mechanism for listings, which aims to democratize the process and potentially mitigate concerns over listing fairness.

Challenges and Criticisms

However, this promising landscape is not free from challenges. The significant downside comes from investor discontent over the performance of some newly listed tokens, a sentiment echoed by Changpeng Zhao’s acknowledgment of the flaws in the existing listing criteria. While many tokens have thrived post-listing, disappointments have also arisen, potentially fostering a distrust among investors who may feel misled by inflated expectations. Such discrepancies can create volatility, which, paradoxically, may deter newcomers and cause more risk-averse investors to shy away from future listings.

Implications for Market Participants

These dynamics present distinct scenarios for various market participants. For crypto investors and traders, the data indicating high ROI on new listings offers an enticing opportunity for capital growth. However, the volatility associated with these listings also presents risks that could lead to significant losses for those entering the market at an inopportune moment. On the flip side, traditional finance players may find themselves at a competitive disadvantage if they fail to adapt to the rapid pace and innovative strategies of cryptocurrency exchanges. This could encourage broader acceptance and a shift towards integrating cryptocurrencies into mainstream investment strategies.

In summary, the phenomenon of CEX listings has become a double-edged sword; while they excel in generating returns that outstrip traditional markets, the potential for investor disappointment remains a critical concern that could impede future growth. As the crypto market continues to evolve, understanding the listed tokens’ outputs in the context of shifting market sentiments will remain crucial for all stakeholders.