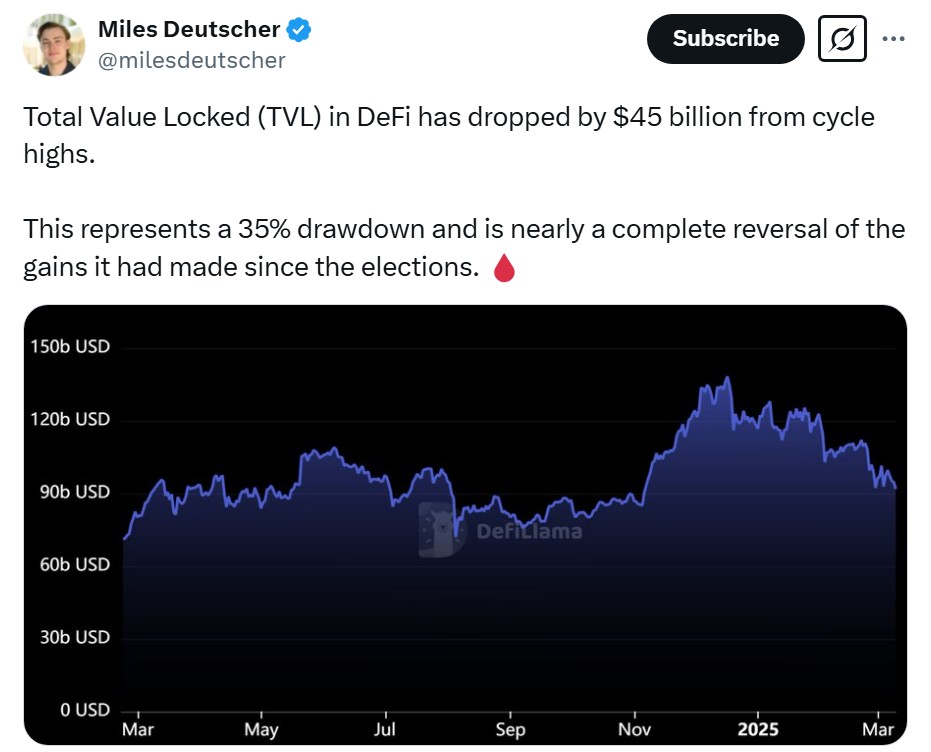

The world of cryptocurrency is experiencing a significant shift, particularly within the decentralized finance (DeFi) sector. Following the election of Donald Trump as US president in November 2024, the total value locked (TVL) in DeFi protocols peaked at an impressive 8 billion on December 17. However, this upward trajectory was short-lived, as notable declines have since reduced the TVL to approximately .6 billion by March 10, according to analyst Miles Deutscher. This drop exemplifies the volatility inherent in the crypto market, and highlights the uncertain landscape that many DeFi projects currently navigate.

Among the most discussed platforms during this tumultuous period is Solana, which has faced scrutiny as its memecoin hype wanes. Meanwhile, Ethereum, the leading smart contract platform, has not been immune to challenges, particularly in terms of its Ether (ETH) token. Despite Bitcoin’s extraordinary rise to surpass 9,000 on January 20, the date Trump took office, Ether struggled to break its previous record high of ,787 from November 2021. In fact, Ethereum’s TVL has plummeted by .6 billion from its cycle highs, showcasing a broader trend of skepticism among investors.

“Despite ongoing pessimism around Ether prices, this trend suggests many holders see current levels as a strategic buying opportunity,” noted IntoTheBlock, referencing a significant outflow of nearly 800,000 ETH worth around .8 billion from exchanges in early March.

This notable outflow occurred despite a 10% drop in Ether’s price, reaching a low of ,007, indicating that many investors may be opting to move their assets into decentralized finance applications rather than selling. This behavior contrasts sharply with the prior trend of net inflows as market conditions fluctuated. Analysts, such as Juan Pellicer from IntoTheBlock, highlight that previous inflows before March 3 likely reflected a selling mentality amidst market uncertainty, while the recent outflow indicates a shift towards accumulation as prices dipped.

As Ethereum gears up for its Pectra upgrade, aimed at enhancing layer-2 efficiency and liquidity, it has experienced its own set of hurdles. The upgrade encountered technical setbacks shortly after its testnet launch on March 5, with developers reporting issues such as erroneous events triggering on Geth nodes. Nonetheless, the commitment to addressing congestion and gas fees continues to be a priority for the Ethereum development community.

The evolving landscape of cryptocurrencies and DeFi is marked by both challenges and opportunities, illustrating the dynamic and often unpredictable nature of this digital frontier.

The Current State of Cryptocurrencies and DeFi Protocols

The landscape of cryptocurrencies, particularly in decentralized finance (DeFi), has experienced significant shifts recently. Below are key points regarding these developments:

- Total Value Locked (TVL) Decline:

The total value of cryptocurrencies locked in DeFi protocols has decreased drastically since Donald Trump’s election, dropping from a high of 8 billion to .6 billion by March 10, 2024.

- Ethereum’s Challenges:

Ethereum has faced significant challenges with its TVL falling by .6 billion and failing to reach a new all-time high despite the rise of Bitcoin.

- Bitcoin’s Soaring Price:

Bitcoin reached a price of over 9,000, contrasting sharply with Ethereum’s struggles.

- Significant ETH Outflows:

Ethereum experienced a net exchange outflow of approximately 800,000 ETH (worth about .8 billion), indicating a potential long-term holding trend among investors.

- Pectra Upgrade Issues:

The Pectra upgrade intended to improve Ethereum’s efficiency faced setbacks on its testnet launch, indicating ongoing challenges in the Ethereum ecosystem.

“Despite ongoing pessimism around Ether prices, this trend suggests many holders see current levels as a strategic buying opportunity.” – IntoTheBlock

These developments are important for readers who are investors or interested in the cryptocurrency market, as understanding the trajectory of assets like Ethereum and Bitcoin can inform investment decisions. The TVL drop might indicate broader market conditions affecting DeFi and highlight potential risks when investing in these assets. Additionally, developments like Ethereum’s upgrades may impact transaction costs and efficiencies, influencing user experience and investment strategies in the future.

Decentralized Finance Dynamics: A Comparative Outlook on Ethereum, Solana, and Market Trends

As the cryptocurrency market fluctuates dramatically, the recent analysis highlighting the total value locked (TVL) in decentralized finance (DeFi) protocols post-2024 US elections presents an interesting narrative. With the dramatic drop from 8 billion to approximately .6 billion, the situation unveils significant insights regarding the performance of leading platforms like Ethereum and Solana. While Solana has faced criticism due to waning memecoin traction, Ethereum has its own set of challenges, marked by its inability to reach previous all-time highs despite Bitcoin’s resurgence to remarkable price levels.

Market Advantages: Ethereum’s status as a pioneer in the DeFi space, coupled with its upcoming Pectra upgrade, emphasizes its determination to enhance layer-2 efficiency and interoperability. This could potentially attract investors who prioritize innovation and lower transaction costs, thereby keeping Ethereum relevant in a crowded marketplace. Furthermore, the significant net outflow of ETH from exchanges indicates a shift in investor sentiment, suggesting that many see current prices as attractive entry points to accumulate and invest in decentralized applications like staking or yield farming.

Market Disadvantages: However, the stark retreat in total TVL reveals a shaky confidence among investors, particularly as Ethereum struggles to set new highs. The critique around its liquidity fragmentation post the rollup-centric roadmap, and the setbacks faced during the Pectra rollout, raise questions regarding its long-term robustness. Solana, despite its current struggles, may benefit from Ethereum’s hindrances as some investors might seek alternatives to diversify their portfolios, making Solana’s memecoin appeal potentially more attractive in the face of Ethereum’s setbacks.

For investors, these developments could mean both opportunity and risk. On one hand, those looking for stability may gravitate toward platforms with a proven track record like Ethereum, particularly with the positive indicators surrounding long-term holding activity. On the other hand, the challenges posed by liquidity fragmentation and technical setbacks from Ethereum’s recent upgrades might incite cautiousness. Newcomers to the DeFi space might be drawn to alternative solutions like Solana, especially if they perceive Ethereum’s difficulties as detracting from its competitive edge.

Overall, the DeFi landscape remains dynamic, with the interplay between these key players offering both potential opportunities and pitfalls in the crypto investment environment. The ongoing evolution in this sector will undoubtedly continue to impact investor strategies moving forward.