The cryptocurrency landscape continues to echo familiar themes as we move into 2025, with a significant focus on artificial intelligence tokens and memecoins. According to a recent quarterly research report from CoinGecko, these two categories have taken center stage, capturing an impressive 62.8% of global investor interest in the first quarter. Notably, AI tokens have surged ahead, accounting for 35.7% of the interest, while memecoins closely follow with their 27.1% share.

Despite the excitement surrounding these sectors, industry experts, like Bobby Ong, co-founder of CoinGecko, suggest that the market is experiencing a déjà vu effect with past trends dominating yet again. Ong commented, “Seems like we have yet to see another new narrative emerge and we are still following past quarters’ trends.” This sense of stagnation raises questions about the future direction of the crypto market.

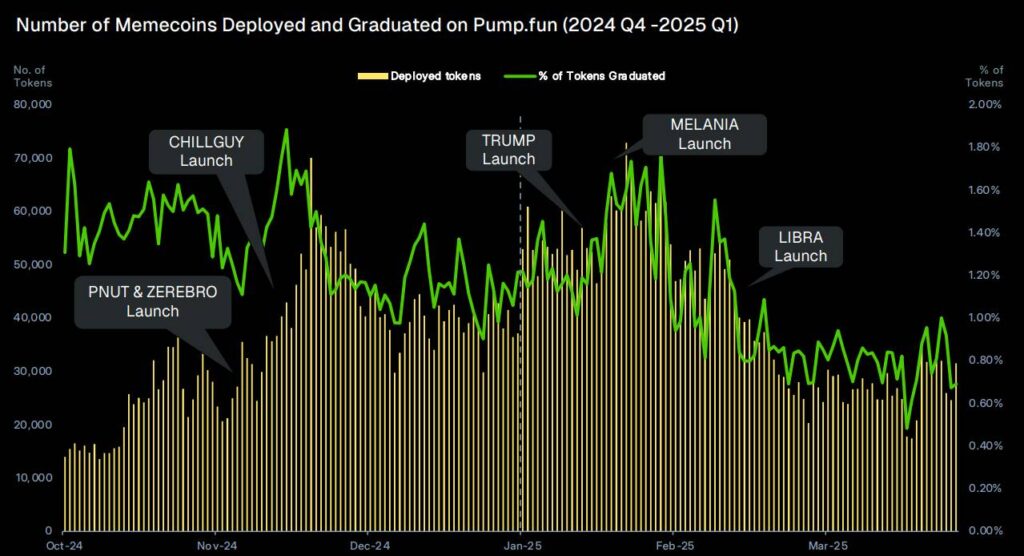

The rise in memecoin interest has been notably influenced by political events, particularly with the launch of memecoins associated with prominent figures like US President Donald Trump. The Official Trump (TRUMP) and Official Melania (MELANIA) tokens, both released shortly before Trump’s inauguration, sparked a flurry of activity on the Solana network, highlighting the interplay between political events and crypto trends.

However, this excitement has not come without its downsides. Concerns have emerged that the popularity of memecoins may detract from the capital available for utility tokens, potentially stunting their price growth. For instance, Solana (SOL) has faced a significant downturn, losing nearly 48% of its value since hitting a peak shortly after Trump’s inauguration.

“There was the recent meme surge and smart money is always happy to capitulate on that,” noted Nicolai Sondergaard, a research analyst at Nansen, reflecting on the ongoing interest in speculative memecoin investments.

The cryptocurrency market also felt the aftershocks of the Libra token’s catastrophic collapse, a memecoin backed by Argentine President Javier Milei, which resulted in a staggering $4 billion loss in market value. This event served as a stark reminder of the volatility inherent in the memecoin space, leading to a marked decline in token deployments and the graduation rate of new tokens.

Despite the fluctuations and potential dangers, some investors remain enticed by the speculative nature of memecoins, as evidenced by stories of remarkable gains that have been made. One trader famously turned a modest investment of $2,000 into an astounding $43 million through the popular Pepe (PEPE) memecoin, highlighting the allure that this segment of the market continues to hold.

Key Insights on Cryptocurrency Market Trends in Q1 2025

The cryptocurrency market is continuing to reflect recurring themes with limited emergence of new narratives. Here are the most significant aspects that may affect investors and enthusiasts:

- AI Tokens and Memecoins Dominating Interest:

- AI tokens captured 35.7% of global investor interest.

- Memecoins accounted for 27.1% of investor interest.

- Together, they represent 62.8% of the total market interest in Q1 2025.

- Recycling of Old Narratives:

- Market themes are largely repetitive, creating a sense of fatigue among investors.

- Bobby Ong, from CoinGecko, noted the lack of new narratives emerging.

- Impact of Political Events on Memecoins:

- The launch of Official Trump and Melania tokens led to increased interest in memecoins.

- However, there are concerns that such speculative tokens drain capital from utility tokens like Solana (SOL).

- Fluctuations in Solana’s Value:

- SOL experienced a significant decline of around 48% following the hype surrounding political memecoins.

- Libra Token Collapse:

- The collapse of the Libra token resulted in a $4 billion market value loss.

- Allegations of liquidity withdrawal contributed to a 94% price crash.

- Risk and Speculation in Memecoins:

- Despite market downturns, some traders continue to speculate on memecoins for potential high returns.

- A notable case involved a trader turning a $2,000 investment into $43 million with the Pepe memecoin.

Investors should remain cautious as speculative trends can lead to significant market volatility and potential losses.

The ongoing trends in the cryptocurrency market underscore the importance of staying informed and cautious. Investors should consider these dynamics carefully to navigate potential risks and capitalize on emerging opportunities.

Cryptocurrency Market Trends: A Tug of War between AI Tokens and Memecoins

The cryptocurrency landscape in early 2025 has been dominated by a familiar rivalry: artificial intelligence tokens versus memecoins. Recent data from CoinGecko reveals that these two categories accounted for an astonishing 62.8% of investor interest. This trend raises significant implications for various stakeholders within the crypto ecosystem.

Competitive Advantages: AI tokens have emerged as frontrunners, capturing 35.7% of global investor interest. This surge in AI-related cryptocurrencies reflects a broader tech-driven narrative that could attract institutional investors and tech enthusiasts eager to explore innovative applications of AI in blockchain technology. Conversely, memecoins, particularly those tied to popular cultural figures like Donald Trump and Melania Trump, have shown their power to draw significant speculative interest, as evidenced by the trading frenzy leading up to Trump’s inauguration. Such trends could benefit day traders and speculative investors looking for quick gains, as memecoins often enable rapid returns based on hype and social media influence.

Disadvantages: However, the overwhelming focus on memecoins may have detrimental effects on the broader market. Industry experts have raised concerns that capital is being siphoned away from utility tokens like Solana (SOL), leading to depreciating asset values. This situation presents challenges for investors seeking long-term growth and sustainability in their crypto portfolios. The sharp decline in SOL’s value—around 48% since the inauguration—serves as a cautionary tale for those heavily invested in speculative trends.

Furthermore, the fallout from the Libra debacle—a high-profile memecoin collapse—has instilled a sense of caution within the market. The significant liquidity withdrawals associated with the Libra token have highlighted the inherent risks associated with memecoin volatility. As a result, conservative investors and institutional players may shy away from memecoins in favor of more stable, utility-driven assets, presenting a challenging environment for emerging projects focused on this category.

Who Benefits and Who Faces Challenges: The current dynamics suggest that savvy traders and those equipped to navigate the volatile nature of memecoins can find lucrative opportunities. For them, the speculative behavior could mean significant profits if timed correctly. On the flip side, cautious investors, particularly those with a focus on long-term investing, may find themselves grappling with uncertainty as they navigate a market still heavily influenced by old narratives. This environment poses difficulties for utility-driven cryptocurrencies that risk being overshadowed by the excitement surrounding AI and memecoins.

As the crypto narrative continues to evolve, stakeholders must remain vigilant in discerning the underlying value versus the speculative allure, ultimately shaping the future direction of investments in this fascinating space.