It’s no secret that elections reshape industries, but few transformations have been as financially lucrative as crypto’s post-election windfall. If you’re an investor, enthusiast, or just a curious observer, you might be grappling with mixed emotions—excitement about the newfound momentum in the industry coupled with questions about the ethics behind it all. While these feelings are valid, the sheer impact of recent political outcomes on the crypto world presents a story worth exploring.

The cryptocurrency sector funneled unprecedented amounts into key political races to shape a favorable legislative environment, and the results are staggering. Within weeks of the U.S. midterm elections, the crypto market added more than trillion in valuation. This extraordinary surge reflects not just market optimism but also a calculated strategy by industry leaders that paid off beyond expectation.

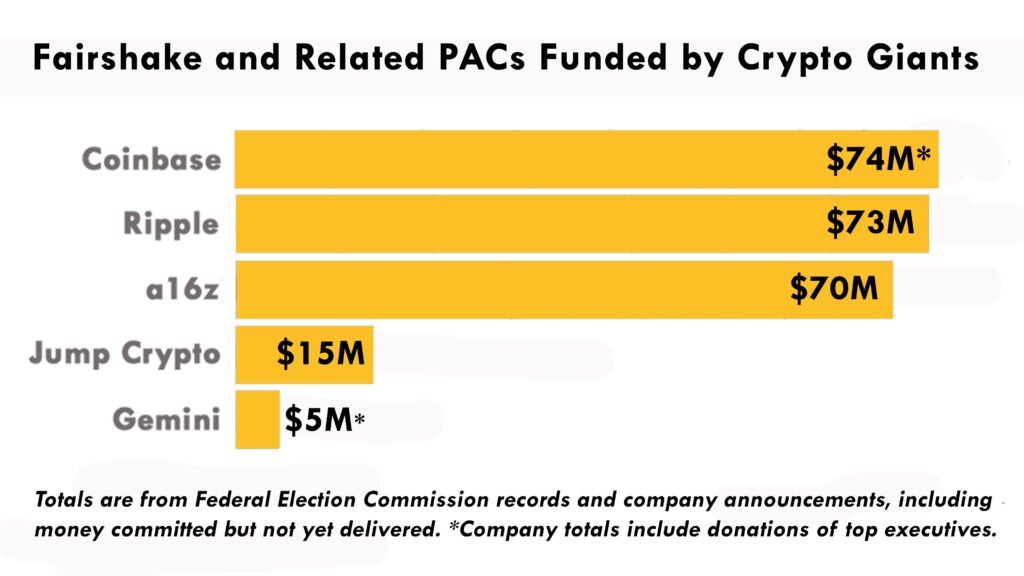

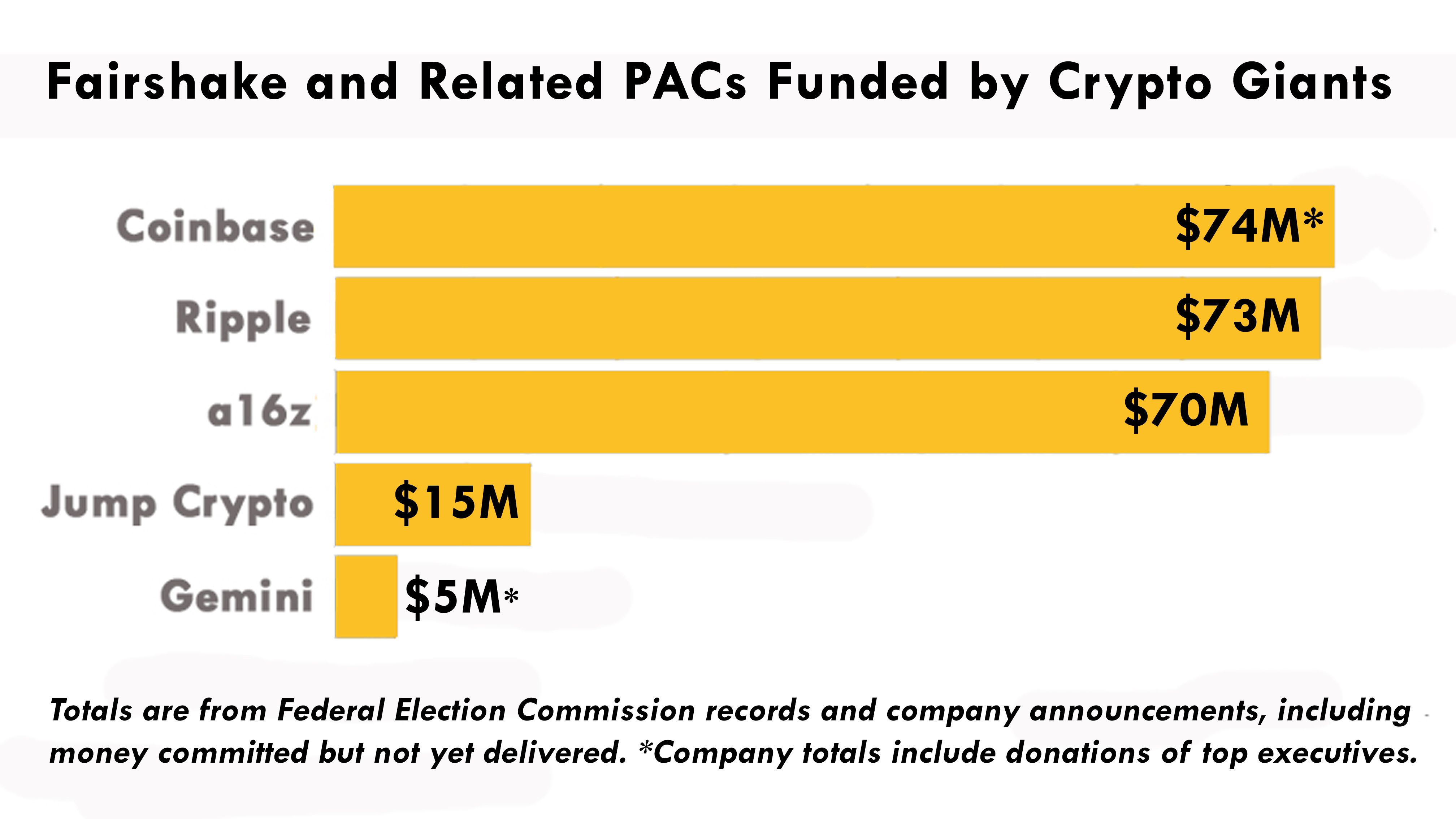

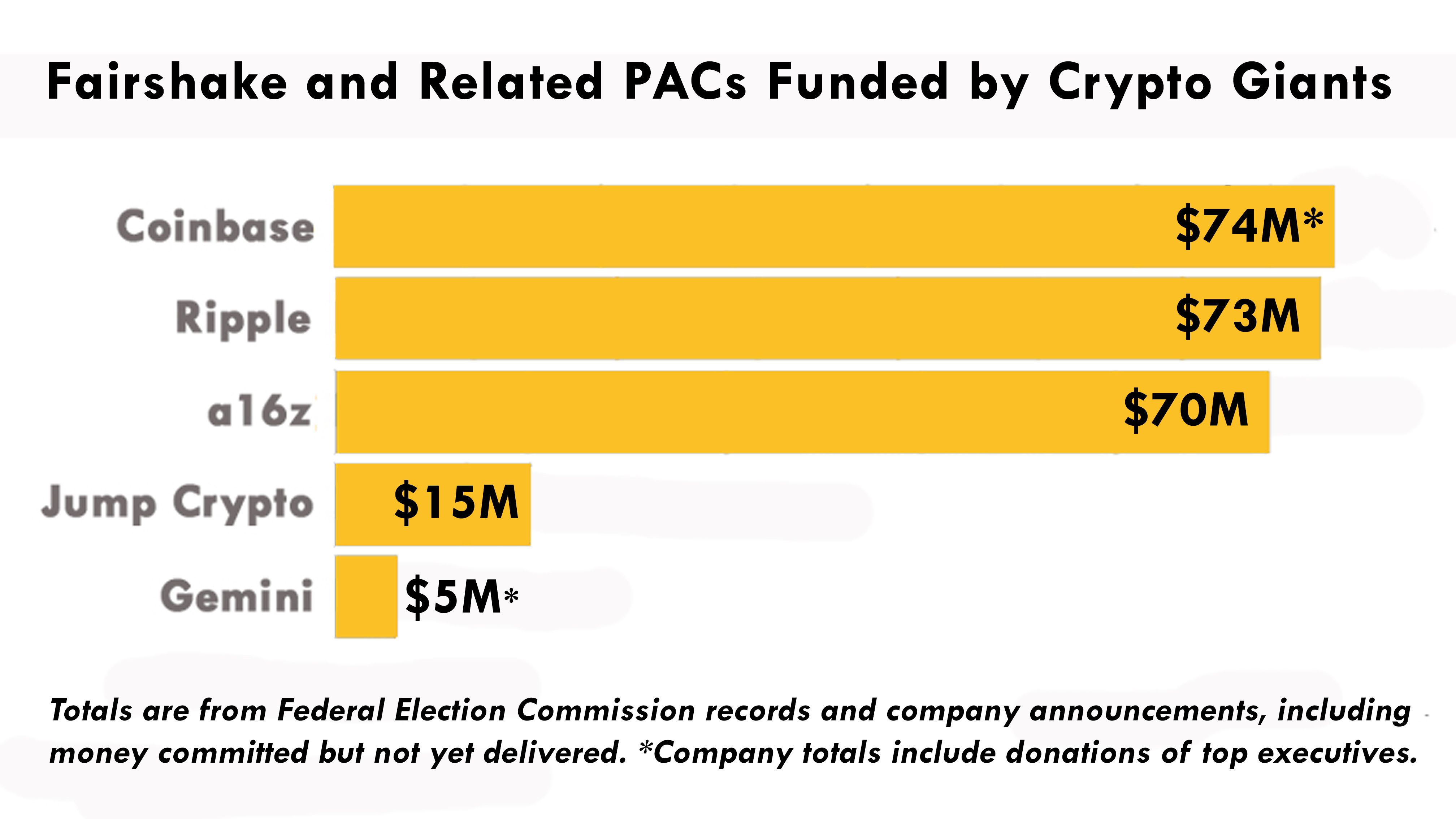

Behind the scenes, key players in the digital asset space directed hundreds of millions of dollars into Political Action Committees (PACs) and campaign initiatives. This cash infusion wasn’t random. It was targeted, strategic, and surprisingly effective in influencing the outcome of congressional and state elections. For many, the stakes were existential—decisions on Capitol Hill surrounding crypto regulation could either stifle innovation or create an environment in which it could flourish. By the looks of it, the latter scenario prevailed.

The effects were immediate. Crypto prices, which had trended bearish earlier in 2023, rebounded decisively after the elections. Major cryptocurrencies such as Bitcoin and Ethereum saw record gains, and Coinbase—one of the largest cryptocurrency exchanges in the U.S.—saw its valuation skyrocket. Ripple’s XRP token, too, leaped in value after courts and regulators seemed poised to strike a friendlier tone, owing to shifts in congressional representation. It’s a scenario almost custom-built to spark optimism among traders and builders alike.

But the billion-dollar question remains: how should we, as participants and watchers of this saga, interpret this windfall? For industry insiders, these gains feel like validation of the belief that crypto holds transformative potential for global finance. However, for skeptics or those new to the space, questions linger about whether political investments of this scale distort democracy or undermine grassroots integrity. These are important considerations, and no matter which camp you find yourself in, it’s clear that the discussion extends far beyond economics—it touches on values, governance, and the future of technological innovation.

If there’s one takeaway from this remarkable chapter in crypto’s history, it’s this: the intersection of technology, politics, and finance is shaping the rules of the game faster than ever before. For many, this represents an opportunity to be part of something revolutionary. If you’re feeling overwhelmed by these developments, remember that the learning curve may be steep, but it also holds immense potential for those willing to explore it.

With the influx of billions into both political causes and market valuations, crypto has claimed a seat at the table of influence. What comes next will define not just the fortunes of a few, but the trajectory of an entire ecosystem poised for growth—or confrontation.

Among those benefiting most visibly from the post-election boom is Coinbase CEO Brian Armstrong, whose strategic financial maneuvers are a masterclass in timing and foresight. For those watching from the sidelines, it’s easy to see these moves as the result of sheer luck or market momentum. But when you dig deeper, Armstrong’s actions reveal a calculated strategy that positioned him, and Coinbase, to seize opportunities amidst a shifting political landscape.

In the months leading up to the elections, Armstrong laid the groundwork for what would become an extraordinary financial upswing. By implementing a pre-programmed plan to sell portions of his Coinbase shares based on price thresholds, he insulated himself from accusations of opportunistic trading while still ensuring he could capitalize on dramatic market shifts. It’s worth pausing on this detail because it illuminates the intricate balancing act faced by industry leaders. Armstrong needed to maintain public trust—especially as crypto companies often face greater scrutiny than their counterparts in traditional finance—while also preparing for the possibility of favorable outcomes driven by political investments.

When the election results tipped in favor of crypto-friendly candidates, Coinbase’s stock price surged from 6 to 6 in a matter of days. Armstrong’s plan kicked into action. Within a week, he executed share sales worth 0 million, a 70% increase over the pre-election value of the same shares. This wasn’t a fluke or a lucky break; it was the culmination of months of preparation and a belief that the company’s political contributions could help create a more favorable regulatory landscape. Over the following weeks, Armstrong continued to sell shares, ultimately cashing out more than 7 million worth of Coinbase stock—shares worth significantly less before the election results were clear.

Yet, what’s striking about Armstrong’s strategy isn’t just the financial windfall—it’s the transparency with which he approached it. Before the elections, he took to social media to explain his decision to sell shares, framing it as an effort to fund new ventures while retaining the majority of his holdings. He positioned the move as a way to diversify his interests while continuing to champion Coinbase’s mission. For many of his supporters, this transparency helped diffuse potential criticism, though skeptics questioned the ethics of selling that much stock at a time when the company’s fortunes were directly tied to political outcomes.

The numbers, however, speak for themselves. Armstrong’s personal stake in Coinbase—valued at around .4 billion before the elections—has ballooned to over .4 billion just weeks later. These gains reflect not just the rising stock price but also the broader perception that Coinbase is strongly poised to thrive in a regulatory environment shaped by crypto-friendly policymakers. Armstrong’s fortune is inextricably linked to the company he co-founded, and as that company’s valuation grows, so does his influence in the industry.

For many within the crypto community, Armstrong’s financial success is viewed through the lens of validation. It reinforces the idea that crypto is entering a new era where it can stand toe-to-toe with traditional finance and other industries wielding political influence. However, it also raises pressing questions about the role of corporate power in shaping public policy. Should one industry, or a handful of its leaders, have the ability to influence elections to this degree? And at what cost does this influence come?

What Armstrong’s journey highlights, more than anything, is the sheer magnitude of crypto’s potential—not just as a financial system but as a force capable of reshaping power dynamics in both markets and politics. For observers who may feel uneasy about these developments, it’s important to note that these shifts are not happening in isolation. They are part of a broader narrative about how technology, governance, and finance are becoming more intertwined. If you’ve been curious or cautious about entering this space, now might be the time to take a closer look—not just at the numbers, but at the stories behind them.

Armstrong’s case is a reminder that while crypto is often portrayed as a decentralized movement, the forces driving its growth can be deeply centralized, tied to the decisions of a few influential players. How this dynamic evolves as the industry matures will be a critical question moving forward. For now, Coinbase’s rise and Armstrong’s strategic foresight tell a story of not just financial gain but also the profound impact of aligning business strategy with political influence.

For crypto enthusiasts, builders, and skeptics alike, this story is a call to dig deeper into the forces shaping the industry’s trajectory. Whether you see Armstrong’s success as a triumph of vision or a symptom of larger systemic concerns, one thing is clear: the industry is entering uncharted territory, and the ripple effects will shape its future for years to come.

The role Ripple and Andreessen Horowitz (a16z) have played in this evolving narrative cannot be overstated. These two industry giants, much like Coinbase, have strategically positioned themselves as powerful political influencers, leveraging their considerable resources to secure a more crypto-friendly political landscape. For those who may be new to following such large-scale political contributions, it can feel like a stark contrast to the decentralized ethos that crypto originally promised. However, the reality is that the growing pains of an emerging industry often involve navigating these complex and sometimes contradictory dynamics.

Ripple, led by its CEO Brad Garlinghouse, took a bold approach to the 2024 elections. The company contributed a staggering million to the Fairshake PAC, aiming to solidify political alliances that could pave the way for more favorable regulatory frameworks. For Garlinghouse, the stakes were personal as well as professional. His significant holdings in Ripple and XRP, the cryptocurrency tied to the company, meant his wealth was intrinsically tied to the fate of the token. And the gamble paid off—XRP saw a meteoric rise, jumping from [gpt_article topic=”Coinbase CEO, Other Crypto Insiders Billions Richer After Seeking to Steer Elections” sections=”5″ structure=”Before generating the section names, analyze the article below and use it as a reference for the new article section structure to ensure all the essential information is included.

THE ARTICLE FOR YOUR INSPIRATION:

This is the third in a series of stories examining the crypto industry’s high-stakes 2024 foray into politics and campaigning. The first explored the electoral track record of Fairshake PAC’s strategy and the second its intense use of a 2010 Supreme Court stance.The leaders of the companies responsible for the river of money that flooded U.S. political shores this year have already benefited tremendously from the outcome of last month’s election — increasing their personal fortunes by billions of dollars, far outpacing the large spending they devoted to crypto-friendly candidates.Coinbase Inc. (COIN) CEO Brian Armstrong and his company devoted some $74 million to the industry’s dominant political action committee, Fairshake, putting Armstrong in a close lead over a few other crypto insiders. That’s an especially significant amount of money from a company that booked about $95 million in 2023 profits. But the elections went their way, and the company’s value has ballooned by $21 billion since Nov. 4, the day before in-person voting began and the outcome became clear.In a pre-programmed series of trades starting less than a week after the election, Armstrong sold $100 million worth of his Coinbase shares. Those same shares on the night before the election had been worth about $39 million less. A week after that, he cashed in about $313 million — all part of a selling strategy he’d set in motion if the price spiked.Since then, the co-founder and CEO sold smaller amounts week after week, for a total of about $437 million for stock that was worth $308 million before the victories of President-elect Donald Trump and a slate of congressional lawmakers backed by crypto. In other words, the pro-crypto sentiment surging after the election outcome that Armstrong helped shape earned him an additional $129 million in wealth for the shares he sold.He still owns more than 10% of the largest U.S. crypto exchange, and the value of about 24 million shares tucked into his trust, according to the latest Securities and Exchange Commission filings, is about $6.4 billion — up near $2 billion since Nov. 5.Armstrong’s stock sales were planned less than three months before the U.S. elections, submitted in a formal strategy meant to distance corporate insiders from accusations of gaming the markets. And the sales haven’t yet reached the halfway point of the SEC-disclosed intent to offload as many as 3.75 million shares, depending on the stock price meeting “certain threshold prices specified in the Armstrong Plan.”He took to social media site X to explain the plan several days before the elections, saying he was diversifying “to make investments in moonshots” but would be keeping the “vast majority” of his shares. He said he put the price targets so high that he didn’t expect that most of it would sell in the next year “unless we do much better than expected.” COIN’s stock is currently trading around $276, up from around $186 on Nov. 4.A Coinbase spokesperson referred CoinDesk to that post when asked for comment.His rivals among crypto leaders who devoted similar levels of cash to the elections included Ripple Labs CEO Brad Garlinghouse and the namesake chiefs of investment firm Andreessen Horowitz (a16z). Ripple gave $73 million, and a16z put in $70 million, including large amounts held over for the next election cycle in 2026.Garlinghouse reportedly owns more than 6% of Ripple, the company, and a large but unspecified amount of the token tied to it, XRP. Various reports put him high among the list of U.S. billionaires as a result. In the wake of the election, XRP surged to become the third-largest crypto asset by market cap.While Garlinghouse chose not to weigh in with details on his net worth, he credited excitement over the return of Trump to the White House in a statement to CoinDesk.”The crypto market is up over $1 trillion since Trump won — that’s the price of Gensler’s foot on the neck of the market, and he’s not even officially gone yet,” Garlinghouse said.Since the election, Garlinghouse’s holdings of XRP have multiplied more than three times as the price of the token jumped from $0.50 to $2.32. And though the non-public Ripple Labs valuation is uncertain and was last set in the neighborhood of $11 billion earlier this year, the election has almost certainly boosted the worth of his major stake. Garlinghouse’s personal wealth has likely skyrocketed as a result.The financial status of Mark Andreessen and Ben Horowitz is even murkier, but both men have gained dramatically since last month from their many stakes in crypto companies, likely outpacing the money they devoted to U.S. politics. But the financial figures aren’t available for a16z’s investments in private companies as they are for public Coinbase.The firm’s vast crypto portfolio includes stakes in Coinbase, Uniswap, Solana, EigenLayer and Anchorage Digital and dozens of others. Virtually all of them became more valuable as the U.S. executive branch will be run by Trump, who says he’ll be the crypto president, and the 535-member Congress includes some 300 predicted to be supportive of digital assets — including the dozens just supported by Fairshake in their elections.But a company spokesman declined to comment on CoinDesk’s review of the gains for Andreessen and Horowitz as individuals.A16z’s dip into U.S. politics was aimed “to help advance clear rules of the road that will support American innovation while holding bad actors to account,” according to a post from the firm’s Chris Dixon. Separately from Fairshake, Andreessen and Horowitz backed Trump’s election effort. And Andreessen has become an adviser to the pro-crypto president-elect as he prepares to start his second term next month. The crypto benefactors from Coinbase, Ripple and a16z combined to make the Fairshake super PAC and its affiliates into the most powerful corporate campaign-finance effort in the 2024 elections, helping 53 members of next year’s Congress win their races. However, Fairshake didn’t weigh in on the presidential election, which may have had the largest effect on crypto market prices. Garlinghouse, in a post-election interview on 60 Minutes, said, “I think it’s clear that Donald Trump embraced crypto and crypto embraced Donald Trump.” While he didn’t claim credit for Trump’s success, Garlinghouse said the crypto PACs “absolutely helped supercharge the candidates” and influenced outcomes in congressional contests.His company pledged $5 million in XRP to Trump’s inauguration — the celebration next month of his return to the presidency — and Coinbase and fellow U.S. crypto exchange Kraken have also raised their hands to fund it.During the elections, the crypto industry was accused by its critics of being remarkably transactional in its political strategy — putting money into the best places to ensure future pro-crypto votes on legislation and buying more than $130 million in congressional campaign ads with framing across the political spectrum (and without mentioning crypto). Gains for the sector have meant a boost for the three main companies behind Fairshake and for their individual leaders, who are tied to them financially.The sector’s political effort went in “purely on interests of the specific industry,” said Rick Claypool, the research director at Public Citizen who has examined crypto’s campaign spending. “Short term, obviously this has caused a big bump in crypto.”The return on investment for industries putting money into politics can “often be pretty good,” said Mark Hays, a senior policy analyst at Americans for Financial Reform, who has also worked on campaign finance issues. “Crypto is newer, and so the opportunity for growth is larger.”While Armstrong and the others prefer a political narrative that features a grassroots upswell in crypto voters that shifted the elections, he and his company were directly behind establishing Stand With Crypto, the group that’s billed as a grassroots effort to harness the will of crypto voters. And Fairshake’s political influence was based almost entirely on money from Coinbase and the partner companies, plus smaller amounts from Jump Crypto and Gemini.Gemini’s leaders, Tyler and Cameron Winklevoss, were also among Trump’s loudest fans in crypto.The day after the voting, Cameron Winklevoss posted on X: “Imagine how much we are going to accomplish in the next 4 years now that the crypto industry won’t be hemorrhaging $ billions on legal fees fighting the SEC and instead investing this money into building the future of money. Amazing awaits.”On Nov. 11, the day Armstrong began selling large amounts of Coinbase stock, Tyler Winklevoss posted, “The shackles are off, 100k incoming.” Bitcoin hit that mark a month after the election.” directives=”Write a new, exciting article in a blog post format. Write it with empathy and understanding. Acknowledge the reader’s feelings and concerns, and offer supportive and encouraging language. Format the text for embedding in a WordPress post using only the

,

- ,

- ,

,

, and tags. Exclude any other HTML tags. Use the reference article below for inspiration. Omit any use of the word Coindesk.

THE ARTICLE FOR YOUR INSPIRATION:This is the third in a series of stories examining the crypto industry’s high-stakes 2024 foray into politics and campaigning. The first explored the electoral track record of Fairshake PAC’s strategy and the second its intense use of a 2010 Supreme Court stance.

The leaders of the companies responsible for the river of money that flooded U.S. political shores this year have already benefited tremendously from the outcome of last month’s election — increasing their personal fortunes by billions of dollars, far outpacing the large spending they devoted to crypto-friendly candidates.

Coinbase Inc. (COIN) CEO Brian Armstrong and his company devoted some $74 million to the industry’s dominant political action committee, Fairshake, putting Armstrong in a close lead over a few other crypto insiders. That’s an especially significant amount of money from a company that booked about $95 million in 2023 profits. But the elections went their way, and the company’s value has ballooned by $21 billion since Nov. 4, the day before in-person voting began and the outcome became clear.

In a pre-programmed series of trades starting less than a week after the election, Armstrong sold $100 million worth of his Coinbase shares. Those same shares on the night before the election had been worth about $39 million less. A week after that, he cashed in about $313 million — all part of a selling strategy he’d set in motion if the price spiked.

Since then, the co-founder and CEO sold smaller amounts week after week, for a total of about $437 million for stock that was worth $308 million before the victories of President-elect Donald Trump and a slate of congressional lawmakers backed by crypto. In other words, the pro-crypto sentiment surging after the election outcome that Armstrong helped shape earned him an additional $129 million in wealth for the shares he sold.

He still owns more than 10% of the largest U.S. crypto exchange, and the value of about 24 million shares tucked into his trust, according to the latest Securities and Exchange Commission filings, is about $6.4 billion — up near $2 billion since Nov. 5.

Armstrong’s stock sales were planned less than three months before the U.S. elections, submitted in a formal strategy meant to distance corporate insiders from accusations of gaming the markets. And the sales haven’t yet reached the halfway point of the SEC-disclosed intent to offload as many as 3.75 million shares, depending on the stock price meeting “certain threshold prices specified in the Armstrong Plan.”

He took to social media site X to explain the plan several days before the elections, saying he was diversifying “to make investments in moonshots” but would be keeping the “vast majority” of his shares. He said he put the price targets so high that he didn’t expect that most of it would sell in the next year “unless we do much better than expected.” COIN’s stock is currently trading around $276, up from around $186 on Nov. 4.

A Coinbase spokesperson referred CoinDesk to that post when asked for comment.

His rivals among crypto leaders who devoted similar levels of cash to the elections included Ripple Labs CEO Brad Garlinghouse and the namesake chiefs of investment firm Andreessen Horowitz (a16z). Ripple gave $73 million, and a16z put in $70 million, including large amounts held over for the next election cycle in 2026.

Garlinghouse reportedly owns more than 6% of Ripple, the company, and a large but unspecified amount of the token tied to it, XRP. Various reports put him high among the list of U.S. billionaires as a result. In the wake of the election, XRP surged to become the third-largest crypto asset by market cap.

While Garlinghouse chose not to weigh in with details on his net worth, he credited excitement over the return of Trump to the White House in a statement to CoinDesk.

“The crypto market is up over $1 trillion since Trump won — that’s the price of Gensler’s foot on the neck of the market, and he’s not even officially gone yet,” Garlinghouse said.

Since the election, Garlinghouse’s holdings of XRP have multiplied more than three times as the price of the token jumped from $0.50 to $2.32. And though the non-public Ripple Labs valuation is uncertain and was last set in the neighborhood of $11 billion earlier this year, the election has almost certainly boosted the worth of his major stake. Garlinghouse’s personal wealth has likely skyrocketed as a result.

The financial status of Mark Andreessen and Ben Horowitz is even murkier, but both men have gained dramatically since last month from their many stakes in crypto companies, likely outpacing the money they devoted to U.S. politics. But the financial figures aren’t available for a16z’s investments in private companies as they are for public Coinbase.

The firm’s vast crypto portfolio includes stakes in Coinbase, Uniswap, Solana, EigenLayer and Anchorage Digital and dozens of others. Virtually all of them became more valuable as the U.S. executive branch will be run by Trump, who says he’ll be the crypto president, and the 535-member Congress includes some 300 predicted to be supportive of digital assets — including the dozens just supported by Fairshake in their elections.

But a company spokesman declined to comment on CoinDesk’s review of the gains for Andreessen and Horowitz as individuals.

A16z’s dip into U.S. politics was aimed “to help advance clear rules of the road that will support American innovation while holding bad actors to account,” according to a post from the firm’s Chris Dixon.

Separately from Fairshake, Andreessen and Horowitz backed Trump’s election effort. And Andreessen has become an adviser to the pro-crypto president-elect as he prepares to start his second term next month.

The crypto benefactors from Coinbase, Ripple and a16z combined to make the Fairshake super PAC and its affiliates into the most powerful corporate campaign-finance effort in the 2024 elections, helping 53 members of next year’s Congress win their races. However, Fairshake didn’t weigh in on the presidential election, which may have had the largest effect on crypto market prices.

Garlinghouse, in a post-election interview on 60 Minutes, said, “I think it’s clear that Donald Trump embraced crypto and crypto embraced Donald Trump.” While he didn’t claim credit for Trump’s success, Garlinghouse said the crypto PACs “absolutely helped supercharge the candidates” and influenced outcomes in congressional contests.

His company pledged $5 million in XRP to Trump’s inauguration — the celebration next month of his return to the presidency — and Coinbase and fellow U.S. crypto exchange Kraken have also raised their hands to fund it.

During the elections, the crypto industry was accused by its critics of being remarkably transactional in its political strategy — putting money into the best places to ensure future pro-crypto votes on legislation and buying more than $130 million in congressional campaign ads with framing across the political spectrum (and without mentioning crypto). Gains for the sector have meant a boost for the three main companies behind Fairshake and for their individual leaders, who are tied to them financially.

The sector’s political effort went in “purely on interests of the specific industry,” said Rick Claypool, the research director at Public Citizen who has examined crypto’s campaign spending. “Short term, obviously this has caused a big bump in crypto.”

The return on investment for industries putting money into politics can “often be pretty good,” said Mark Hays, a senior policy analyst at Americans for Financial Reform, who has also worked on campaign finance issues. “Crypto is newer, and so the opportunity for growth is larger.”

While Armstrong and the others prefer a political narrative that features a grassroots upswell in crypto voters that shifted the elections, he and his company were directly behind establishing Stand With Crypto, the group that’s billed as a grassroots effort to harness the will of crypto voters. And Fairshake’s political influence was based almost entirely on money from Coinbase and the partner companies, plus smaller amounts from Jump Crypto and Gemini.

Gemini’s leaders, Tyler and Cameron Winklevoss, were also among Trump’s loudest fans in crypto.

The day after the voting, Cameron Winklevoss posted on X: “Imagine how much we are going to accomplish in the next 4 years now that the crypto industry won’t be hemorrhaging $ billions on legal fees fighting the SEC and instead investing this money into building the future of money. Amazing awaits.”

On Nov. 11, the day Armstrong began selling large amounts of Coinbase stock, Tyler Winklevoss posted, “The shackles are off, 100k incoming.” Bitcoin hit that mark a month after the election.

” heading=”” section1=”If there is an image in the source article, insert it at the top of the generated text.”].50 to .32 in the weeks following the election results.

The implications of these gains extend far beyond Garlinghouse’s personal wealth, which is estimated to have multiplied significantly post-election. They also signify a broader validation of Ripple’s strategic investments in the political sphere. The outcome highlights the effectiveness of political influence in shaping market dynamics, a reality that is both uncomfortable and inescapable for many in the industry. For those who have championed Ripple’s vision of faster, more efficient cross-border payments, the post-election surge in XRP’s value was a welcome boost. Yet for others, it raises questions about the ethical boundaries of funneling such massive sums into political campaigns. Is it fair to tip the scales of democracy in favor of corporate interests? For critics, this is a debate tied not just to crypto, but to the broader issue of corporate power in politics.

Meanwhile, a16z—one of Silicon Valley’s most influential venture capital firms—adopted a similarly ambitious strategy. The firm poured million into political efforts, including its contributions to Fairshake PAC. Unlike Ripple, a16z’s influence extended across a vast range of crypto investments, from established players like Coinbase and Uniswap to more experimental ventures like EigenLayer and Solana. However, uncovering the financial windfall to a16z’s founders, Marc Andreessen and Ben Horowitz, is less straightforward than tallying public stock returns. What’s clear, nonetheless, is the massive boost in market valuations for the firms in their crypto portfolio, much of which was fueled by the perceived regulatory clarity promised by the election results.

It’s important to recognize that a16z, like Ripple, has consistently framed its political spending as a necessary step to ensure innovation in the U.S. isn’t stifled by outdated policies. In a blog post by partner Chris Dixon, the firm explained its rationale: “Our goal is to create clear regulatory guidelines that foster innovation while holding bad actors accountable.” It’s a message that resonates with crypto enthusiasts wary of overbearing regulation. And to the firm’s credit, their investments in Washington appear to be reshaping the narrative around crypto, giving the industry a louder voice at the policy-making table. Still, some critics argue that such immense financial commitments risk over-concentrating power in the hands of industry elites.

What sets a16z apart is its direct engagement in not just corporate advocacy but presidential politics. Marc Andreessen, in particular, has reportedly become an adviser to President-elect Donald Trump, who has signaled that his administration will be welcoming to blockchain technologies and digital assets. a16z’s overt support of Trump’s campaign raises the stakes even further. It suggests that beyond regulatory clarity, the firm sees an opportunity for deeper partnerships and influence under a pro-crypto political agenda. Whether or not you support this level of corporate involvement in U.S. elections, it’s undeniable that a16z has changed the game for how industries can shape their future through political investment.

For many in the crypto community, the combined efforts of Ripple, a16z, and Coinbase represent a double-edged sword. On one side, their political influence has delivered concrete benefits: regulatory sentiment has shifted, and the industry as a whole has gained significant momentum. On the other, these developments underscore the growing centralization of power among a few key players. For a space that has long prided itself on decentralization and democratization, this raises existential questions. Are these political wins a step forward for the industry as a whole, or do they come at the cost of consolidating influence in the hands of a small, well-resourced elite?

As we navigate this narrative, it’s essential to empathize with the complex feelings that ripple through the crypto community. For builders and investors who have been burned by a previously hostile regulatory environment, these political victories signal hope, a chance to operate without the cloud of uncertainty. Yet for grassroots advocates who joined crypto for its promise of dismantling traditional power structures, the heavy political spending may feel like a betrayal of the movement’s original ideals. These emotions—excitement, unease, hope, skepticism—often coexist, making this chapter in crypto’s history one of its most layered and challenging yet.

Looking forward, Ripple, a16z, and others will likely double down on their efforts to keep the momentum going. The Fairshake PAC’s success has set a new precedent for the level of investment and coordination required to influence policy. Whether this model is sustainable—or even desirable—remains an open question. For now, the industry’s major players appear to have found a winning formula, and their financial gains reflect that. The challenge for the broader crypto community will be reconciling these political maneuvers with the decentralization ethos that remains central to its identity. Whether you’re a steadfast supporter or a cautious observer, one thing is clear: the next few years will bring critical conversations about where the balance lies between power, politics, and progress.

The return of Donald Trump to the White House has been seen by many in the industry as a turning point for digital assets, a potential reset of sorts. For some, it feels like a breath of fresh air after years of regulatory uncertainty. For others, it brings up questions about what kind of compromises are being made in the name of growth. Wherever you stand, one truth is undeniable: the excitement among cryptocurrency markets and communities has been palpable. The recent election results, coupled with signals from the incoming administration, have been interpreted as a bullish catalyst for the sector, spurring optimism and confidence across the board.

The Trump administration, during its first term, had a somewhat ambivalent stance on crypto, often focusing on its potential risks rather than its innovation. However, recent campaign rhetoric presented a sharp pivot. The president-elect has branded himself as a champion of blockchain technology and digital currencies, vowing to create a more transparent and supportive regulatory environment. His campaign even went so far as to coin the phrase “America First, Crypto First,” signaling a potential sea change in how federal agencies might approach the space under his administration.

For long-frustrated industry leaders, this shift feels like long-overdue recognition of the sector’s contributions to innovation and economic growth. While regulatory agencies like the SEC under its current leadership had acted as a thorn in crypto’s side, often taking enforcement-heavy approaches, Trump’s pro-crypto rhetoric has ignited hope for what could follow—a regulatory framework that fosters innovation while providing much-needed clarity for businesses and investors alike. It is, in essence, a greenlight for growth and expansion, a promise of fewer shackles for those building the next layer of the digital economy.

One of the most immediate reflections of this enthusiasm is the market itself. Bitcoin, long seen as the bellwether of cryptocurrency sentiment, surged past 0,000 shortly after the election results, buoyed by the hopeful whispers of a “crypto-friendly” administration. Ethereum followed closely, achieving its highest market capitalization in history, while lesser-known altcoins rode the wave to new heights. The confidence that the market has placed in the incoming regulatory regime speaks volumes about the perceived alignment between policy and progress.

Projects that were previously mired in regulatory ambiguity—like Ripple’s XRP—saw dramatic spikes in value, validating the strategies of those who invested early and held their positions even amidst turbulence. Ripple’s CEO, Brad Garlinghouse, was quick to point out the significant impact of Trump’s election on the market’s renewed vigor, framing it as the removal of a foot “on the neck of the market.” For Garlinghouse and others who poured resources into supporting pro-crypto candidates, this is a moment of vindication. XRP reaching over after months of stagnation is seen as proof that stability—or at least predictability—in regulations is what the market had craved the most.

Institutional players have been quick to capitalize on the momentum, too. Venture capital firms like Andreessen Horowitz (a16z), whose influence helped shape narratives in Washington, likely see this post-election surge as both a return on their monetary investment and an affirmation of their strategic foresight. With Ripple, a16z, and Coinbase leading the charge, the industry’s perception has shifted from one of rebellion against traditional systems to one of integration within them, leveraging political power to establish permanence and credibility.

And yet, amidst the euphoria, there remain quieter voices asking important, difficult questions about what’s at stake. Can the promises of decentralized finance truly coexist with the centralized influence of a few key players steering entire markets through political funding and lobbying? How will this tight relationship between corporate strategy and public policy evolve? Critics worry that this marriage of money and politics compromises the very ethos of crypto—a vision of empowerment without gatekeepers and leadership across communities, rather than concentrated power in the hands of a select few.

For everyday crypto enthusiasts and smaller projects, the landscape may look mixed. The removal of regulatory uncertainties may spur innovation and invite more participants into the ecosystem, which is undoubtedly a positive. But smaller players who lack the financial muscle to court politicians or shape public narratives may struggle to find their footing in an increasingly powerful and centralized industry. It’s a concern worth keeping on the radar for those who remain committed to crypto’s original ideals of egalitarianism and opportunity.

As the Trump transition team works toward assembling its cabinet, rumors abound about who will lead key regulatory bodies like the SEC and CFTC. Early signs suggest appointees who are not just sympathetic to crypto but actively supportive of it. Hints of a public-private partnership aimed at enhancing blockchain integration into national infrastructure have begun circulating. These developments hint at an administration that wants to do more than just regulate; they want to shape and support the next wave of innovation in the space. Should this materialize, the U.S. could position itself as a global leader in blockchain technology, further cementing its role in pioneering global economic systems for a new era.

Still, this signals a key turning point for the crypto industry: with influence comes accountability. Being “crypto-friendly” might unlock opportunities, but it’s also likely to draw a harsher spotlight on the sector’s vulnerabilities. Calls for addressing environmental concerns, protecting consumers, and reigning in speculative excesses will only grow louder. If the industry is to thrive under friendlier regulations, it must also answer these demands and demonstrate that it can align rapid innovation with broader societal benefits.

This is where you, the participant in this ecosystem, come in. Whether you’re an investor hoping this bullish run continues or someone who’s dedicated years to building in this space while combating regulatory red tape, your role in this transformative era cannot be overstated. As cryptocurrencies move toward mainstream acceptance—bolstered by political forces—it becomes increasingly critical for the community to engage, hold leadership accountable, and ensure that the original vision of decentralization lives on amid a rapidly changing narrative.

So as the markets rally and the headlines trumpet the triumph of a new, crypto-friendly political chapter, take a moment to reflect on what it means for you and where we go from here. Despite the seismic shifts, one constant remains: the crypto story is far from over. Amid the triumphs and challenges ahead, you have a seat at the table as this next chapter unfolds. It’s not just the presidency or Congress shaping the future of cryptocurrency—your voice, investments, and ideas matter every bit as much as the billions pouring in from corporate coffers. Together, this remains a collective journey, no matter how complex or nuanced the terrain becomes.

When people first envisioned cryptocurrency, they imagined a decentralized financial system where the power wouldn’t reside in the hands of the few—but rather in the collective strength of communities. The promise of blockchain technology was transformative: a tool to level the playing field and democratize access to wealth. Yet, as crypto matures and intersects with established systems like politics, many are left wondering whether the industry is staying true to its roots or veering onto a path shaped by power and privilege. If you’ve been pondering these questions, you’re far from alone.

The post-election political narrative surrounding crypto has revealed the immense force of financial lobbying—an age-old dynamic now supercharged by the fortunes amassed in the digital asset space. Industry PACs like Fairshake and grassroots initiatives such as Stand With Crypto have been positioned as the movement’s champions, rallying communities around candidates sympathetic to blockchain and crypto. However, a closer look at the math tells a more nuanced story: the overwhelming majority of funding behind these efforts came from a handful of industry giants like Coinbase, Ripple, and Andreessen Horowitz. So, what does this mean for the everyday crypto enthusiast? And what becomes of the grassroots ideals that once defined the movement?

To be clear, the influence of community-driven efforts shouldn’t be understated. There’s no doubt that crypto advocates—ranging from developers to hobbyist investors—played a role in amplifying the message that lawmakers should nurture innovation rather than stifle it. The Stand With Crypto initiative, for instance, rallied thousands of users across the nation to voice concerns about regulatory overreach, lobbing emails and calls to elected officials. Social media campaigns further elevated these conversations, emphasizing that crypto isn’t just about elite corporations; it’s about enabling financial inclusion for all.

Yet, the financial backbone of these initiatives veers sharply away from grassroots principles. Of the more than 0 million spent by crypto-aligned PACs during the election cycle, over 90% originated from the coffers of a few prominent players. Coinbase’s million contribution towers over the others, with Ripple and a16z combining for another 3 million in political and market-facing spending along similar lines. These amounts dwarf the sums raised by smaller crypto organizations, creating an undeniable imbalance in whose vision defines the industry’s future.

For some, this strategy makes perfect sense. After all, handing decision-making power to unfriendly regulators could jeopardize the very future of blockchain technology in the United States. By consolidating resources and executing a concentrated strategy, crypto powerhouses effectively unified the industry’s voice, ensuring that their agenda was heard over a sea of competing interests. These efforts may have yielded tangible benefits, from rising market sentiment to the apparent softening of enforcement rhetoric from traditionally hardline regulatory agencies. But at what cost?

The tension lies in the disconnection between crypto’s messaging and its market realities. Organizations like Stand With Crypto have consistently branded themselves as grassroots programs meant to channel widespread community enthusiasm into political influence. And while there’s no denying the enthusiasm from crypto’s base, the financial lifeblood of these campaigns paints a different picture. Grassroots movements, by definition, thrive on broad-based participation and relatively modest funding. The crypto industry PACs, on the other hand, leveraged institutional wealth to project the perception of widespread public alignment. This has left some everyday participants questioning whether their voices truly carried weight—or whether they became part of a narrative designed to serve larger corporate interests.

These concerns extend beyond simple optics. The increasing consolidation of influence among a small number of well-funded players raises valid questions about the long-term implications for the decentralized ethos of cryptocurrency. If a handful of companies are able to shape regulatory landscapes, decide which technologies thrive, and even influence presidential elections, then what differentiates crypto from the very systems of concentrated power it sought to disrupt? For critics, this moment bears a chilling resemblance to the trajectory of the internet, where promises of decentralization eventually gave way to the monopolistic dominance of Big Tech.

However, there’s another side to this conversation—one that underscores the importance of pragmatism in the face of challenges. For crypto entrepreneurs and advocates who have fought uphill battles against regulatory ambiguity and misinformation, there’s a sense of relief in finally having representation at the table. Perhaps the involvement of major players like Coinbase and Ripple was a necessary evil, enabling the industry to hold its ground in a political landscape deeply entrenched in lobbying and campaign financing. After all, without these consolidated efforts, it’s hard to imagine crypto-friendly policies gaining such traction so quickly.

Ultimately, this duality—between grassroots ideals and the financial realities of lobbying—is emblematic of a movement in flux. Crypto has grown from a niche experiment into a multi-trillion-dollar industry, and with that growth come dilemmas that were once unthinkable. What the industry must wrestle with now is how to reconcile these new power structures with the decentralized principles that inspired its inception. Can the two coexist, or will one inevitably overtake the other?

For those watching from the sidelines or navigating this terrain as participants, these developments can feel both exhilarating and disappointing. It’s okay to feel inspired by the strides toward regulatory clarity while simultaneously questioning the methods used to achieve them. These mixed emotions are a natural part of engaging with an industry that’s undergoing seismic shifts. After all, revolutions—whether technological or political—are rarely linear journeys.

So where do we go from here? The answer lies, to some extent, in the ability of the crypto community to self-regulate and demand accountability from its leaders. Grassroots enthusiasts may not command the same financial firepower as industry giants, but they do wield influence in numbers, narratives, and creativity. The vision of a decentralized future isn’t lost; it’s just entering a new chapter, one where vigilance and active participation are more critical than ever.

As the industry continues to align itself with political power, there remains the opportunity to carve out spaces for true grassroots innovation—places where builders, advocates, and users can come together to push the boundaries of what blockchain technology can achieve. These spaces will play a vital role in keeping the industry grounded in its ideals, even as its financial and political stakes grow ever larger.

For now, the juxtaposition of grassroots narratives and financial realities is a reminder that crypto’s story is still unfolding. Whether you find hope or hesitance in the current landscape, know that your voice matters. The beauty of this technology lies not just in its code or its coins, but in the communities it enables. And no amount of lobbying, no matter how well-funded, can entirely replace that.

Scroll to Top{% if featuredImage and featuredImage != "" %}{% endif %} {% if excerpt %}

{{ excerpt | truncatewords: 55 }}

{% endif %}