In a significant move within the cryptocurrency landscape, Michael Egorov, the founder of Curve Finance, has proposed an innovative initiative on the Curve DAO governance forum aimed at enhancing income opportunities for CRV token holders. The new protocol, known as Yield Basis, seeks to provide a more reliable way for users who stake their tokens and engage in governance to earn returns, marking a shift away from the sporadic airdrops that have characterized Curve’s token economy. This proposal comes at a time when the platform is looking to solidify its position amidst changing market dynamics.

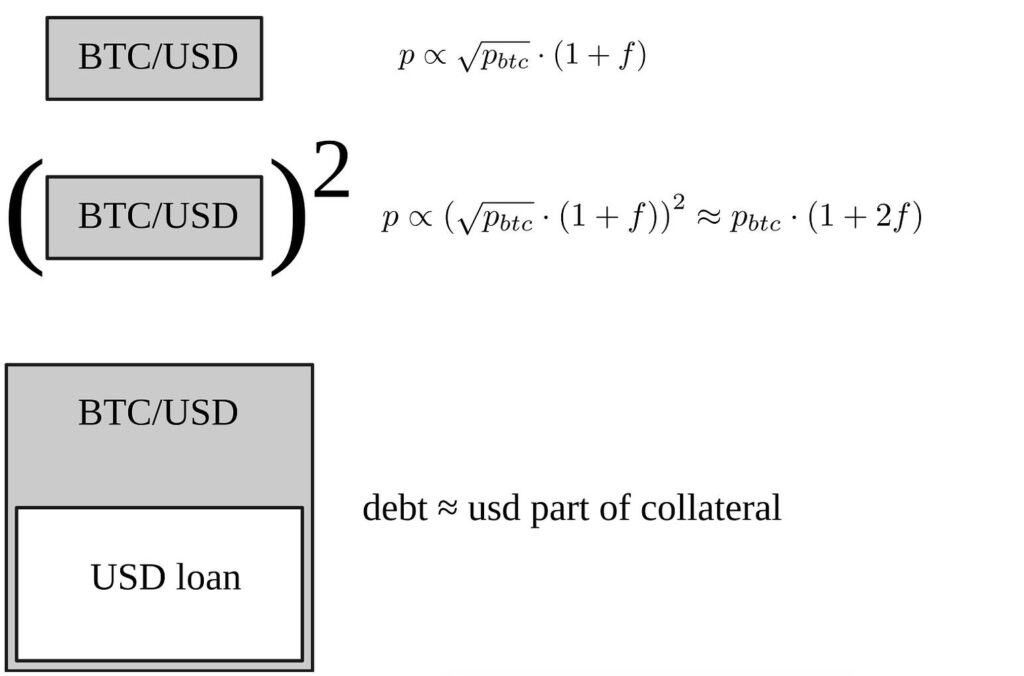

Yield Basis plans to initiate its journey by minting $60 million worth of Curve’s crvUSD stablecoin. The funds generated from these tokens will primarily support three bitcoin-focused pools: WBTC, cbBTC, and tBTC, each capped at $10 million. This strategic distribution is designed to attract institutional and professional traders by offering transparency and sustainable yields on bitcoin, while effectively steering clear of the impermanent loss challenges frequently faced by liquidity providers in automated market makers.

The proposal carries the promise of returning between 35% and 65% of its value to veCRV holders, with a quarter of the Yield Basis tokens set aside for the broader Curve ecosystem. Voting on this pivotal proposal is scheduled to occur from September 17 to September 24, potentially redefining the earning structures for CRV holders.

“The introduction of Yield Basis represents a proactive step toward creating a stable income model for our community and responding to the evolving needs of the crypto market,” said Egorov in his latest communication.

However, it is worth noting that Egorov himself has faced considerable financial challenges, including several high-profile liquidations tied to leveraged CRV purchases earlier this year. These incidents have had their toll on both Egorov and the Curve project, highlighting the volatility in the crypto realm. Despite this backdrop, the introduction of Yield Basis could signal a fresh chapter for Curve Finance as it navigates these turbulent waters.

In the latest market movements, CRV saw a slight increase of around 1% within the past 24 hours, as anticipation builds around the upcoming proposal and its potential impact on the decentralized exchange landscape.

Curve Finance’s Yield Basis Proposal

Key points impacting readers and stakeholders:

- Introduction of Yield Basis: A new protocol to provide direct income to CRV token holders.

- CRV Token Mechanics: Stakeholders can earn veCRV tokens through governance votes, moving beyond traditional airdrops.

- Initial Funding: $60 million worth of crvUSD stablecoin will be minted to support the Yield Basis initiative.

- Support for Bitcoin Pools: Funds allocated for three bitcoin-focused liquidity pools, each capped at $10 million.

- Returns for Stakers: Yield Basis aims to return 35% to 65% value to veCRV holders.

- Institutional Attraction: Designed to appeal to institutional traders with transparent and sustainable bitcoin yields.

- Avoiding Impermanent Loss: The protocol addresses liquidity provider concerns associated with price fluctuations in automated market makers.

- Governance Participation: Voting on the proposal takes place from September 17 to September 24, encouraging community involvement.

- Founder’s Financial Situation: Michael Egorov’s recent liquidations highlight risks and volatility, which may affect community sentiment and trust.

Curve Finance’s Yield Basis Proposal: A Strategic Move in DeFi

The recent unveiling of the Yield Basis proposal by Michael Egorov on the Curve DAO governance forum marks a significant shift in the decentralized finance (DeFi) landscape. This innovative approach aims to empower CRV token holders by providing a more substantial and sustainable way to earn income, partially addressing a longstanding concern regarding the efficacy of governance participation rewards. In a system frequently reliant on sporadic airdrops, Yield Basis promises a robust and steady income stream for stakers, contrasting favorably with similar initiatives in the DeFi space.

While other decentralized exchanges have occasionally introduced liquidity mining rewards, they often fall short in maintaining long-term interest from their respective communities. Curve’s proposal enhances its competitive edge by directly tying potential earnings to governance engagement, a strategy that not only incentivizes participation but also fortifies the overall integrity of the ecosystem. By reserving a portion of the tokens specifically for the Curve ecosystem, the initiative also fosters a sense of community ownership, a notable advantage that could attract more users, particularly institutional and professional traders drawn to the transparency and reliability of such structured returns.

However, the proposal isn’t without its potential pitfalls. The historical context of Egorov’s recent financial troubles, including significant liquidations tied to leveraged CRV purchases, casts a shadow over the initiative. The reliance on external market conditions, compounded by the precarious nature of pooled liquidity, raises the specter of impermanent loss—a significant disadvantage that could deter some liquidity providers. Especially for risk-averse investors, the specter of volatility and losses inherent in DeFi could hamper broader adoption of the Yield Basis model, potentially isolating the proposal from a wider audience in the crypto marketplace.

This move could benefit active participants within the Curve ecosystem eager to maximize their returns and engage in governance decisions. Conversely, it poses challenges for less experienced investors or those wary of the volatility associated with DeFi investments. As the voting period for the proposal approaches, it will be crucial for stakeholders to weigh these factors thoughtfully and gauge whether the potential benefits outweigh the risks involved in navigating the dynamic waters of decentralized finance.