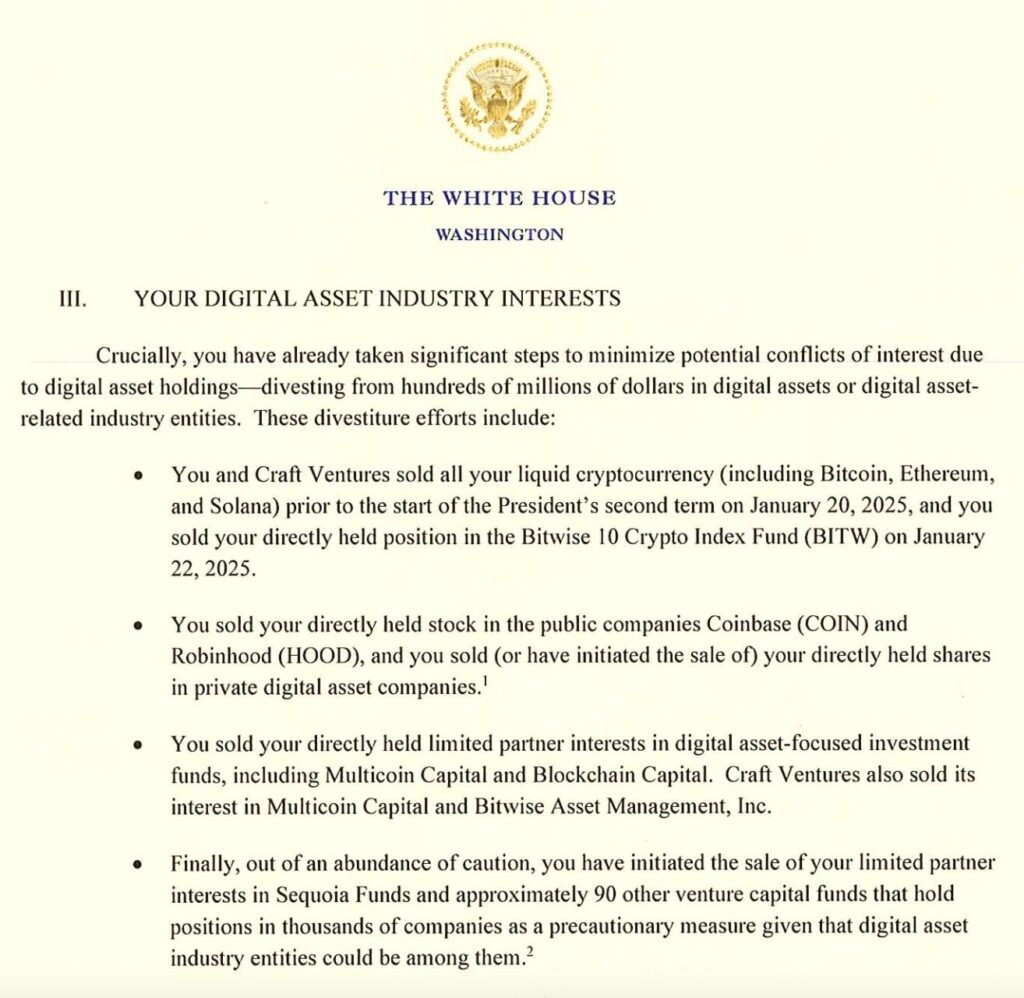

In a striking move within the cryptocurrency ecosystem, David Sacks, a prominent venture capitalist, has strategically liquidated over 0 million from his investment portfolio in digital assets and crypto-related stocks. This significant sell-off, revealed in a White House memorandum dated March 5, was undertaken as Sacks prepared to take on his new role as the White House AI and crypto czar. The document indicates that Sacks personally accounted for around million of the divestment, which includes liquid cryptocurrencies like Bitcoin, Ether, and Solana.

The rationale behind this substantial withdrawal is to mitigate any potential conflicts of interest before Sacks officially commenced his duties, which prominently involve shaping legal frameworks for the burgeoning crypto industry. Given the volatility of the cryptocurrency market, Sacks’ move has sparked conversations about transparency and accountability within the sector. According to reports, since the beginning of Donald Trump’s presidency, the crypto market has witnessed a major drop, raising questions about the interplay between political decisions and market dynamics.

“You and Craft Ventures have divested over 0 million of positions related to the digital asset industry,” states the White House memorandum, reflecting the proactive steps taken in the light of Sacks’ upcoming responsibilities.

Aside from offloading liquid cryptocurrencies, Sacks also divested from significant publicly traded entities like Coinbase and Robinhood, as well as private investment stakes in firms including Multichain Capital and Blockchain Capital. This strategic repositioning not only underscores Sacks’ commitment to ethical governance but also highlights the prevailing winds of change in the cryptocurrency landscape.

Shortly after the memorandum’s release, Senator Elizabeth Warren sent a letter to Sacks requesting clarity on his asset divestment timeline, further emphasizing the scrutiny surrounding public figures in the crypto space. Warren’s inquiry reflects broader concerns about the interplay between finance and politics, particularly in a rapidly evolving industry where regulatory frameworks are still being developed.

Since stepping into his new role, Sacks has emerged as a vocal advocate for various crypto-related issues, including the establishment of a Strategic Bitcoin Reserve. He recently voiced strong opposition to the idea of imposing transaction taxes on cryptocurrencies, emphasizing fears that modest taxes can lead to broader fiscal burdens over time.

As the cryptocurrency market continues to navigate turbulent waters—recently dipping below ,000 for Bitcoin—Sacks’ actions and advocacy will likely be closely monitored by investors and regulators alike, as they seek to understand the future direction of digital assets in a politically charged environment.

David Sacks’ Crypto Divestment and Implications for the Future

David Sacks, who recently took on the role of White House AI and crypto czar, has divested over 0 million in cryptocurrency and related stocks, as revealed by a White House memorandum. This divestment raises significant concerns and implications for the crypto industry and its investors.

- Significant Divestment:

Sacks and Craft Ventures sold a total of 0 million in digital assets, with million directly attributed to Sacks.

- Conflict of Interest Prevention:

The memorandum details efforts to mitigate potential conflicts of interest before Sacks assumed his role, which includes creating a legal framework for cryptocurrencies.

- Complete Crypto Liquidation:

He divested all liquid cryptocurrencies from his personal portfolio and Craft Ventures’ portfolio, including major assets like Bitcoin, Ether, and Solana.

- Market Impact:

Since Sacks’ divestment, the crypto market has experienced a downturn, losing substantial value and impacting investors.

- Political Scrutiny:

Senator Elizabeth Warren has publicly urged Sacks to clarify his current holdings in cryptocurrencies, highlighting ongoing scrutiny from lawmakers.

- Taxation Debate:

Sacks has opposed the idea of imposing transaction taxes on cryptocurrencies, drawing parallels with the history of income tax changes over time.

These developments underscore the volatile nature of the crypto market and the potential regulatory challenges it may face. Individuals investing in or interested in cryptocurrencies should remain vigilant about legal frameworks and market trends that could affect their financial decisions.

David Sacks: Navigating the Controversial Crypto Landscape

David Sacks’s recent divestment of over 0 million from the crypto sector highlights both strategic foresight and potential conflicts as he steps into his role as the White House’s AI and crypto czar. This proactive approach is primarily aimed at eliminating any semblance of a conflict of interest, marking a significant move in the often contentious relationship between government roles and private investments in cryptocurrencies.

Competitive Advantages: Sacks’s ability to effectively sell off substantial holdings in major cryptocurrencies and related stocks, such as Bitcoin, Ether, and influential firms like Coinbase and Robinhood, showcases a level of tactical awareness. By divesting assets before his official appointment, he is likely positioning himself as a trustworthy figure in a field that has been rife with skepticism from legislators, particularly those who are cautious about the implications of digital assets. This strategic exit could help stabilize his standing with a public that is increasingly vigilant about transparency and integrity in the crypto space, creating a more favorable environment for regulatory discussions.

Moreover, Sacks’s advocacy against burdensome taxes on crypto transactions resonates positively with investors who fear over-regulation might stifle innovation and growth in the industry. His push for a Strategic Bitcoin Reserve also indicates a forward-thinking vision that could potentially galvanize support from both the crypto community and policymakers alike.

Competitive Disadvantages: Despite these strengths, his recent financial maneuvers do raise questions regarding his motives and commitment. Critics, including Senator Elizabeth Warren, have voiced concerns over the timing of his divestments and whether he can truly execute his responsibilities free from bias. The scrutiny regarding possible undisclosed tie-ups or secondary holders could undermine public trust, especially as he embarks on crafting policies that directly impact the crypto landscape.

Furthermore, the cryptomarket’s current downturn, exacerbated by political turbulence and rising interest rates, adds another layer of complexity. Sacks’s success as an advocate may hinge on whether he can articulate effective solutions for an industry facing declining confidence and financial instability. This situation could create significant hurdles for Sacks, as he may struggle to rejuvenate investor sentiment while also facing increasing calls for regulatory clarity from both sides of the aisle.

Overall, Sacks’s dual role as an advocate and a decision-maker could benefit crypto enthusiasts and investors who are eager for a stabilizing force, but it also risks alienating potential allies if perceived conflicts continue to shadow his actions. As the crypto landscape evolves, his every step will be watched closely by both supporters and opponents alike, making it crucial for him to balance transparency, strategic advantage, and regulatory frameworks in an industry that thrives on innovation yet grapples with uncertainty.