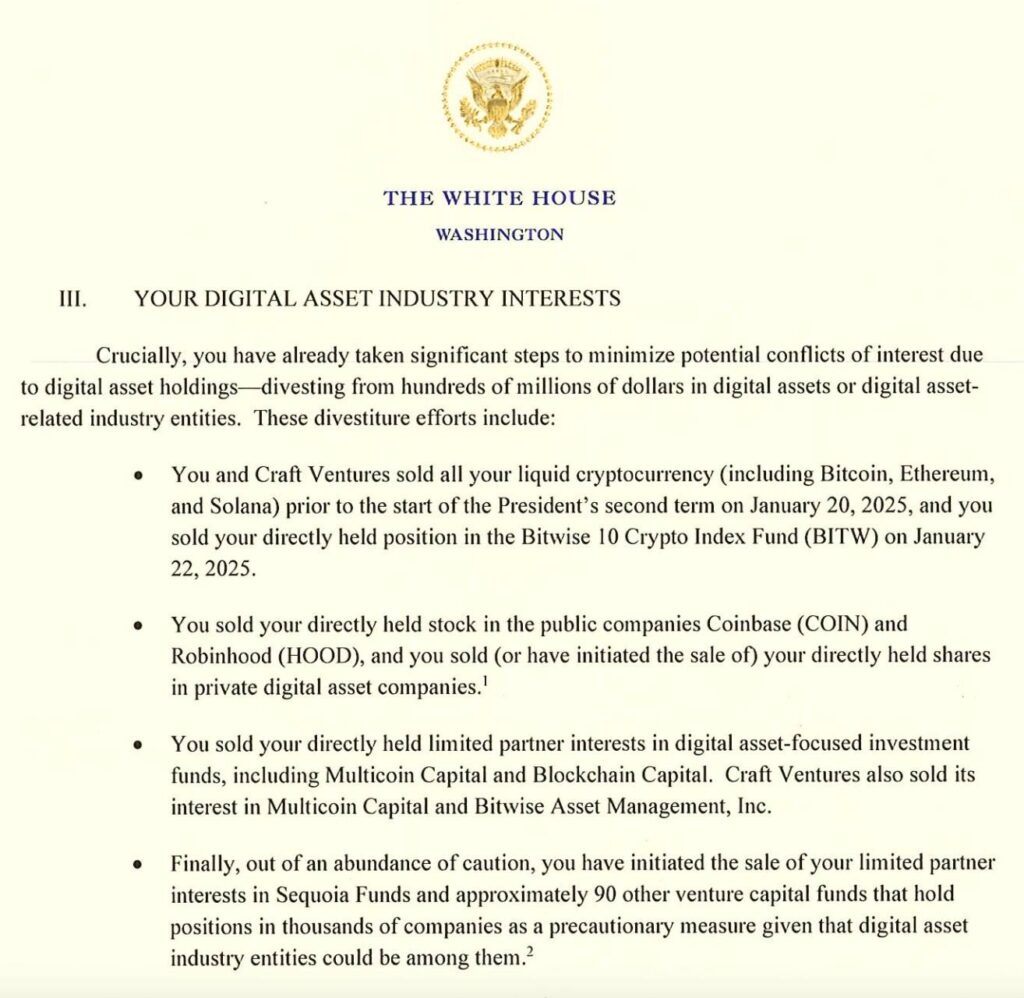

In a significant maneuver within the cryptocurrency landscape, David Sacks, a notable figure in venture capital, has divested over 0 million from crypto and related assets just before stepping into his role as the White House AI and crypto czar. This information comes to light through a memorandum from the White House revealing that Sacks has taken “significant steps” to avoid potential conflicts of interest in this high-profile position aimed at shaping regulations for the digital asset sector.

Just before assuming his new responsibilities, Sacks sold off a considerable amount of liquid cryptocurrency from both his personal portfolio and that of his firm, Craft Ventures. This included major cryptocurrencies such as Bitcoin, Ether, and Solana, reflecting a careful strategy to maintain transparency and integrity in his upcoming role.

“You and Craft Ventures have divested over 0 million of positions related to the digital asset industry, of which million is directly attributable to you,”

highlighted the memorandum dated March 5. Notably, this sell-off took place ahead of President Donald Trump’s inauguration, marking a period of significant volatility in the crypto market in which digital assets experienced substantial declines, shedding light on how external economic pressures can influence investor behavior.

Senator Elizabeth Warren has raised concerns about Sacks’ previous holdings, urging him to clarify his financial ties to cryptocurrencies amidst calls for greater accountability in the industry. Emphasizing the importance of clear communication, Warren’s inquiries touch on broader themes of transparency and governance as Sacks now advocates for a robust regulatory framework for cryptocurrencies.

In the weeks following Sacks’ onboarding at the White House, he has continued to engage in discussions around the future of the crypto market, including pushing back against proposed taxation on cryptocurrency transactions, illustrating his commitment to fostering a favorable environment for digital innovation.

As the cryptocurrency market navigates these tumultuous times, leaders like Sacks are essential for guiding policy and regulatory strategies that could shape the industry for years to come.

David Sacks’ Crypto Divestment and Its Implications

David Sacks’ recent actions reveal significant insights into the intersection of cryptocurrency and government roles, as well as potential impacts on the broader market. Here are the key points:

- Divestment of 0 Million: Sacks and Craft Ventures sold over 0 million in crypto and related assets to mitigate conflicts of interest before his new role.

- Focus on Conflict of Interest: The memorandum highlighted proactive steps taken to eliminate potential conflicts of interest before Sacks began his duties.

- Comprehensive Asset Offloading: All liquid cryptocurrency holdings, including significant assets in Bitcoin (BTC), Ether (ETH), and Solana (SOL), were sold prior to Trump’s inauguration.

- Impact of Market Declines: The crypto market saw a significant downturn post-inauguration, influenced by economic factors such as tariffs and interest rate uncertainty.

- Public Scrutiny: Senator Elizabeth Warren’s inquiry into Sacks’ divestment timing emphasizes the ongoing scrutiny of financial interests within government positions.

- Advocacy for Crypto Industry: Sacks has taken a public stance against proposed taxes on cryptocurrency transactions, warning of potential long-term implications for the industry.

“That’s always how taxes start. They are described as being very modest.” – David Sacks

Overall, Sacks’ actions and subsequent advocacy could influence regulatory frameworks, shaping the future landscape of the crypto industry, which may directly affect investors, developers, and everyday users of digital assets.

David Sacks’ Crypto Divestment: Navigating Conflicts of Interest in a New Era

Recently, David Sacks, the newly appointed White House AI and crypto czar, found himself at the center of a significant controversy following the disclosure of his substantial divestment from the cryptocurrency market. Selling off over 0 million, Sacks took decisive steps to sidestep any potential conflicts of interest arising from his government role, a move that raises both eyebrows and questions within the crypto community and beyond. This proactive divestment is increasingly crucial as the regulatory landscape surrounding digital assets evolves rapidly.

When examining similar news in the crypto regulatory space, figures such as former SEC chair Gary Gensler and even Treasury Secretary Janet Yellen have been under scrutiny for their ties to large financial institutions and their past engagements with cryptocurrencies. The major advantage Sacks holds is his transparency in divesting, which could enhance his credibility as a neutral figure in the policymaking arena. While this openness is refreshing, it also raises a critical question: Are officials who divest from cryptocurrencies adequately distanced from the industry to guide regulations effectively?

The flipside is that Sacks’ past investments and the significant amounts involved in his sell-off might lead skeptics to question whether he has fully severed ties to the cryptocurrency market. This perception could create obstacles for him in establishing policies that are perceived as fair and impartial. Furthermore, with Senator Elizabeth Warren’s pointed inquiry about his public claims on divestment, Sacks might face pressure to provide consistent clarifications, straddling the line of accountability and eroding public trust.

Investors and stakeholders in the crypto market can benefit from Sacks’ role by expecting more structured regulations that could stabilize the tumultuous landscape. His advocacy for crucial initiatives, such as a Strategic Bitcoin Reserve, hints at a possible positive shift in policy that could encourage investment stability. However, those who still harbor vested interests in cryptocurrencies might find the regulatory tightenings a potential hindrance to their market strategies, creating friction between traditional principles of venture capitalism and emerging regulatory demands.

Overall, while David Sacks has taken commendable steps to ensure ethical governance in his new position, the complexities of his previous significant investments and current responsibilities could complicate the trajectory of a rapidly evolving crypto ecosystem. How he navigates these challenges will be pivotal in shaping not only his legacy but also the future landscape of cryptocurrency regulation.