The cryptocurrency landscape experienced significant turbulence in the first quarter of 2025, as economic uncertainty and a major hack on the Bybit exchange rattled the decentralized finance (DeFi) sector. According to a recent report from DappRadar, the total value locked (TVL) in DeFi protocols plunged to $156 billion, marking a substantial 27% decline compared to the previous quarter. This downturn was mirrored by a sharp drop in the price of Ether (ETH), which fell 45% to $1,820.

Ethereum, the blockchain with the highest TVL, saw its value decrease by 37%, ultimately settling at approximately $96 billion. Other prominent blockchains like Sui faced even steeper losses, plummeting 44% to $2 billion. The impacts were widespread; blockchains such as Solana, Tron, and Arbitrum also endured reductions of over 30% in their respective TVLs, primarily due to a combination of increased withdrawals and a lower proportion of stablecoins invested in their ecosystems.

“Broader economic uncertainty and lingering aftershocks from the Bybit exploit,” the report described, as key factors driving the downturn in the DeFi sector.

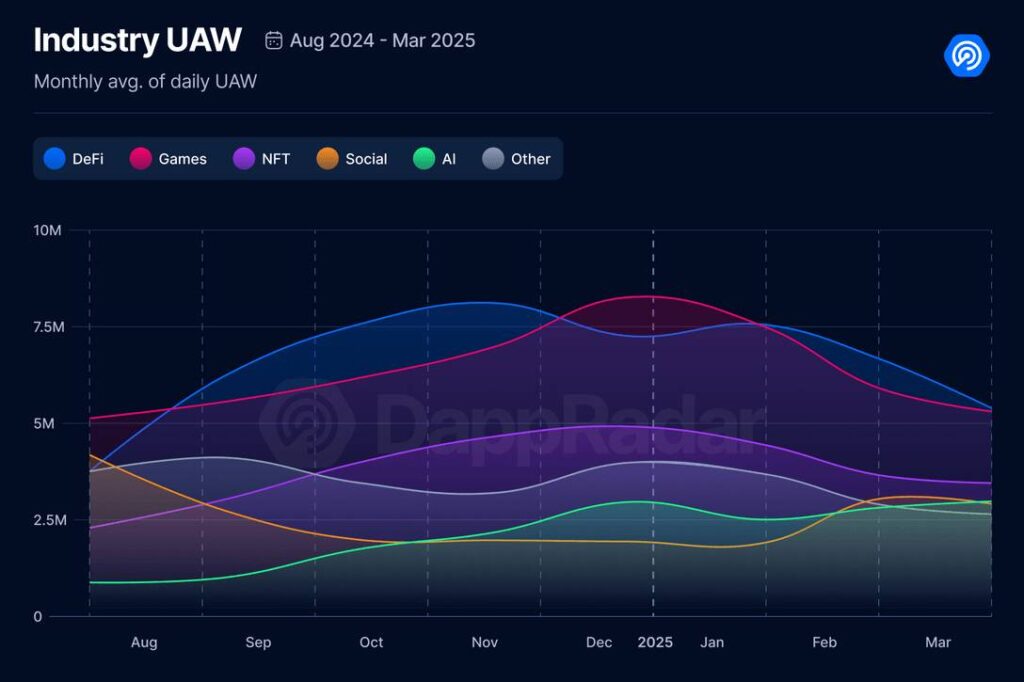

Interestingly, while DeFi struggled, the report highlighted a remarkable growth in AI and social applications. The number of daily unique active wallets interacting with these protocols surged by 29% and 10%, respectively, in Q1 2025. This brought the monthly average of users in AI protocols to approximately 2.6 million, while social apps attracted around 2.8 million. DappRadar noted that AI agent protocols have experienced “explosive growth,” indicating that they have moved beyond mere concepts and are actively influencing user interactions.

In the realm of NFTs, the trading volume faced its own decline, dropping 25% to $1.5 billion. OKX’s NFT marketplace emerged as the leader in sales, generating $606 million, while competitors OpenSea and Blur followed closely behind. Notably, collections like Pudgy Penguins and CryptoPunks saw significant transactions, reaffirming their status despite fluctuating market conditions. DappRadar echoed the sentiment that “CryptoPunks remains a staple,” underscoring its prestige amidst the volatility.

Impact of Economic Uncertainty and Crypto Developments on DeFi and AI Growth

The recent shifts in the crypto landscape, driven by economic factors and technological advancements, have significant implications for individuals and the broader market. Here are the key points from the latest report:

- Decline in DeFi Total Value Locked (TVL):

- The total value locked in decentralized finance (DeFi) protocols dropped to $156 billion in Q1 2025.

- This represents a 27% decline quarter-on-quarter, attributed to economic uncertainty and recent hacks.

- Impact on Major Blockchains:

- Ethereum saw a decrease of 37% to $96 billion in TVL.

- Sui experienced a significant decline of 44% to $2 billion.

- Other blockchains like Solana, Tron, and Arbitrum also faced reductions of over 30%.

- Growth in AI and Social Apps:

- Daily unique active wallets interacting with AI protocols increased by 29%, while social apps grew by 10%.

- The average number of unique active wallets hit 2.6 million for AI and 2.8 million for social protocols.

- This growth indicates a shift in user engagement towards AI and social applications amidst a declining DeFi landscape.

- NFT Market Decline:

- NFT trading volume decreased by 25% to $1.5 billion in Q1 2025.

- Major sales included OKX’s NFT marketplace leading with $606 million in sales.

- Pudgy Penguins were the most sold collectibles, highlighting a shift in consumer interests.

“AI agents are shaping new user behaviors, indicating their growing importance in the digital ecosystem.” – DappRadar

This evolving landscape emphasizes the importance of staying informed about market trends. Understanding the shifts in DeFi, as well as the growth of AI and social applications, could influence individual investment strategies and engagement in upcoming technologies and markets.

DeFi Declines Amidst AI Growth: An Insight into the Current Crypto Landscape

The most recent findings from the crypto analytics firm DappRadar reveal a concerning trend for decentralized finance (DeFi), with the total value locked plummeting to $156 billion in Q1 2025. This marks a significant 27% reduction from the previous quarter, largely attributed to economic uncertainty and the repercussions of a major exploit on the Bybit exchange. In contrast, the landscape for AI and social applications appears to be thriving, showcasing notable user growth.

Competitive Advantages in User Engagement

AI protocols and social applications have experienced an impressive surge in daily unique active wallets (DUAW), with increases of 29% and 10%, respectively. This indicates an exciting shift in user preferences, signaling that despite hardship in the DeFi sphere, there’s a growing appetite for innovation within AI. Such rapid adoption may position these sectors as favorable alternatives for users disillusioned by declining DeFi yields, fostering an environment ripe for investment and development in these areas. The rise of AI agents, as mentioned, demonstrates that they are no longer just conceptual technologies; they are actively reshaping user engagement and behaviors.

Challenges Facing the DeFi Sector

The decline in DeFi activity was exacerbated by significant price drops in major cryptocurrencies like Ether, which fell 45%. Compounded with the instability from crypto exchange exploits, this drop leads to a crisis of confidence among investors. High-traffic blockchains like Ethereum and Sui witnessed drastic reductions in their total value locked, driving users away in search of more stable or progressive platforms.

Implications for Investors and Innovators

These trends could spell trouble for traditional DeFi investors, particularly those who have heavily invested in Ethereum and other blockchains suffering substantial losses. Conversely, the growth in AI and social applications can present opportunities for developers and investors looking to pivot towards an expanding area within the crypto space. They may find that communities are more responsive to AI-driven solutions that offer novel user experiences against the bleak backdrop of traditional finance losses.

Moreover, the notable downturn in NFT trading highlights a broader issue within the digital asset market, fueling speculation around the sustainability of such collections. The resilience of exclusive pieces like CryptoPunks suggests that while mainstream interest in NFTs may fluctuate, there remains a niche market for high-value collections that could appeal to a different set of investors.

In summary, the current situation presents a dual narrative: while DeFi faces significant headwinds, the rise of AI and social apps opens new avenues for engagement, setting the stage for a potential renaissance in how we see and use digital currency and assets.