At the recently held Accelerate 2025 conference, Akshay BD, the non-chief marketing officer at the Solana Foundation, presented a compelling critique of the current state of capital markets. He emphasized that these markets are failing to cater to a wide array of investors, highlighting the challenges faced by retail investors who often find themselves locked out of lucrative private market opportunities. According to Akshay, blockchain technology, particularly the innovations supported by Solana, holds the potential to democratize investment and ownership, allowing broader participation in the economy.

“We can make everyone an investor or a dreamer over time,” Akshay asserted, pointing to the transformative power of blockchain.

As concerns grow about economic uncertainty, illustrated by low bond yields and asset price bubbles, investors are increasingly anxious. Akshay noted that the traditional asset allocation model, famously represented by the 60-40 portfolio, has struggled to deliver consistent returns in recent years. This instability has been partly driven by a widening economic divide where income from wages lags behind wealth accumulated through asset ownership, exacerbating the disconnect between labor and capital.

Delving deeper, Akshay highlighted the impact of rapid advancements in artificial intelligence, suggesting that this could further stratify economic divides. He offered two divergent paths for society: adopting a universal basic income model, where economic aid supports those unable to secure jobs or wealth, or embracing the idea of universal basic ownership, which would allow anyone with a mobile phone to participate in asset ownership. This vision positions blockchain not merely as a technological advancement but as a potential solution to socio-economic disparities.

“The question is, which way do we go?” he asked, underscoring the importance of fostering inclusive financial ecosystems.

In the context of the Solana ecosystem, Akshay envisions a future where individuals can invest in a broad spectrum of assets—from energy companies to local businesses—through tokenization, making ownership accessible at the swipe of a QR code. This innovative approach aims to amplify the market participation of retail investors, thereby addressing concerns around overheated public markets.

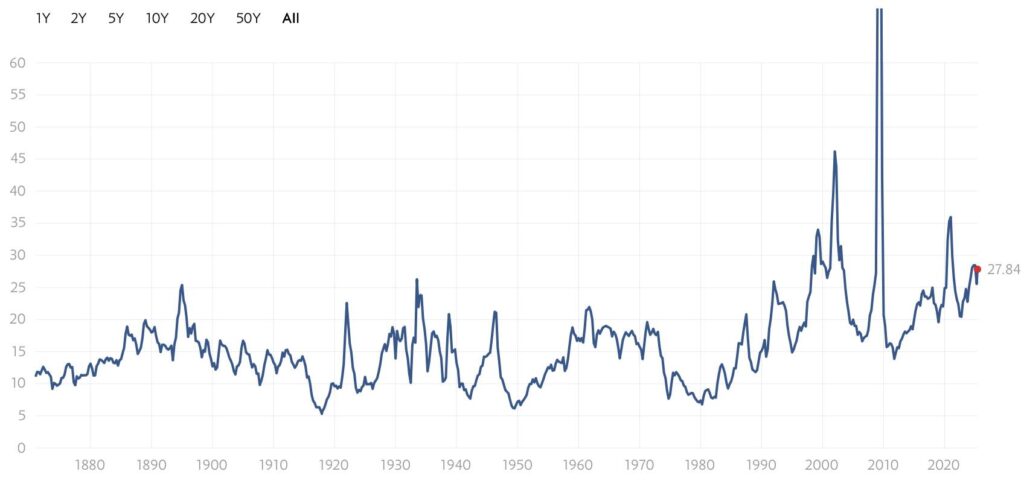

With the S&P 500 currently trading above historical averages, many investors are navigating a valuation landscape shaped by low interest rates and technological optimism. Akshay contends that opening up certain markets to retail investors could stave off potential market overheating—a goal some sectors of the cryptocurrency industry, particularly those focused on real-world asset (RWA) tokenization, are striving to achieve.

In closing, Akshay’s insights from the Accelerate 2025 conference not only reveal a critical examination of existing market dynamics but also propose an ambitious vision for the future of investment, one where blockchain technology may play a pivotal role in reshaping access and ownership for the masses.

Transforming Capital Markets with Blockchain

The current state of capital markets is not adequately addressing the needs of all investors, as highlighted by Akshay BD of the Solana Foundation. Below are key points from his discussion at the Accelerate 2025 conference, which could impact readers’ understanding of investment opportunities and economic equity.

- Shortcomings of Traditional Capital Markets:

- Current market structures fail to serve a broad base of investors.

- Traditional asset allocation models, like the 60-40 portfolio, are no longer yielding consistent results.

- Retail investors are often excluded from private markets, leading to a widening gap between earned income and asset ownership.

- Blockchain as a Solution:

- Blockchain technology can democratize investing, potentially allowing everyone with a mobile phone to own assets.

- Tokenization of assets could enable individuals to invest in a diverse range of opportunities, from businesses to local enterprises.

- Impact of Economic Factors:

- Low bond yields and asset price bubbles contribute to investor anxiety.

- Heightened concerns regarding economic divides, exacerbated by the rise of artificial intelligence.

- Future Economic Models:

- Discussion of potential models like universal basic income vs. universal basic ownership.

- Emphasis on creating a more inclusive economy where asset ownership is accessible to all.

- Current Market Valuations:

- Public equity markets are trading above historical averages, with the S&P 500 price-to-earnings (P/E) ratio exceeding long-term norms.

- High valuations can precede market corrections, emphasizing the need for new investment strategies.

- Role of Technology in Investment:

- Advancements in technology have historically hindered broader market access.

- Crypto infrastructure may allow the financialization of productive assets, promoting widespread ownership.

“What it gives you is the ability for you to financialize all the productive assets in an economy, so you can have anybody who participates in that economy be an owner of that economy.” – Akshay BD

Transforming Capital Markets: Solana’s Vision vs. Traditional Structures

At the forefront of discussions surrounding capital markets, Akshay BD from the Solana Foundation emphasizes the pressing need for evolution. By highlighting inherent discrepancies within existing financial structures, his insights echo a growing sentiment among various experts in finance and technology sectors. While traditional asset management frameworks, such as the enduring 60-40 portfolio, are faltering in delivering consistent returns, blockchain technology presents a promising alternative. Here, we’ll explore the competitive advantages and disadvantages of Solana’s approach compared to its peers in the financial technology landscape.

Competitive Advantages:

Solana’s vision of democratizing investment through blockchain technology stands out as a key advantage. The proposition of enabling retail investors to participate actively in private markets, traditionally reserved for accredited participants, is revolutionary. With the potential to tokenizing diverse assets, including small businesses and energy companies, Solana aims to break down entry barriers, positioning itself as a facilitator of inclusive economic participation. This approach not only resonates with socially conscious investors but also aligns with technological advancements witnessing crypto’s rise amidst the market’s volatility.

Competitive Disadvantages:

However, transitioning from traditional capital markets to a decentralized model is fraught with challenges. The complexities of regulatory compliance and the need for investor education are critical hurdles that Solana—and the broader crypto market—must navigate. Uncertainties related to asset valuation in a rapidly advancing AI landscape may also deter potential investors who crave stability. Thus, while Solana’s innovative approach could appeal to tech-savvy individuals, it risks alienating more conservative investors wary of such disruptions.

Target Beneficiaries and Challenges:

The vision outlined by Akshay BD could greatly benefit marginalized retail investors. By fostering broader access to capital markets, Solana’s initiative could mitigate the widening wealth gap, thus empowering underrepresented demographics. Conversely, institutional investors accustomed to traditional asset allocation may feel threatened by a surge of retail investments flooding into the market, which could lead to increased volatility and unpredictable market dynamics. Furthermore, the rapid tokenization of assets may prompt a shift in how value is perceived, challenging existing financial frameworks and potentially displacing traditional investment firms that fail to adapt to this digital era.

In contrast to Solana’s forward-thinking approach, traditional platforms may struggle with their rigid structures, potentially hindering their ability to pivot in an increasingly competitive landscape. Thus, the arrival of inclusive investment opportunities could redefine equity in capital markets, posing both opportunities and dilemmas across the investing spectrum.