The cryptocurrency landscape is vibrantly evolving, with the latest news highlighting the launch of Invesco’s tokenized private credit strategy on the Arbitrum network by the digital asset exchange DigiFT. This development marks a significant step forward in the integration of real-world assets (RWA) into blockchain technology, offering a unique avenue for institutional investors to tap into on-chain credit markets.

As reported on March 13, Invesco’s US Senior Loan Strategy (iSNR) token, which went live on Arbitrum, aims to mirror the performance of a private credit fund managed by the reputable investment manager headquartered in Atlanta. Notably, when the fund debuted on February 19, it boasted an impressive .3 billion in assets under management, according to Bloomberg data. DigiFT claims this tokenized initiative as the “first and only tokenized private credit strategy,” showcasing an innovative fusion of traditional investment with cutting-edge technology.

“By incorporating iSNR on Arbitrum, we enhance its functionality, allowing decentralized finance (DeFi) applications, decentralized autonomous organizations (DAOs), and institutional investors to connect with a regulated, on-chain private credit strategy,” said Henry Zhang, CEO of DigiFT.

For those looking to invest, the minimum requirement for the iSNR tokenized fund stands at ,000, with purchases available through popular stablecoins such as USDC and USDT. Interestingly, this move comes at a time when real-world asset tokenization appears to be gaining momentum, despite a recent downturn in the broader crypto market.

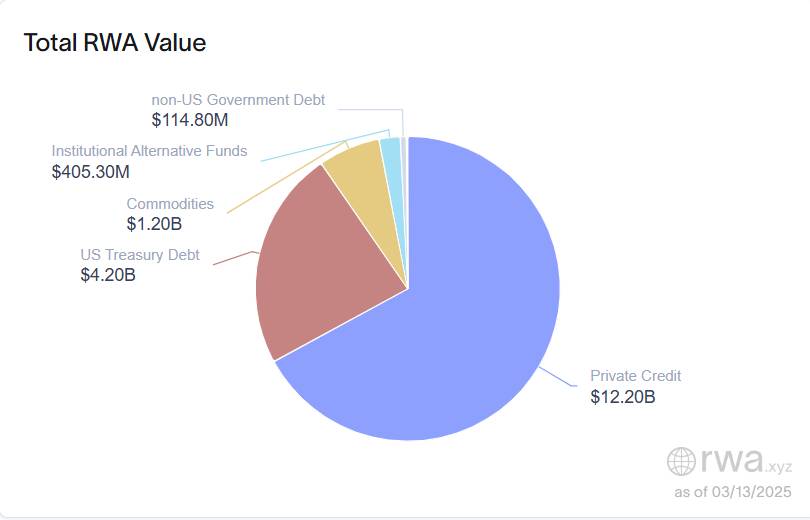

Additional industry developments reveal that companies like Securitize and Franklin Templeton are also capitalizing on the trend, launching new tokenized products that further integrate traditional finance with the DeFi sphere. With the total value of RWAs on-chain reportedly surging 17.5% in just 30 days to reach .1 billion, this sector shows promise, particularly in private credit and U.S. Treasury debt, which together account for a staggering 91% of that total.

With these advancements, it’s evident that the intersection of real-world assets and blockchain technology is rapidly crystallizing, heralding new opportunities and applications within the cryptocurrency industry.

DigiFT Launches Tokenized Private Credit Strategy

Key points from the recent announcement regarding DigiFT’s launch of Invesco’s tokenized private credit strategy:

- DigiFT’s Launch on Arbitrum: DigiFT has introduced Invesco’s US Senior Loan Strategy (iSNR) token on the Arbitrum network, expanding real-world asset (RWA) use cases in digital finance.

- Token Performance Tracking: The iSNR token is designed to track the performance of a private credit fund managed by Invesco, offering a regulated option for on-chain investments.

- Investment Accessibility: Minimum investment for the iSNR token is set at ,000, allowing institutional investors to access private credit markets.

- Integration with DeFi: The addition of iSNR to Arbitrum enhances its utility by enabling integration with decentralized finance applications, DAOs, and further institutional investment.

- Token Purchases with Stablecoins: Investors can buy tokenized shares using popular stablecoins such as USDC and USDT, making it easier to participate in the market.

“Positive regulatory developments and the rise of liquid multichain economies are expected to drive RWA tokenization into the crypto limelight this year.”

Impacts on Readers’ Lives:

- Diversification of Investment Options: The introduction of tokenized private credit strategies can provide individual and institutional investors with new avenues for diversifying their portfolios.

- Access to On-chain Markets: With the iSNR token, readers interested in digital assets may find opportunities to participate in investment strategies previously limited to traditional finance.

- Understanding DeFi Applications: Readers can benefit from learning about how decentralized finance (DeFi) applications are evolving and integrating real-world assets, which could lead to innovative investment products.

- Market Trends Awareness: Keeping abreast of the developments in tokenized assets can empower readers to make informed decisions in a rapidly changing financial landscape.

Comparative Analysis: DigiFT’s Launch of Tokenized Private Credit Strategy

DigiFT’s introduction of Invesco’s tokenized private credit strategy on the Arbitrum network marks a significant milestone in the realm of real-world asset (RWA) tokenization. This move gives institutional investors greater access to on-chain credit markets, showcasing the potential of blockchain to enhance financial products. However, how does this offering stack up against similar news in the industry, and who stands to gain or lose in this evolving landscape?

One of the standout advantages of DigiFT’s iSNR token is its first-mover status as the only tokenized private credit strategy available on-chain. By establishing this unique niche, DigiFT positions itself ahead of competitors like Securitize, which recently integrated sophisticated price feeds for their tokenized products. In contrast to DigiFT, Securitize is focusing on traditional institutional funds, such as the BlackRock USD Institutional Liquidity Fund, diversifying their offerings beyond private credit. This diversification may appeal to investors seeking stability in fluctuating markets, but it could dilute the focused appeal of DigiFT’s distinct product.

Securitize’s recent partnerships highlight the growing connectivity within DeFi ecosystems, allowing their tokenized products to seamlessly interact with established DeFi protocols. This integrated approach enables broader functionality and access for investors, whereas DigiFT’s offerings, while innovative, anchor on a singular asset, potentially limiting their immediate adaptability. Institutional investors aiming for versatility may thus find Securitize’s offerings more compelling in the short term.

Another player, Franklin Templeton, is also venturing into the tokenization space with products on popular layer-2 networks. Their emphasis on tokenized money market funds can cater to risk-averse investors looking for safer traditional assets. This diversification could present challenges to DigiFT, especially if market sentiment shifts toward lower-risk, more stable assets, leaving the iSNR token vulnerable to volatility in credit markets.

However, the growing demand for RWAs and recent positive regulatory developments signal a flourishing environment for DigiFT’s iSNR token. With the total on-chain value of RWAs witnessing substantial growth, the current trend could lead to increasing interest from institutional investors. Those looking for new avenues to diversify their portfolios through innovative assets can significantly benefit from DigiFT’s approach. Conversely, traditionalists may find the shift toward tokenization a daunting prospect, potentially creating apprehensions regarding volatility and the regulatory landscape surrounding digital assets.

While DigiFT has introduced an innovative solution, the competitive landscape is rapidly evolving. Institutional investors and stakeholders must weigh the unique advantages of DigiFT’s offerings against the multifaceted strategies of established players like Securitize and Franklin Templeton. The question remains: will the pioneering spirit of DigiFT lead to sustained success, or will competitors outpace them with a broader array of investment options as the tokenization trend continues to unfold?