In a groundbreaking development within the cryptocurrency industry, Digital Asset Treasuries (DATs) are emerging as experimental platforms at the intersection of decentralized finance and corporate capital management. According to Sygnum Bank’s Chief Investment Officer, Fabian Dori, these innovative structures are pioneering the use of decentralized assets as productive capital, a concept that could reshape the landscape of corporate finance.

As traditional financial systems grapple with the rapid evolution of digital currencies, DATs are positioned to bridge the gap between the two worlds, offering a new avenue for companies to manage and utilize their digital assets. This experimentation reflects a broader trend in the financial sector, where organizations are increasingly looking to incorporate blockchain technology and cryptocurrencies into their operational frameworks.

“Digital Asset Treasuries represent an unprecedented shift in how corporations can leverage decentralized assets,” Dori remarked, underscoring the potential for these entities to unlock new forms of value.

The idea of utilizing decentralized assets for productive purposes within corporate treasuries is not just a theoretical exercise; it involves real-world implications for liquidity, risk management, and financial strategy. As financial innovations like DATs continue to gain traction, they could potentially lead to more stable and efficient ways of handling corporate finances in a world increasingly influenced by digital currencies.

Understanding Digital Asset Treasuries

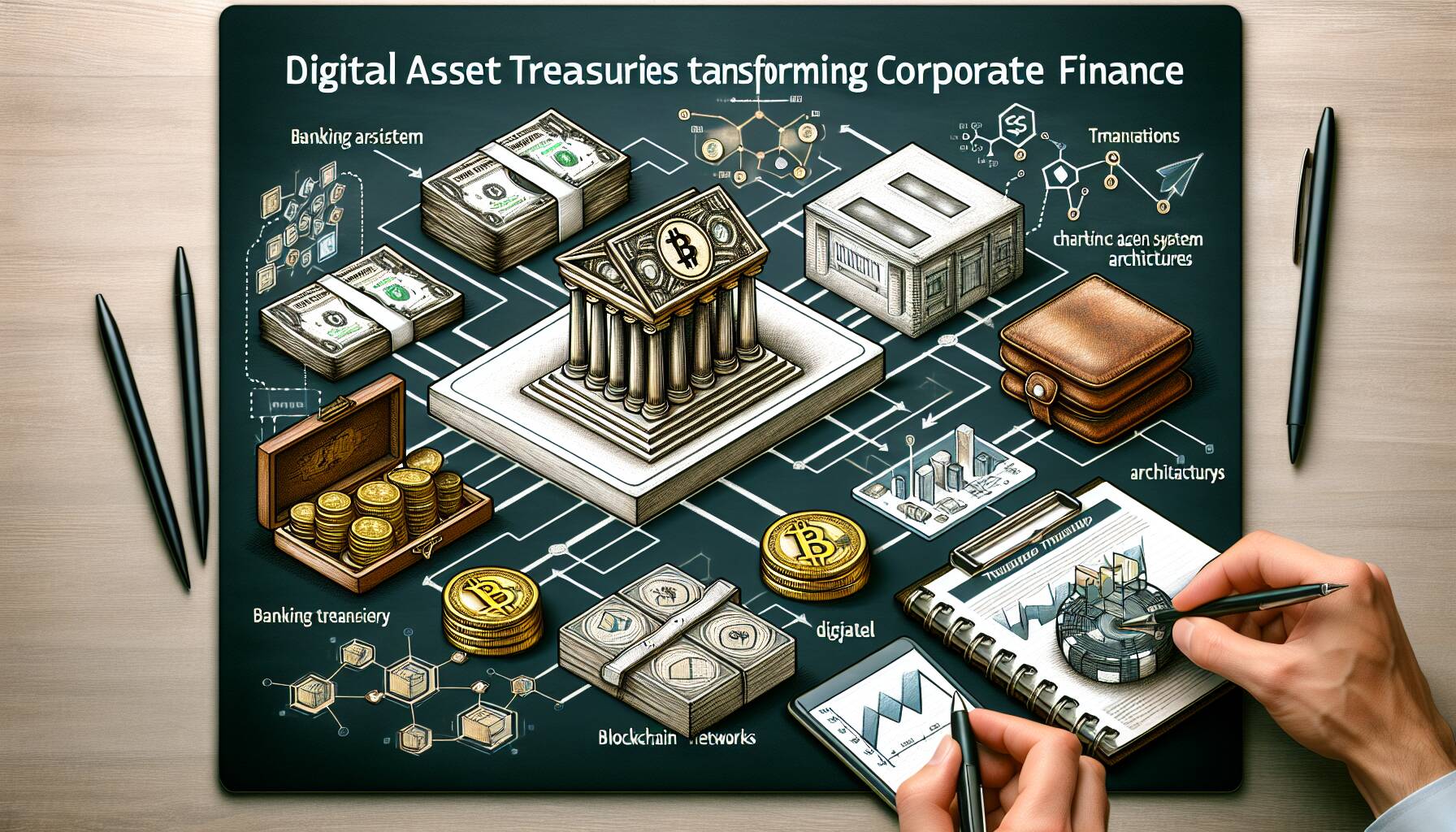

Digital Asset Treasuries (DATs) represent a significant shift in corporate finance practices.

- Innovative Financial Strategy: DATs allow corporations to integrate decentralized assets into their financial operations.

- Productive Capital: They can function as productive capital rather than merely speculative investments.

- Corporate Finance Architecture: This approach challenges traditional mechanisms and could redefine financial management within companies.

- Potential Risk Management: Businesses might leverage DATs to mitigate risks associated with conventional asset volatility.

- Adoption Challenges: There could be regulatory hurdles and a need for new frameworks to govern their use in corporate settings.

“The integration of decentralized assets into a corporate treasury is not just a trend, but a fundamental shift in how companies perceive and utilize capital.” – Fabian Dori, Sygnum Bank CIO

Innovative Financial Strategies: The Rise of Digital Asset Treasuries

Digital Asset Treasuries (DATs) are pioneering the integration of decentralised assets into the realm of corporate finance, presenting a compelling case for businesses looking to enhance their capital efficiency. According to Sygnum Bank’s CIO, Fabian Dori, these new frameworks serve as crucial testing grounds for how decentralised assets can be utilised as productive capital. This positions DATs as formidable competitors against traditional treasury management systems, offering advantages like enhanced liquidity and improved risk management.

One of the most significant competitive advantages of DATs is their ability to tap into the growing market of cryptocurrencies and decentralised finance (DeFi). Companies adopting DATs can potentially benefit from greater transparency, reduced transaction costs, and the flexibility to manage digital assets in real time. However, these benefits also come with challenges. For instance, the volatility of decentralized assets and regulatory uncertainties can pose risks for companies relying heavily on this model.

Organizations operating in technology-driven sectors, particularly within finance and investment, stand to gain the most from adopting DATs. The innovative nature of these treasuries can streamline processes and create opportunities for new revenue streams. Conversely, established corporations with more traditional capital management practices might struggle to transition, facing potential disruptions or resistance from stakeholders who are cautious about embracing such changes.

In summary, while the implementation of Digital Asset Treasuries offers transformative potential for forward-thinking organizations, the uncertainty surrounding regulatory frameworks and market conditions could create hurdles for less agile competitors.