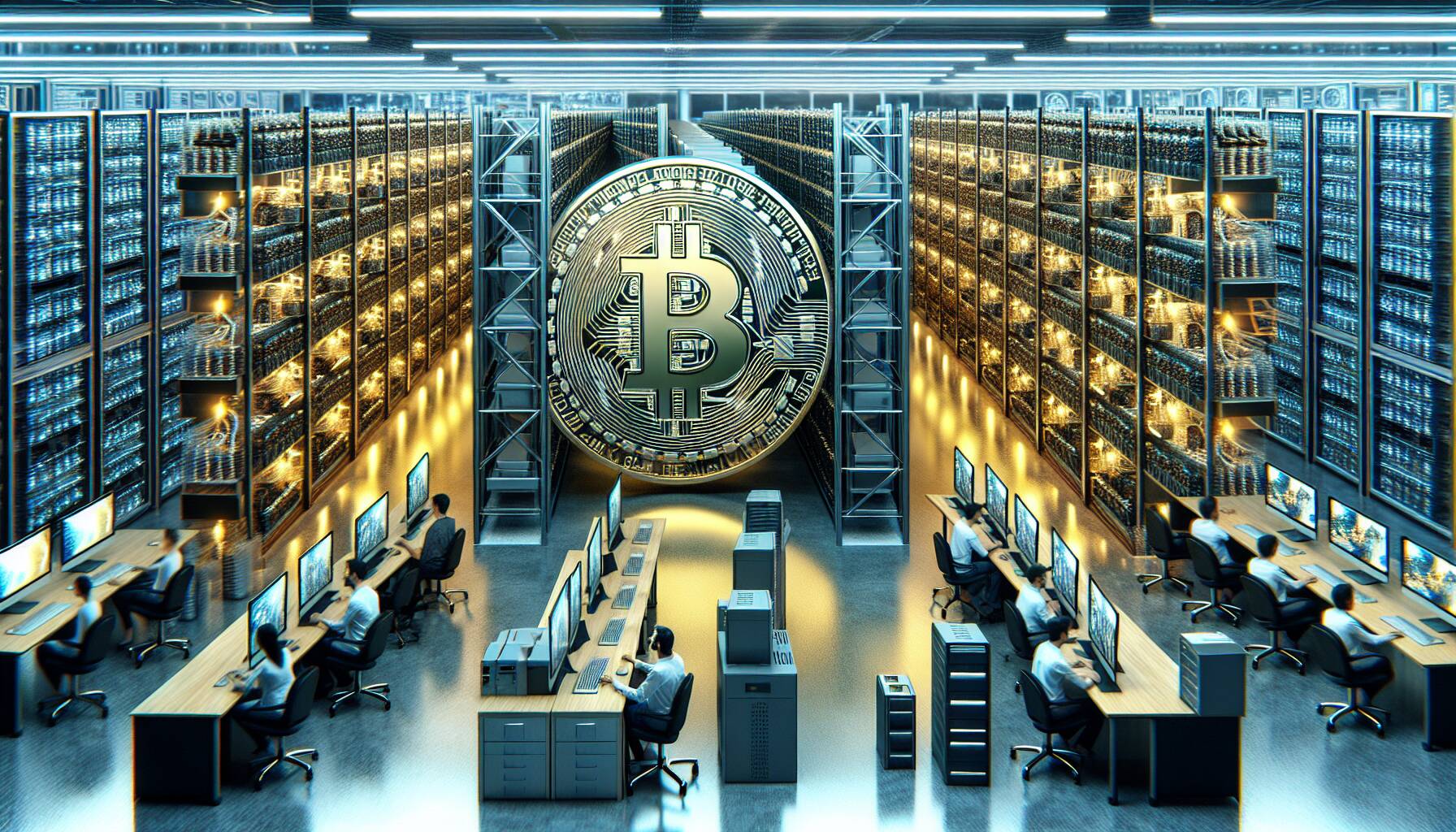

DL Holdings (1709), an ambitious investment firm, has taken a significant step into the cryptocurrency arena by announcing a substantial investment in bitcoin mining. The company has agreed to spend HK$320 million (approximately $41 million) to acquire 2,995 advanced Antminer S21 hydro-cooled machines from Bitmain. This move positions DL Holdings with the goal of becoming Hong Kong’s largest publicly traded bitcoin miner within the next two years.

According to their statement, these powerful mining rigs will be strategically deployed in data centers located in Oman and Paraguay. With Bitmain—one of the leading manufacturers of crypto mining equipment—providing hosting and operational support, DL Holdings is poised to ramp up its mining capabilities significantly. Just two weeks prior to this announcement, the company had already invested in 2,200 machines, bringing their total hashrate to an impressive 2.1 exahashes per second (EH/s).

“This investment not only enhances our mining capacity but also aligns with our strategy to innovate and optimize operations through advanced technology,”

DL Holdings stated. Additionally, the firm has plans to tokenize its mining operations and leverage AI optimization tools, focusing on energy efficiency. This forward-thinking approach may lead to the creation of accessible digital investment products, broadening the appeal of cryptocurrency investments to a wider audience.

DL Holdings Plans Major Bitcoin Mining Investment

Key points regarding DL Holdings’ investment and its implications:

- Investment Amount: DL Holdings agreed to invest HK$320 million ($41 million) in bitcoin mining rigs.

- Equipment Supplier: The mining rigs will be sourced from Bitmain, a leading manufacturer in the crypto mining industry.

- Machine Details: The investment includes 2,995 Antminer S21 hydro-cooled machines.

- Global Expansion: Machines will be installed in data centers located in Oman and Paraguay.

- Hashrate Achievement: Combined with a prior purchase of 2,200 machines, DL Holdings will achieve a hashrate of around 2.1 exahashes per second (EH/s).

- Tokenization Strategy: The company plans to tokenize its mining operations, which may impact the accessibility of investment in cryptocurrencies.

- AI Integration: DL intends to integrate AI optimization tools to improve energy efficiency in mining operations.

This investment strategy may influence readers by highlighting the increasing legitimacy and potential profitability of cryptocurrency mining in the financial market.

DL Holdings Expands Bitcoin Mining Operations: A Competitive Edge in the Cryptocurrency Market

DL Holdings (1709) is making significant strides in the cryptocurrency sector, planning to enhance its bitcoin mining capabilities with a substantial investment of HK$320 million ($41 million) in cutting-edge mining rigs from Bitmain. This strategic move positions them to potentially dominate the HK market as the largest publicly traded bitcoin miner within two years.

In contrast to recent reports from competitors such as Marathon Digital Holdings and Riot Blockchain, which face challenges related to fluctuating bitcoin prices and regulatory scrutiny, DL Holdings benefits from a robust operational framework supported by Bitmain. By securing 2,995 Antminer S21 hydro-cooled machines and integrating operations in data centers located in Oman and Paraguay, DL Holdings showcases a diversified operational strategy that enhances resilience against regional market instabilities.

However, this rapid expansion is not without risks. Other firms in the sector have experienced setbacks due to rising energy costs and environmental concerns tied to crypto mining. DL Holdings’ ambitious plan to incorporate AI optimization tools for energy efficiency may, however, provide them a competitive advantage, allowing them to mitigate some of these challenges that have plagued their counterparts. This tech integration is an attractive feature for investors seeking sustainable and innovative solutions in the cryptocurrency landscape.

The enhanced capacity and future tokenization of mining operations could prove beneficial to institutional investors looking for exposure in the crypto industry without direct market volatility. Conversely, this aggressive expansion strategy might create hurdles for smaller miners who are unable to compete with the economies of scale that DL is establishing. If successful, DL Holdings may set a new benchmark in operational excellence in the bitcoin mining sector, potentially leaving smaller entities behind as they struggle to adapt to evolving market demands.