On April 20, Dogecoin enthusiasts from around the globe come together to celebrate “Dogeday,” an unofficial holiday that has become a staple in the memecoin community. Coinciding with International Weed Day, Dogeday emerged as a cultural phenomenon in 2021, highlighting the playful and community-driven spirit behind Dogecoin, often seen as a lighthearted take on cryptocurrency.

Despite its origins as a joke, Dogecoin (DOGE) boasts a significant presence in the crypto market, currently holding the rank of the eighth-largest cryptocurrency by market capitalization, valued at approximately $23.3 billion, as reported by CoinMarketCap. Yet, its tokenomics have sparked debate, particularly due to the daily issuance of 14.4 million DOGE, which translates to an inflation rate exceeding $2.16 million each day.

“Dogecoin’s staying power stems from a blend of community-driven enthusiasm, low entry barriers, and speculative appeal,” says Anndy Lian, an expert in blockchain and author.

Lian notes that Dogecoin’s inflationary nature—adding nearly 5 billion coins every year—plays a key role in attracting retail investors. Unlike Bitcoin or Ethereum, whose values often soar above $1, Dogecoin’s lower price reaches a psychological sweet spot for many investors.

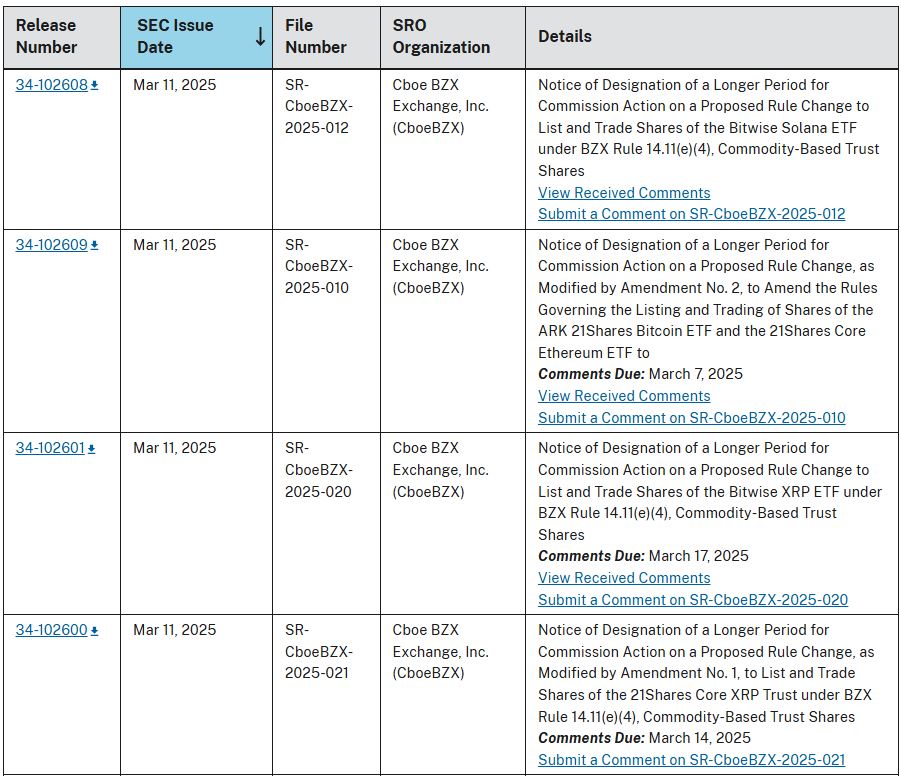

The Dogecoin community’s excitement is further heightened as they await important developments regarding several exchange-traded fund (ETF) applications currently under review by the U.S. Securities and Exchange Commission (SEC). Notably, four Dogecoin ETF filings are pending: the Bitwise Dogecoin ETF, the Grayscale Dogecoin ETF, the 21Shares Dogecoin ETF, and the Osprey Fund Dogecoin ETF. The SEC’s responses are anticipated in the coming weeks, with Grayscale’s application deadline set for May 21, following a previous delay.

As followers of Dogecoin continue to rally for the memecoin, it remains important to observe the upcoming ETF decisions, which could significantly impact its future in the crypto ecosystem. The sentiment around Dogecoin showcases how social media influence and community support can shape the trajectory of even the most unconventional cryptocurrencies.

Dogeday Celebrations and Dogecoin’s Future

Dogecoin holders worldwide are gearing up for “Dogeday” on April 20, recognizing the significance of this unofficial holiday as they await critical developments regarding exchange-traded fund (ETF) applications. Here are the key points of interest:

- Dogeday Celebration:

- Dogeday serves as a celebration for the Dogecoin community, gaining popularity since 2021.

- It aligns with International Weed Day, adding to its meme-centric appeal.

- Market Position:

- Dogecoin is the eighth-largest cryptocurrency, valued at approximately $23.3 billion.

- This highlights its staying power despite being labeled primarily as a “joke token.”

- Tokenomics:

- Dogecoin issues about 14.4 million new DOGE daily, resulting in a substantial inflation rate.

- This contributes to its affordability, typically priced under $1, which appeals to retail investors.

- Community and Speculative Appeal:

- The token’s value is significantly driven by community enthusiasm and social media traction.

- Meme-driven branding attracts younger, internet-savvy investors.

- ETF Applications:

- The Dogecoin community is eagerly waiting for SEC decisions on several ETF applications.

- Deadlines are approaching for Bitwise, Grayscale, 21Shares, and Osprey Fund’s ETF requests.

The outcomes of these ETF applications could influence Dogecoin’s market stability and perceived legitimacy, potentially impacting investments and community sentiment significantly.

Dogeday: A Deep Dive into the Memecoin Phenomenon

April 20 has turned into a hallmark date for Dogecoin enthusiasts, as they come together to celebrate “Dogeday.” This vibrant occasion emphasizes not only the playful spirit of the memecoin community but also the anticipation surrounding pending Dogecoin-related ETF applications. While Dogecoin garners attention as a lighthearted digital asset, its impressive market status as the eighth-largest cryptocurrency indicates a serious underlying value. However, this unique juxtaposition of humor and seriousness poses advantages and challenges within the ever-evolving crypto landscape.

Competitive Advantages: Dogecoin thrives on an enthusiastic community that embraces both camaraderie and collective investment potential. With low entry barriers, it caters to retail investors who may feel daunted by Bitcoin or Ethereum’s price points. This accessibility can bolster community growth and market adoption. Moreover, the appeal of Dogecoin is amplified through its engaging meme culture, especially resonating with younger, internet-savvy crowds, creating a unique niche in the crowded market of cryptocurrencies.

Additionally, the inflationary nature of Dogecoin—with over 5 billion new coins introduced annually—helps keep it within an attractive price range. This can psychologically entice retail investors who appreciate the concept of purchasing a substantial amount of coins without breaking the bank. In contrast to assets like Bitcoin, which present investment risks tied to scarcity, Dogecoin offers a more inviting option for those entering the crypto space.

Competitive Disadvantages: However, the lack of substantial use cases for memecoins like Dogecoin can be a double-edged sword. The asset’s reliance on social media buzz and market hype leaves it vulnerable to volatility and speculative trading, which may deter more risk-averse investors. Furthermore, the ongoing debates surrounding Dogecoin’s inflationary supply could impact its long-term viability. Some investors might view the continuous influx of coins as a dilution of value, which can generate skepticism among traditional investors who favor scarcity-based assets.

As the Dogecoin community eagerly awaits updates on ETF approvals from the SEC, the implications are substantial. Successful ETF launches could lead to a significant influx of institutional investment, bolstering credibility and expanding legitimacy in the crypto market. Conversely, if regulatory bodies decide against these applications, it could stymie momentum and dampen community enthusiasm. Thus, while Dogeday serves as a moment of celebration, the broader implications of how Dogecoin navigates its regulatory landscape could either fortify its standing or lead to challenges that shake its foundational appeal.

In summary, Dogeday is not just a festive moment; it’s a reflection of a larger narrative that may benefit retail investors eager to enter the crypto world but may also pose hurdles for those with a more traditional investment approach. The market’s trajectory hinges on both community sentiment and the regulatory decisions looming on the horizon.