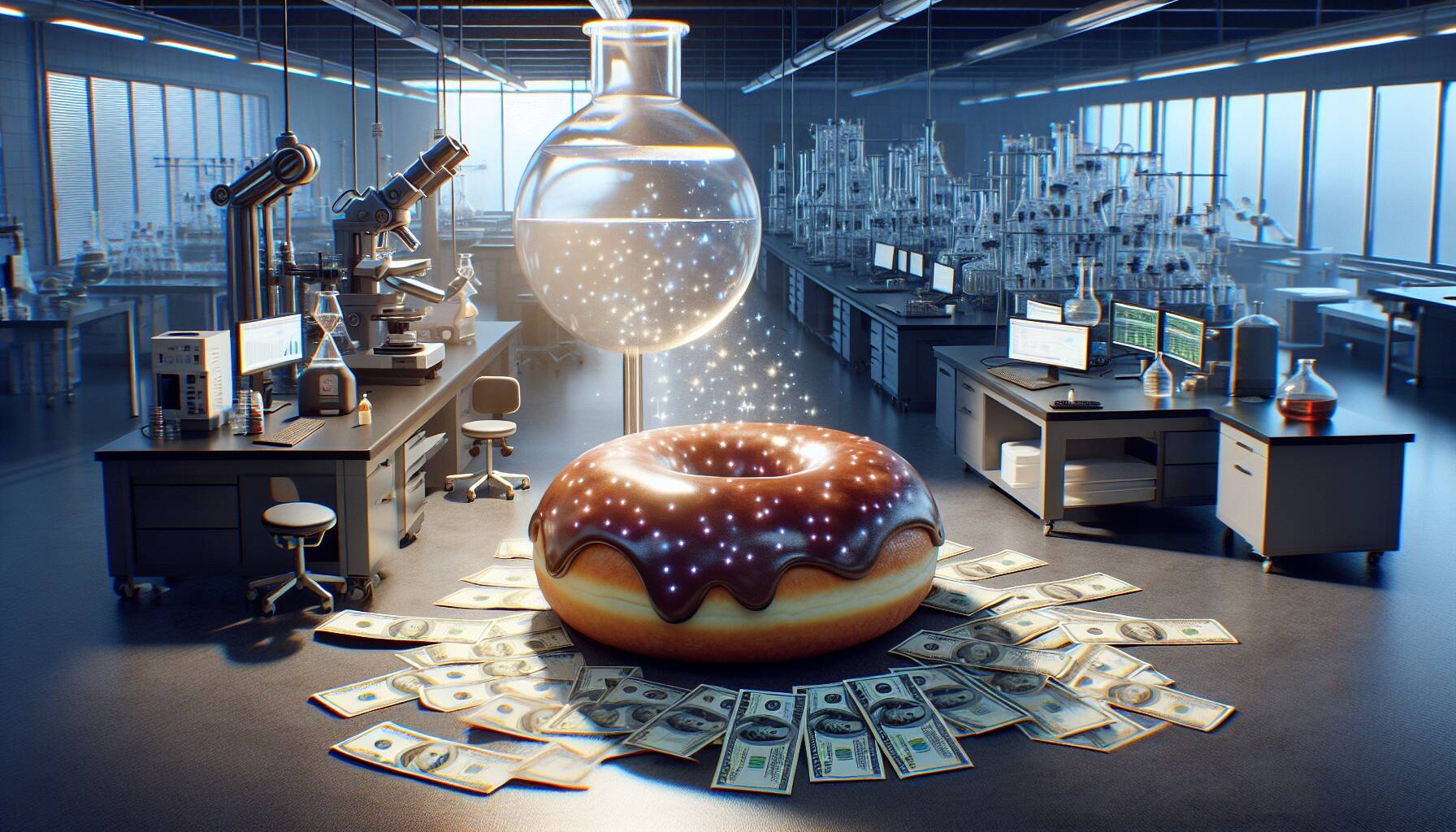

In a noteworthy development within the cryptocurrency landscape, Donut Labs has successfully secured $22 million in funding through both pre-seed and seed rounds over the past six months. This significant capital infusion underscores the growing interest and confidence investors have in innovative blockchain solutions.

Donut Labs stands as a testament to the increasing momentum in the crypto sector, illustrating how startups are attracting substantial financial backing even amidst market fluctuations.

The funds raised will likely play a crucial role in expanding Donut Labs’ operations and enhancing its technological offerings, allowing them to explore new avenues in the dynamic world of cryptocurrency. As the startup ecosystem evolves, the ability to attract such investment signals a bright future for pioneers in this fast-paced industry.

Donut Labs Funding Success

Key points regarding Donut Labs’ recent funding achievements:

- Funding Amount: Donut Labs has successfully raised $22 million in funding.

- Funding Stages: The funds were acquired through both pre-seed and seed rounds.

- Time Frame: This funding was secured within the last six months.

- Investor Confidence: The substantial amount raised indicates strong investor confidence in Donut Labs’ potential.

- Impact on Growth: The funding will likely be used to enhance product development and market expansion.

The funding success could lead to advancements in technology and services that could benefit consumers and industries.

Donut Labs Secures $22 Million: A Deep Dive into its Competitive Landscape

In the rapidly evolving world of startups, Donut Labs has just made a significant move by raising $22 million through both pre-seed and seed funding rounds in the past six months. This substantial financial backing positions them favorably within the tech ecosystem, especially among companies looking to streamline collaborative environments.

When comparing this funding achievement with similar recent news in the sector, it’s evident that Donut Labs has carved out a solid competitive advantage. For instance, other emerging tech firms have struggled to attract such substantial funding in one go, often spreading their efforts over longer periods. This quick influx of capital gives Donut Labs the leverage to accelerate product development and market entry faster than its peers, enabling them to seize opportunities in a growth-driven market.

On the flip side, this rapid influx of funds could also create pressure. With significant investments often comes higher expectations for performance and growth, which could be daunting for a relatively nascent company. Additionally, as competitors notice Donut’s success, they may ramp up their innovation efforts, resulting in a more saturated market environment. This heightened competition could challenge Donut Labs to continuously differentiate itself and maintain its market position.

The news surrounding Donut Labs is particularly beneficial for tech investors and startup enthusiasts. The increased funding rounds signal a robust confidence in the company’s vision and potential for growth, making it an attractive opportunity for venture capitalists looking for promising innovations. However, it could present challenges for existing players in the collaborative tech arena, as they may need to innovate more aggressively to keep pace with the disruptive ideas that Donut Labs is poised to introduce to the market.