In an exciting development for the decentralized finance (DeFi) landscape, the trading platform dYdX announced its inaugural token buyback program on March 24. This strategic initiative aims to reinvest in dYdX’s ecosystem, enhancing both its security and governance features. According to their announcement, a robust 25% of the protocol’s net fees will be allocated monthly to buybacks of the native dYdX (DYDX) token on the open market.

Following the news, DYDX experienced a significant surge, climbing over 10% to trade at approximately [openai_gpt model=”gpt-4o-mini” prompt=”You are a news reporter covering the cryptocurrency industry. Given the article description, provide an introductory overview of the news in an informative style. AVOID using overly technical terms or details! DO NOT offer recomendations to buy or sell any assets! Analyze from a fact-based perspective and bring in additional research when claims are made. Write this overview with creativity and flair, ensuring it reads like a human-written text and incorporates keywords in a natural way for SEO optimization. Generate HTML-formatted content using only

, and

tags. Exclude headings and other HTML tags. DO NOT include a ‘Conclusion’ section! Here is the product description: ‘Decentralized finance (DeFi) trading platform dYdX announced its first-ever token buyback program on March 24, aiming to reinvest in its ecosystem to enhance security and governance.According to the announcement, 25% of the protocol’s net fees will be dedicated to monthly buybacks of its native dYdX (DYDX) token on the open market.Following the announcement, DYDX surged over 10% and was trading at about $0.731 at the time of writing, according to CoinGecko. The token has gained more than 21% over the past two weeks.DYDX spikes on buyback news. Source: CoinGeckoRelated: dYdX explores sale of derivatives trading armNew dYdX distribution model Previously, dYdX distributed 100% of its platform revenue to ecosystem participants. Under the new allocation model, 25% will be used for token buybacks, another 25% will fund its USDC liquidity provision program, MegaVault, 10% will be directed to its treasury, and the remaining 40% will continue as staking rewards.DYdX noted that the current allocation of 25% to token buybacks may increase, with ongoing community discussions potentially pushing this percentage to as high as 100% over time.Related: DeFi market stages a comeback as derivatives surgeThe platform currently holds a total value locked (TVL) of $279 million, according to DefiLlama. It generated $1.29 million in revenue from fees in February and $1.09 million so far in March.Token buybacks get 25% of revenue, which has been dropping. Source: DefiLlama“DeFi festival” waits for summer to endThe DeFi industry commonly references the DeFi summer of 2020 as a benchmark, characterized by rapid user growth driven by yield farming and decentralized applications.In a recent interview with Cointelegraph, dYdX Foundation CEO Charles d’Haussy predicted that the next significant DeFi boom would occur shortly after summer, potentially beginning as early as September and lasting “months and months.”DYdX existed in mid-2020 primarily as a DeFi platform for spot trading, lending, borrowing and margin trading. Its popularity popped in 2021 following the launch of its layer-2 perpetual futures exchange and the introduction of its native DYDX token.In its 2024 ecosystem report, dYdX projected that the decentralized derivatives market would expand to $3.48 trillion by 2025, up from $1.5 trillion in derivatives volume processed by decentralized exchanges (DEXs) in 2024.Magazine: Memecoins are ded — But Solana ‘100x better’ despite revenue plungeThis article does not contain investment advice or recommendations. Every investment and trading move involves risk, and readers should conduct their own research when making a decision.'”].731, as reported by CoinGecko. Notably, the token has enjoyed a 21% increase over the past two weeks, signaling positive sentiment among investors.

Under the new distribution model, dYdX will not only focus on buybacks but also on other aspects of its ecosystem. The remaining revenue will be divided, with an additional 25% dedicated to funding the USDC liquidity provision program, MegaVault, while 10% will bolster its treasury. The initiative shows potential for growth, as discussions within the community could ultimately increase the share directed to buybacks from 25% to as much as 100% over time.

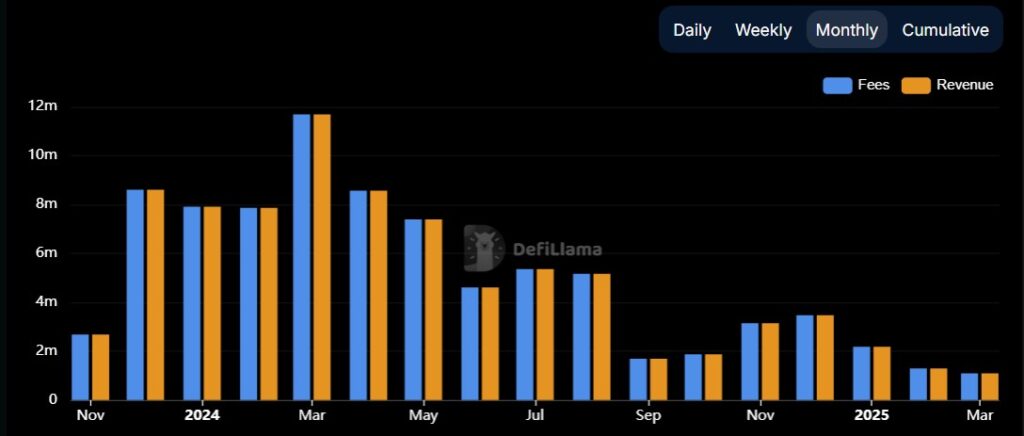

Currently, dYdX boasts a total value locked (TVL) of 9 million, and has generated significant revenue, including .29 million from fees in February and .09 million so far in March, according to DefiLlama. This robust revenue stream highlights the continued interest and participation in the platform.

As the DeFi industry looks forward, dYdX Foundation CEO Charles d’Haussy spoke about an anticipated resurgence in the market, suggesting that a DeFi boom could follow this summer, potentially starting in September.

dYdX has evolved significantly since its inception mid-2020, transitioning from a platform focused on spot trading to one that now encompasses lending, borrowing, and margin trading. Its popularity notably surged in 2021 with the launch of its layer-2 perpetual futures exchange and the introduction of the DYDX token. Furthermore, in its 2024 ecosystem report, dYdX projects the decentralized derivatives market to balloon to .48 trillion by 2025, a substantial increase from the .5 trillion anticipated in 2024 for decentralized exchanges.

This news marks a pivotal moment not only for dYdX but also for the broader DeFi community, highlighting a strategic shift that could have lasting implications for the industry.

dYdX Announces Token Buyback Program

The recent announcement from dYdX regarding its first-ever token buyback program introduces significant changes in its financial strategy, which could impact investors and users of the platform. Here are the key points:

- Token Buyback Program:

- First-ever buyback program announced on March 24.

- 25% of net fees will go towards monthly buybacks of the DYDX token.

- DYDX token surged over 10% following the announcement.

- New Distribution Model:

- 25% allocated to token buybacks.

- 25% for USDC liquidity provision program, MegaVault.

- 10% directed to treasury.

- 40% continues as staking rewards.

- Potential Increase in Buyback Allocation:

- Current discussions may increase buyback allocation to as high as 100% over time.

- This can lead to potential price appreciation for holders of the DYDX token.

- Market Trends and Projections:

- dYdX’s total value locked (TVL) is 9 million with a recent revenue of .29 million in February.

- Predicted growth of the decentralized derivatives market to .48 trillion by 2025.

- A potential resurgence in DeFi activity anticipated post-summer 2023, which could propel further interest in dYdX.

“DeFi festival” waits for summer to end, with expectations for the next boom following this period.

Understanding these developments is crucial for potential investors and users of dYdX, as they may influence trading strategies and investment decisions in the evolving DeFi landscape.

dYdX’s Token Buyback: A Strategic Move in the DeFi Landscape

In a significant step forward for decentralized finance (DeFi), dYdX has recently announced its inaugural token buyback program, which has already led to a notable uptick in the value of its native DYDX token. This initiative, which channels 25% of the protocol’s net fees toward buybacks, is designed to fortify its community and enhance governance. Such a strategy echoes similar moves in the DeFi arena, where platforms such as Uniswap and Aave also leverage buyback programs to boost liquidity and incentivize participation. However, dYdX’s decision to allocate a portion of revenue to buybacks introduces both strategic advantages and potential pitfalls.

Competitive Advantages: One of dYdX’s foremost strengths lies in its operational transparency and commitment to community engagement. By clearly earmarking funds for token buybacks and governance enhancement, the platform cultivates trust among its users. This level of transparency may attract new participants who are seeking assurance in a volatile market. Additionally, with the token’s price rising over 10% post-announcement, the strategy demonstrates immediate positive market reception, which could stimulate further investment in their ecosystem.

In contrast to protocols like Compound, which heavily focus on lending and borrowing, dYdX’s comprehensive approach—balancing buybacks, liquidity provisions, and staking rewards—positions it as a multifaceted player in the DeFi space. This could give dYdX an edge, particularly for users who seek to participate in multiple facets of DeFi from a single platform, thereby potentially increasing user retention and platform loyalty.

Potential Disadvantages: Nevertheless, the move is not without its risks. The allocation of only 25% to buybacks raises questions about the sustainability of revenue generation—especially in a fluctuating market where trading volumes can sharply decline. For instance, a dip in volume could severely constrain the funds available for buybacks, undermining confidence among existing token holders. This situation could mimic challenges faced by other DeFi platforms that struggled with diminishing revenues when engaging in similar buyback schemes.

Moreover, while dYdX’s plans for increasing the buyback percentage based on community discussions show a willingness to adapt, they might also lead to uncertainties and fractious debates within the community. If users’ interests conflict regarding the allocation of funds, this could lead to division rather than unity, straining governance mechanisms and weakening the platform’s overall health.

Who Benefits and Who Might Face Challenges: The primary beneficiaries of dYdX’s strategy are likely to be long-term DYDX holders who stand to gain from increased token value due to buybacks. Additionally, traders looking for diverse opportunities within a robust DeFi platform may find dYdX enticing. Conversely, new investors or those not heavily invested in the ecosystem could find themselves at a disadvantage, especially if the platform experiences volatility and the perceived promise of buybacks doesn’t materialize into consistent returns.

As dYdX aims to carve its niche in the competitive DeFi landscape while eyeing a potential recovery in overall market sentiment, all eyes will remain on how effectively it can implement this buyback strategy to navigate the dynamic challenges of decentralized finance.