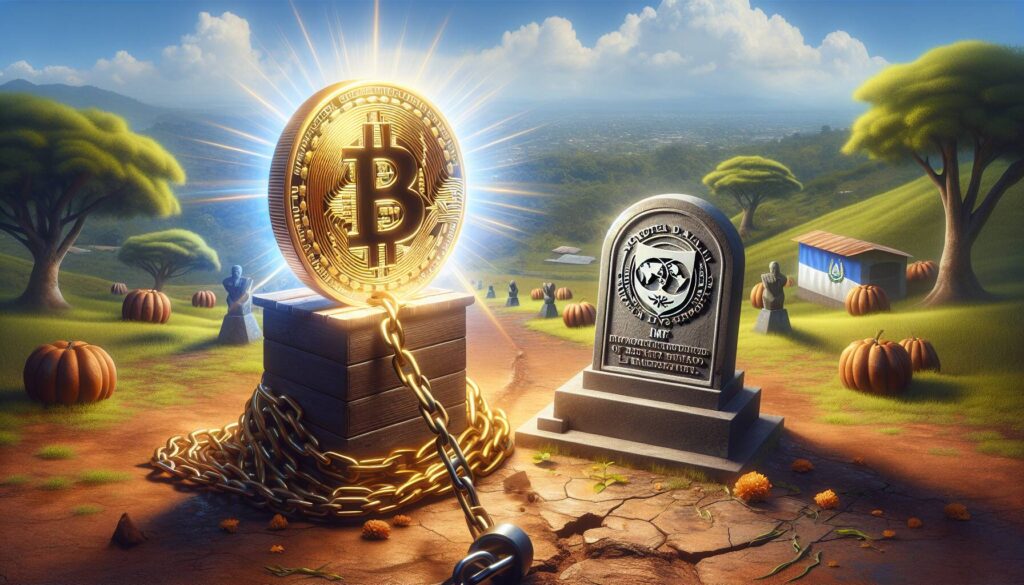

In a significant shift for its cryptocurrency ambitions, El Salvador’s government is now set to pursue its bitcoin plans under new restrictions as part of a .4 billion Extended Fund Facility (EFF) arrangement, recently approved by the International Monetary Fund (IMF). On February 26, the IMF unveiled this 40-month program aimed at addressing the country’s ongoing macroeconomic challenges and boosting its growth trajectory, with an initial disbursement of 3 million. However, the arrangement comes with stipulations that curb the government’s bitcoin initiatives.

As of February 24, El Salvador had amassed an impressive portfolio of over 6,081 BTC, valued at nearly 0 million, which is managed by its Bitcoin Management Agency. Despite this investment, the IMF has imposed restrictions on the public sector’s ability to accumulate further bitcoin during the program’s duration. This has led to speculation among observers, especially considering that President Nayib Bukele teasingly announced a purchase of 19 BTC as prices dipped below ,000. His post on social media caught a lot of attention, highlighting the ongoing tension between personal ambition and institutional limitations.

“The IMF highlighted that the actual use of bitcoin in El Salvador remains limited, with its adoption stymied by significant price volatility and a lack of public confidence,”

the organization noted. Notably, it also pointed out that the financial sector currently has no exposure to bitcoin, and transactions conducted in this cryptocurrency for tax payments have been minimal, prompting the government to amend its controversial Bitcoin Law. This amendment has made the use of bitcoin voluntary for private businesses, effectively stripping it of its legal tender status.

The overarching goal of the EFF is to improve the country’s primary balance by 3.5% of GDP over the next three years, a target that is hoped to be achieved through austerity measures, such as reducing wage bills while maintaining critical social spending. Economic forecasts suggest that El Salvador can expect growth rates of between 2.5% and 3% in the medium term, driven by enhancements in security and overall reforms. As part of this recovery plan, the country also aims to lower its debt to 81% of GDP by 2029 while decreasing its gross financing needs.

As the situation unfolds, it remains to be seen how these new financial regulations will impact the burgeoning crypto landscape in El Salvador and whether the nation can reconcile its bitcoin aspirations with the constraints set forth by international financial bodies.

El Salvador’s Bitcoin Dreams Under IMF Constraints

The recent arrangement between El Salvador and the International Monetary Fund has crucial implications for the country’s approach to Bitcoin. Here are the key points to consider:

- IMF’s Extended Fund Facility (EFF) Approved:

- 40-month program aimed at addressing macroeconomic issues.

- Provides .4 billion with an immediate disbursement of 3 million.

- Aims to boost growth prospects while limiting Bitcoin initiatives.

- Bitcoin Accumulation Restrictions:

- Public sector accumulation of Bitcoin is prohibited during the program.

- This restriction can impact public trust and investment in Bitcoin.

- Current Bitcoin Holdings:

- El Salvador holds over 6,081 BTC, valued at approximately 0 million.

- Recent purchase of 19 BTC highlighted by President Nayib Bukele.

- Marginal Usage of Bitcoin:

- The IMF reports minimal Bitcoin circulation due to volatility and low public trust.

- The financial sector has no exposure to Bitcoin, affecting its integration into everyday life.

- Amendment to Bitcoin Law:

- Acceptance of Bitcoin made voluntary for private entities.

- Removal of legal tender status reduces pressure on businesses and consumers.

- Economic Growth Focus:

- Aim to improve GDP primary balance by 3.5% over three years.

- Projected medium-term growth of 2.5% to 3%, dependent on security and reforms.

- Debt expected to decline to 81% of GDP by 2029, improving economic stability.

This arrangement can modify the public perception of Bitcoin, affecting individual and business decisions regarding its adoption and use in El Salvador.

El Salvador’s Bitcoin Journey Faces New Constraints Under IMF Guidance

El Salvador has been at the forefront of the cryptocurrency movement, making headlines for its ambitious approach to integrating Bitcoin into its economy. However, the recent approval of a .4 billion Extended Fund Facility (EFF) by the International Monetary Fund (IMF) brings a new layer of restrictions to its cryptocurrency endeavors. While this arrangement aims to stabilize macroeconomic issues and stimulate growth, it also imposes significant limitations on the country’s Bitcoin policies.

The comparative landscape reveals that while many nations are exploring the potential of cryptocurrency as a tool for economic development, El Salvador’s experience underscores the challenges of navigating traditional financial institutions. The IMF’s prohibition on the accumulation of Bitcoin by public sector entities starkly contrasts with other regions where governments embrace digital assets more openly. This juxtaposition may raise questions about the sustainability of El Salvador’s Bitcoin model moving forward. Other nations are observing closely, weighing the potential benefits against risks inherent in cryptocurrency volatility and regulatory scrutiny.

Competitive Advantages and Disadvantages

The immediate infusion of 3 million from the IMF will certainly bring much-needed liquidity to El Salvador’s economy, allowing for improvements in public services and infrastructure. However, this financial support comes at a steep price: the curtailment of Bitcoin initiatives. Countries with less stringent oversight, like various Caribbean nations, can adopt more flexible approaches to cryptocurrency without facing similar constraints, potentially leveraging digital currencies as drivers of tourism and investment.

El Salvador’s government, particularly under President Nayib Bukele, still demonstrates resilience by strategically acquiring Bitcoin even amid these limitations. This move could appeal to crypto enthusiasts and investors, potentially attracting interest in the nation as a cryptocurrency hub despite the mounting restrictions. Yet, this mixed message may confuse potential investors while alienating conservative stakeholders who prioritize fiscal stability over high-risk assets.

Who Stands to Gain or Lose?

The EFF arrangement can benefit public sector employees and social programs that rely on stable funding sourced from international loans. It might also stabilize the economy in the short term, presenting an opportunity for growth amid global economic uncertainties. Conversely, local businesses and potential investors in the cryptocurrency sector may feel the pinch from the weakened legal framework surrounding Bitcoin. The stringent measures could stifle innovation and deter future investments, particularly from those eager to engage in digital asset markets.

In summary, while the EFF presents a lifeline aimed at rectifying macroeconomic imbalances, the restrictions placed on Bitcoin integration may hinder El Salvador’s long-term vision. As the nation navigates this complex relationship with the IMF and cryptocurrency, the potential impact on both investors and citizens remains a pivotal storyline in the evolving landscape of financial technology.