In a groundbreaking move for the cryptocurrency landscape, Ethena, a decentralized stablecoin platform, has officially partnered with The Open Network (TON). This collaboration, unveiled during the Token2049 event in Dubai on May 1, is set to make Ethena’s stablecoins accessible to Telegram’s massive user base of over one billion people. The integration will introduce Ethena’s US dollar-backed stablecoins, USDe and its staked variant sUSDe, directly within the TON blockchain, all while enhancing user experiences within the popular messaging app.

“Telegram has truly global distribution across its billion users, with presence in emerging economies in regions like Asia, Africa and Latin America,” Ethena stated, highlighting the expansive reach of this initiative.

As part of the launch, two significant integrations are planned: one within Telegram’s custodial Wallet and the other in the TON Space wallet, a self-custodial option for users. The staked USDe will be launched under the name tsUSDe, allowing Telegram users to engage with US dollar-denominated savings seamlessly through their messaging platform.

This rollout is not just a short-term project; it’s the beginning of a deeper partnership between Ethena and the TON Foundation, with ambitious plans that may encompass neobanking, peer-to-peer payments, and decentralized finance (DeFi) services in the future. Ethena’s innovative approach promises a 10% annual yield for eligible tsUSDe holders within major TON wallets, adding an enticing incentive for users.

Ethena described the integration as “one of Ethena’s most meaningful launches to date.”

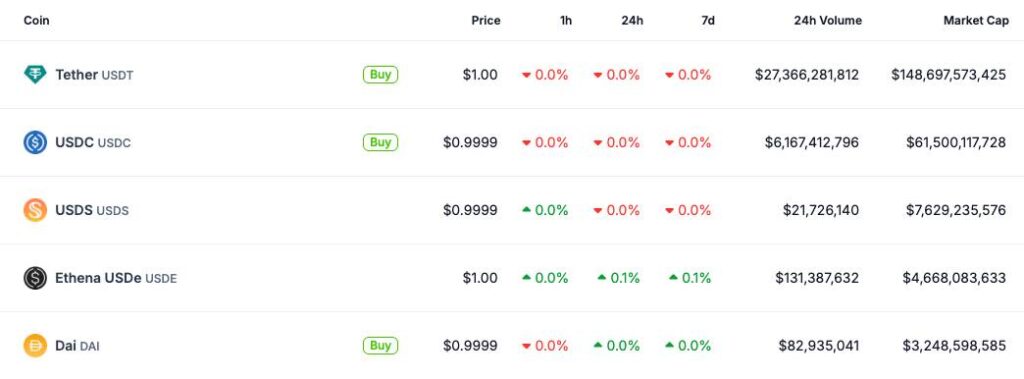

Currently, Ethena’s USDe ranks as the fourth-largest stablecoin by market capitalization, boasting a value of approximately $4.7 billion. It trails behind competitors like Tether’s USDt, Circle’s USDC, and Sky’s USDS. With this new partnership, Ethena aims not just to solidify its position but also to expand the use of its stablecoins across a diverse and vast user demographic, paving the way for the future of stable digital currencies in everyday transactions.

Ethena Partners with The Open Network (TON) for Decentralized Stablecoin Integration

This article details a significant partnership aimed at bringing stablecoin functionalities to Telegram’s extensive user base. Here are the key points that may impact readers:

- Partnership Announcement:

Ethena has partnered with TON, enabling its US dollar-denominated stablecoins to be integrated into Telegram.

- Global Reach:

Telegram has over one billion users, particularly in emerging economies, which could increase access to digital financial services.

- Integration Details:

- Deployment of Ethena’s USDe and sUSDe within the TON blockchain.

- sUSDe will be known as tsUSDe for Telegram users.

- Integration includes custodial wallets within Telegram and self-custodial wallets like TON Space.

- Future Prospects:

This partnership may lead to neobanking, peer-to-peer payments, and DeFi lending/trading being more accessible to users worldwide.

- Financial Incentives:

tsUSDe holders will earn a 10% annual percentage yield in TON and rewards for balances up to 10,000 tsUSDe.

- Market Position:

Ethena’s USDe ranks fourth among stablecoins by market capitalization, contributing to a competitive landscape for digital currencies.

- Ambitious Scaling Goals:

TON aims to connect to at least 100 chains, expanding the ecosystem for users and developers.

Ethena and TON: A Groundbreaking Partnership in the Stablecoin Space

The recent collaboration between Ethena and The Open Network (TON) represents a significant leap in the realm of decentralized finance, particularly in terms of stablecoin accessibility. With a staggering user base of over one billion on Telegram, this partnership not only enhances Ethena’s visibility but also positions it to better compete with leading stablecoins like Tether (USDT) and USDC. One of the major competitive advantages of this integration is the ability to reach users in emerging markets across Asia, Africa, and Latin America, thus tapping into a demographic that may be underserved by traditional banking systems.

Conversely, the competitive disadvantages include the inherent volatility connected with the broader cryptocurrency marketplace and regulatory scrutiny that stablecoins often face. Ethena is also jockeying for position within a crowded field, as it competes against formidable players like Circle’s USDC, which boasts a long-standing reputation and robust institutional support. Additionally, with USDe currently holding the title of the fourth-largest stablecoin by market cap, there’s still significant room for growth, but it could face challenges in significantly closing the gap with its larger counterparts.

This partnership stands to benefit various user groups, including users seeking low-risk savings options with the introduction of tsUSDe, which offers enticing yield prospects. Furthermore, as Ethena explores additional DeFi offerings, the integration could appeal to developers and crypto enthusiasts looking to leverage the TON ecosystem. However, challenges may arise for traditional banks and financial institutions that might view this shift towards decentralized finance as a threat to their existing business models.

Ultimately, Ethena and TON’s collaboration signals an exciting era in stablecoin development. As they roll out features over the coming months, both the advantages of increased accessibility and the risks associated with regulatory pressures will shape the participation landscape. The stage is set for significant innovation in the stablecoin sector, with potential benefits for tech-savvy users and challenges for traditional financial structures.