Recent fluctuations in the cryptocurrency market have sparked significant attention, particularly surrounding Ether (ETH), which experienced a 13% drop in value from March 8 to March 11. This decline has been largely attributed to investors shifting their focus towards safer assets like short-term fixed-income and cash, amid growing concerns over a global tariff war and potential economic downturns. At its current price of ,940, Ether would require a 29% surge to regain its previous milestone of ,500.

Market apprehensions intensified after the United States implemented retaliatory measures against Canada regarding electricity surcharges, fueling uncertainty among traders.

Market instincts often lead to overreactions, suggesting that Ether could rebound quicker than other assets once sentiment shifts positively. On one hand, some analysts argue that the performance of risk assets hinges on inflation and economic growth indicators, while others assert that future gains will rely heavily on stimulus measures and monetary expansion.

The recent volatility also saw 5 million in leveraged long positions liquidated, pushing Ether down to a low of ,744—its lowest point since October 2023. Currently, however, certain market signals indicate a potential recovery, as resilience is noted in Ether’s derivatives and on-chain metrics.

Despite being 60% below its all-time high of ,868 from November 2021, Ethereum’s layer-2 solutions have made strides in improving transaction efficiency.

As competition in the smart contract space intensifies and the interest in applications like non-fungible tokens (NFTs) wanes, it’s essential to recognize the improvements in network performance. For instance, on March 11, the cost of a token swap on Ethereum’s base layer stood at .70, reflecting a 97% increase in layer-2 activity compared to late 2021.

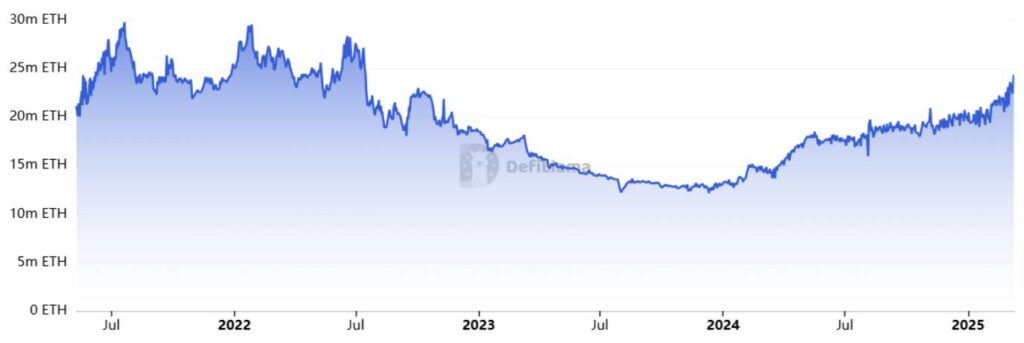

In another positive development, Ethereum has maintained its stronghold as a preferred choice for institutional investors, bolstered by .9 billion in spot exchange-traded funds (ETFs). This consistent growth in total value locked (TVL) in Ethereum’s smart contracts, reaching its highest point since July 2022, underscores the ongoing interest and investment in the platform.

As of March 11, Ethereum’s TVL in ETH rose by 10% within two weeks, showcasing gains driven by liquid staking and decentralized finance activities.

With Ethereum now leading in decentralized exchange volumes, surpassing competitors like Solana, the cryptocurrency continues to demonstrate potential for recovery and sustained growth. While macroeconomic conditions will play a critical role in future price movements, Ether appears to be strategically positioned for a rebound as market stability returns.

Evolving Trends in Ethereum and Market Implications

The recent fluctuations in Ethereum’s price and trading activity have significant implications for both investors and the broader economic landscape. Here are some key points to consider:

- Significant Price Drop:

- Ether (ETH) fell 13% from March 8 to March 11, driven by investor shifts to safer assets amidst economic concerns.

- ETH needs a 29% gain to reclaim its ,500 mark, emphasizing the volatility and unpredictability of cryptocurrency investments.

- Market Sentiment and Recovery Potential:

- Traders often overreact to market changes, which may lead to a quicker rebound for Ether compared to other assets once confidence returns.

- Indicators such as ETH derivatives suggest that resilience exists, potentially paving the way for recovery.

- Competition and Market Dynamics:

- Ethereum is currently trading significantly below its all-time high (,868), largely due to increased competition and decreased demand for various decentralized applications.

- Despite this, Ethereum’s layer-2 transaction capabilities have improved efficiency, making it a strong contender in the blockchain space.

- Growing Institutional Adoption:

- Ethereum’s standing as a preferred choice for institutional investors is bolstered by .9 billion in spot exchange-traded funds (ETFs).

- The total value locked (TVL) in Ethereum has reached its highest level since July 2022, driven by increased interest in liquid staking, lending, and yield farming.

- Future Outlook:

- While Ethereum is well-positioned to regain its value, its rebound is contingent upon improvements in macroeconomic conditions.

- The network has reclaimed its lead in decentralized exchange (DEX) volumes, suggesting bullish momentum if the trend continues.

These trends highlight the evolving nature of the cryptocurrency market, suggesting that informed participation could offer opportunities amidst potential risks.

The Current State of Ether: Navigating Challenges and Opportunities

The recent performance of Ether (ETH) has stirred conversations across the cryptocurrency landscape, particularly as it saw a significant 13% drop between March 8 and March 11. This downturn was largely triggered by investors seeking shelter in more stable, short-term fixed-income assets amid growing economic uncertainties. As ETH flounders near ,940, the road to reclaiming its previous momentum to ,500 appears steep, requiring a robust 29% increase. This situation starkly highlights the competitive advantages and challenges Ether faces in comparison to its peers in the cryptocurrency sphere.

Comparative Advantages: One notable strength for Ether is its first-mover advantage in the smart contract arena, coupled with significant advancements in its layer-2 networks that showcase improved transaction efficiency. Despite being 60% off its all-time high, Ethereum’s ability to facilitate a diverse range of applications—from decentralized finance to NFTs—positions it favorably as projects increasingly seek to leverage its network capabilities. Furthermore, its recent dominance in decentralized exchange (DEX) volumes, outpacing competitors like Solana, underscores the sustained institutional interest bolstered by over .9 billion in spot exchange-traded funds (ETFs).

Comparative Disadvantages: However, these advantages are tempered by the realities of a highly competitive environment where alternative blockchains rapidly evolve. Solana and others are not just on the sidelines but are actively working to carve out their niches by potentially outperforming Ethereum in transaction speed and cost-efficiency. Moreover, the overarching market narrative around inflation and economic performance creates a challenging backdrop for Ether, which needs a strong influx of leveraged buyers to inspire confidence—a factor currently low at a five-month trough.

This volatile environment creates both opportunities and risks for various stakeholders. For new investors or retail traders drawn to the allure of recovery, the prospect of a fast rebound may appear enticing. Conversely, institutions holding significant ETH might feel pressure from the price volatility, prompting them to reassess their strategies, especially given the risk of liquidating long positions. Moreover, the persistent shift toward cash and stable assets threatens Ether’s short-term performance, which may dissuade potential new adopters from entering the market.

The resilience shown through increasing total value locked (TVL) and layer-2 transaction activity gives hope for a rebound, yet it’s essential for investors to remain cautiously optimistic. As broader macroeconomic conditions improve, Ethereum could very well leverage this period of adaptation to regain its price position and market trust—if it can navigate the dual threats of competition and market sentiment effectively. The interplay of these factors will be critical in determining how Ether and its ecosystem evolve in the coming weeks.