The recent movement in the cryptocurrency market has brought Ether (ETH) into focus, as it experienced a sharp decline of 13% between March 8 and March 11. Investors have been shifting towards safer short-term fixed-income and cash positions amidst growing worries about a global tariff war and a potential economic downturn. As a result, ETH is currently trading at around ,940, needing a significant 29% increase to reclaim the ,500 mark it once held.

“Market concerns escalated after the United States responded to Canada’s electricity surcharge with retaliatory measures.”

This market turbulence has led to heightened volatility; notably, 5 million in leveraged long positions were liquidated during this brief window, pushing Ether down to its lowest price since October 2023. Despite the panic selling, some analysts see indicators suggesting a possible recovery, with ETH demonstrating resilience in both derivatives and on-chain metrics.

Adding depth to the current scenario, Ethereum has been experiencing notable advances in its layer-2 network, which has seen a surge in daily transactions, now substantially higher than its main layer. This increased activity reflects improvements in network efficiency, where transaction costs are significantly lower than they were in late 2021. However, a counterargument arises as validators are earning less compared to the previous peak despite this surge in activity.

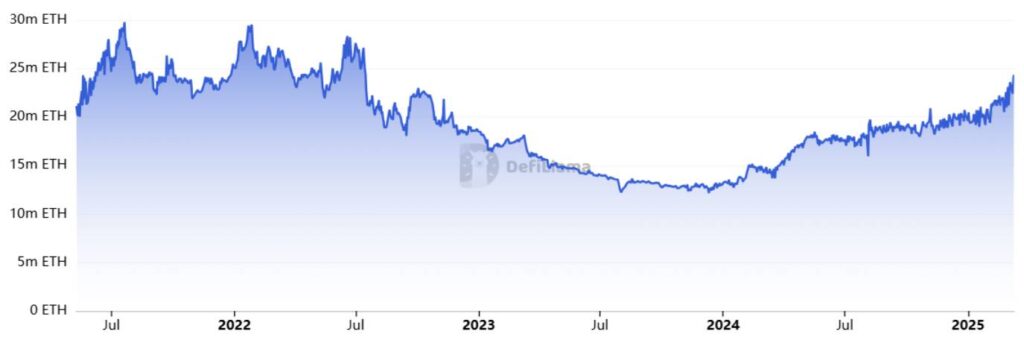

“Ethereum’s total value locked (TVL) reached its highest level since July 2022, marking a 10% increase over the past two weeks.”

As we move forward, Ether’s performance is likely to hinge on broader macroeconomic conditions, but the data points to a growing potential for it to reclaim lost ground and possibly reach the ,500 threshold in the coming weeks.

Impact of Current Ethereum Market Trends

The recent fluctuations in the ETH market can significantly influence investors’ strategies and outcomes. Here are the key points related to the situation:

- ETH Price Decline:

- ETH fell 13% between March 8 and March 11 due to investor caution amid economic tensions.

- The current price of ETH stands at ,940, requiring a 29% gain to reach ,500.

- Market Sentiment:

- Growing fears of an economic downturn have led investors to favor cash and short-term fixed-income assets.

- Historically, overreactions in trading might signal a faster recovery for ETH than other assets when sentiment improves.

- Investor Behavior:

- Recent liquidations of leveraged long positions amounting to 5 million have contributed to panic selling.

- Traders are currently displaying weakness in bullish conviction, as evidenced by low leveraged buying activity.

- Growth Indicators:

- Ethereum’s Layer 2 network has seen significant growth, with daily operations three times higher compared to the base layer.

- Ethereum’s total value locked (TVL) in smart contracts reached its highest level since July 2022, signaling increased institutional interest.

- Decentralized Exchange (DEX) Performance:

- Ethereum has reclaimed the top spot in DEX trading, surpassing competitors like Solana in trading volumes.

- The growth in DEX volume and TVL is expected to positively influence ETH’s price recovery potential.

“Ultimately, Ether’s price trajectory is closely tied to macroeconomic conditions, and its ability to stabilize could present opportunities for investors to regain previous highs.”

Ether’s Recent Struggles: Analyzing Competitive Landscape and Future Prospects

In the wake of a recent 13% drop from March 8 to March 11, Ether (ETH) has found itself navigating a tumultuous market characterized by geopolitical tensions and a flight to safety among investors. While fear of an economic downturn has driven many towards fixed-income assets, the crypto sector’s inherent volatility could present both challenges and opportunities for traders and investors.

The current climate surrounding ETH suggests a distinct competitive advantage compared to other assets. Historically, traders tend to overreact, which often leads to quicker rebounds for Ether than for traditional investments like stocks and bonds. For instance, as the S&P 500 futures faced pressures, ETH’s underlying resilience indicates that, should market sentiment shift positively, Ether could potentially recover faster than its rivals. This scenario could be particularly beneficial for day traders and short-term investors who desire agility in their investment strategies.

However, Ether’s price must surge by 29% to reach the pivotal ,500 threshold, necessitating an uptick in demand from leveraged buyers, whose activity is currently near a five-month low. This dependence on leveraged positions poses a disadvantage, as it introduces a level of exposure that could exacerbate losses during downturns, alienating more conservative investors seeking stability.

Moreover, while Ethereum’s layer-2 ecosystem is growing at a remarkable rate—far surpassing activity on the Ethereum base layer—there are still concerns regarding validator earnings declining compared to late-2021 peaks. This trend could deter potential validators and developers, presenting an obstacle for Ethereum as it vies for dominance against newer competitors like Solana and Cardano. Whether other platforms can leverage Ethereum’s slower growth remains to be seen, but their regulatory hurdles provide a momentary hurdle that Ethereum can exploit.

The situation further complicates for Ethereum as it continuously strives to maintain its leading position amidst a wave of competition in the DeFi space. With a total value locked (TVL) of 24 million ETH and increasingly strong decentralized exchange (DEX) volumes, Ethereum demonstrates a robust ecosystem. Yet, this strength may not be sufficient to sideline rivals whose adoption rates in the DeFi sector are rising.

Ultimately, Ether’s ability to reclaim investor confidence will largely depend on forthcoming macroeconomic indicators. Should global economic conditions improve, Ethereum is poised to benefit from the flux of institutional investments powered by the surging interest in crypto exchange-traded funds (ETFs). Conversely, if uncertainties continue to plague the market, the inherent volatility of Ether could pose significant problems for those seeking refuge in safer investments.

As we trace Ether’s trajectory, opportunities abound for those willing to ride the waves of volatility. However, the associated risks highlight the need for a cautious approach, especially for investors eyeing long-term positions in a seemingly unpredictable environment.