The cryptocurrency landscape has become increasingly turbulent, particularly for Ether (ETH), which saw its price drop below the ,600 mark on February 24. Since then, ETH has struggled to make a significant recovery, influencing traders and analysts alike to question the factors necessary for a rebound above the ,500 level. The recent downturn led to a staggering 8 million in leveraged long liquidations in ETH futures, showcasing the heightened volatility in the market during this challenging period.

Despite the excitement surrounding altcoins, Ether has notably lagged behind its competitors, underperforming the overall altcoin market by 10%. This decline follows a surge in interest for memecoins that have significantly benefited Solana (SOL), Ethereum’s rival in the blockchain arena. The intensity of competition is rising, with promising platforms like Berachain and Hyperliquid beginning to capture the attention—and funds—of investors, adding further pressure on Ether to demonstrate its staying power and advantages.

“Several issues are impeding Ether’s price recovery, with investors expressing concern over Ethereum’s upcoming Pectra upgrade and its overall competitiveness in the evolving market landscape.”

Investors are now grappling with anxiety over Ethereum’s potential to regain its footing. Issues such as the effectiveness of network upgrades, demand from institutional investors, and overall on-chain activity are all areas of concern. Recent reports of empty blocks on the Ethereum testnet have intensified these worries, as the network grapples with technological and competitive challenges. Many traders are eager for assurances that Ethereum’s network enhancements will not only improve user experience but also provide clear competitive advantages.

Interestingly, the lack of institutional demand is making headlines, notably reflected in negative spot ETF flows where investors have withdrawn 6 million in the last ten trading days alone. While some analysts once believed that native staking approval for Ethereum ETFs might rekindle interest, current trends suggest that’s becoming a distant hope. With Ethereum’s supply increasing and staking rewards diminishing, the road ahead appears precarious without significant changes in market sentiment and demand dynamics.

“For Ether to rise above the ,500 mark, a comprehensive reassessment of how Ethereum positions itself against its growing competitors will be crucial.”

In this ever-evolving cryptocurrency environment, Ether’s path forward hinges on navigating these critical issues: network upgrades, increased user engagement, and a compelling case that highlights its advantages over emerging rivals. As the market watches closely, only time will tell how Ether will adapt and potentially reclaim its bullish momentum in an increasingly competitive space.

Ether (ETH) Price Concerns and Future Outlook

The current state of Ether (ETH) reveals significant challenges that could impact traders, investors, and the overall crypto market. Here are the key points regarding its price decline and the surrounding circumstances:

- Price Drop and Liquidations:

- ETH price fell below ,600 as of February 24, 2023.

- Triggered over 8 million in leveraged long liquidations within 15 days.

- Current struggles to sustain recovery highlight volatility in crypto markets.

- Underperformance Relative to Altcoins:

- ETH has underperformed the altcoin market by 10% during this period, raising investor concern.

- Competition from memecoins and other blockchains, notably Solana (SOL), impacts investor sentiment.

- Challenges from Network Upgrades:

- The upcoming Pectra upgrade may not address critical issues affecting usability and transaction fees.

- Concerns over interoperability and potential delays in the upgrade could further dampen market confidence.

- Competition and Market Dynamics:

- Emerging competitors, such as Berachain and Hyperliquid, pose threats to ETH’s market dominance.

- Berachain’s impressive total value locked (TVL) signals a shift in liquidity and governance benefits.

- Institutional Demand Weakness:

- Negative ETF flows show a lack of institutional interest, with 6 million in net withdrawals noted.

- Lower demand and increased supply contribute to Ether’s inflationary status.

- Future Potential and Market Sentiment:

- For ETH to surpass ,500, it must regain market confidence through network upgrades and usage increases.

- Reduced friction for layer-2 solutions is necessary for the broader ecosystem to thrive.

The overall focus on Ethereum’s decentralized technology and updates will be critical in determining its market strength against competitors.

Readers involved in trading or investing in cryptocurrencies should assess these factors closely, as they can influence ETH’s performance and potential future gains or losses in their portfolios.

Ethereum’s Challenges Amidst Rising Competition

The recent downturn in Ether’s (ETH) valuation, currently hovering below ,600, has stirred significant unrest in the crypto community. This latest dip, coupled with a staggering 8 million in leveraged liquidations over a mere 15 days, has many traders pondering the future trajectory of ETH, especially as it continues to trail behind the altcoin market by 10%. Comparatively, Ethereum’s prime rival, Solana (SOL), has capitalized on the recent memecoin frenzy, drawing attention and investment away from ETH. This situation highlights some critical competitive advantages and disadvantages that Ethereum faces.

Competitive Advantages

Ethereum retains the first-mover advantage in the smart contract space and boasts a highly active developer community, which is a significant asset when considering network upgrades. Future enhancements, such as the anticipated Pectra upgrade, could potentially improve transaction fees and user experience, keeping it relevant in the ever-competitive landscape. Moreover, its long-standing reputation in decentralized finance (DeFi) gives it a substantial edge, attracting new projects and developers, despite rising competition from protocols like Berachain and Hyperliquid.

Competitive Disadvantages

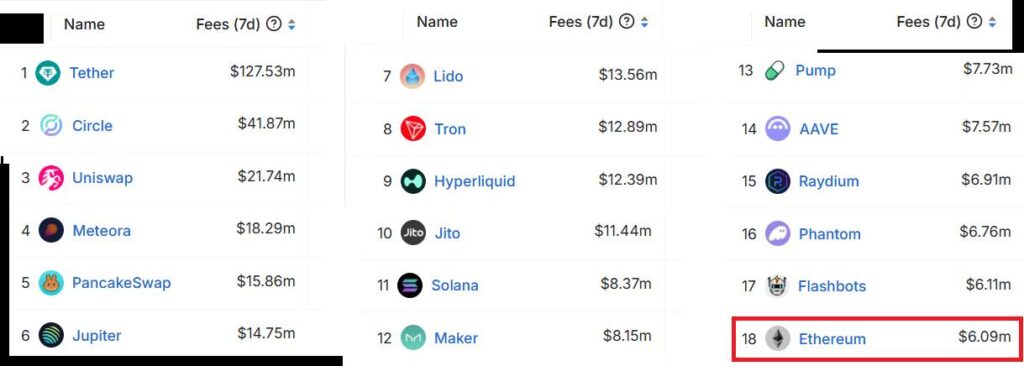

On the downside, Ethereum’s upgrades may not meet the rapid pace of innovation seen in newer competitors. Berachain’s impressive billion in total value locked (TVL) and Hyperliquid’s ability to outpace ETH in open interest signal a shift that could pose substantial threats to Ethereum’s market share. Additionally, persistent issues like low on-chain activity and inadequate institutional demand hinder ETH’s potential for growth. Recent figures indicate a withdrawal of 6 million from spot ETFs, a stark reminder that institutional interest is waning.

Who Benefits, Who Faces Challenges?

Potential investors, looking for a stable and reliable platform, may benefit from Ethereum’s existing ecosystem and well-established reputation, especially if the upcoming upgrades do deliver tangible benefits. However, those leveraging the market’s volatility for quick gains might find themselves at a disadvantage. As Ethereum struggles to regain its foothold, emerging platforms may entice those who are risk-tolerant, eager for higher returns from these fast-evolving technologies.

Ultimately, for Ethereum to fortify its position and entice both investors and developers alike, it must swiftly address its current shortcomings. The evolving landscape suggests that a cohesive strategy aimed at enhancing usability, interoperability, and institutional appeal could pave the way for ETH to reclaim its stature in a chaotic and highly competitive market.