In recent days, the cryptocurrency market has faced turbulence, particularly with Ether (ETH) experiencing a notable decline. Between March 8 and March 11, ETH fell by 13%, as investors sought refuge in safer, short-term fixed-income and cash positions amid escalating global uncertainties, including a tariff war that intensified following the United States’ response to Canada’s electricity measures. Currently, ETH is priced at ,940, which means it needs to rebound by 29% to reclaim the ,500 threshold that many traders are eyeing.

This drop in Ether’s value is reflective of a broader market sentiment where fear of an economic downturn has led to overreactions among traders. Historically, such conditions can set the stage for vigorous recoveries, hinting that ETH might rebound more swiftly than other assets once the mood shifts. However, a significant factor contributing to the recent price adjustment is the liquidation of 5 million in leveraged long positions, pushing ETH down to its lowest point since October 2023.

Despite the challenges, there are indicators of resilience within the Ethereum ecosystem. The network has seen growth in its layer-2 solutions, enhancing transaction efficiency and attracting daily average operations that are significantly higher than its base layer, despite concerns regarding validators earning less than in late 2021. On March 11, the average transaction fee was just .70, a stark contrast to the average seen during peak activity.

Ethereum’s path forward remains entwined with macroeconomic developments, but early signs of recovery are emerging as the network reinforces its popularity with institutional investors and experiences a surge in total value locked (TVL) across its various financial products.

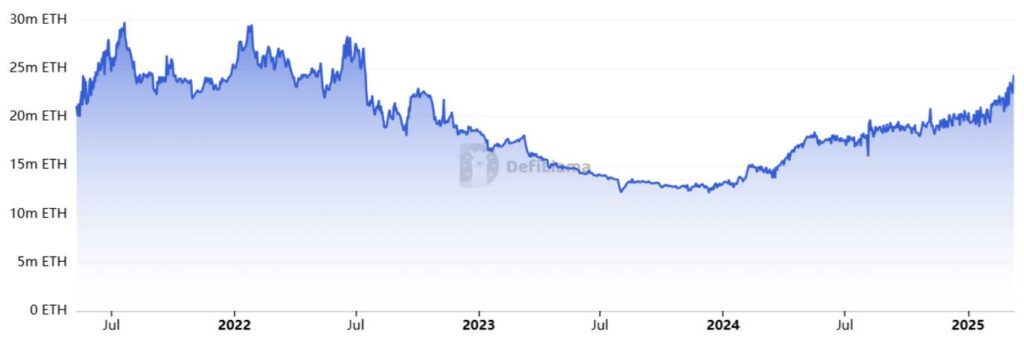

As of March 11, Ethereum’s TVL reached its highest level since July 2022, driven by strong interest in services like liquid staking, lending, and yield farming. Additionally, the network reclaimed its leading position in decentralized exchange volumes, surpassing its rivals with .5 billion in trading activity, an encouraging sign for the future of ETH as it navigates these turbulent waters.

Impact of Recent Ether (ETH) Price Movements

Recent fluctuations in Ether’s price have significant implications for investors and the broader crypto market. Here are the key points:

- ETH Price Decline: Ether fell 13% between March 8 and 11, highlighting market volatility amid a global tariff war and economic slowdown fears.

- Future Price Recovery: To reclaim the ,500 mark, ETH must gain 29% from its current price of ,940, necessitating increased demand from leveraged buyers.

- Market Psychology: Traders often overreact to market news, suggesting a faster rebound for Ether compared to other assets once sentiment improves.

- Low Leveraged Interest: Current market conditions have led to the lowest activity from leveraged buyers in five months, which may impact potential recoveries.

- Liquidity Pressure: Significant panic selling led to the liquidation of 5 million in leveraged long positions, causing ETH’s price to drop to its lowest since October 2023.

- Layer-2 Network Growth: Ether’s layer-2 ecosystem has seen substantial growth, improving transaction efficiency and network performance compared to late 2021.

- TVL Increase: Total Value Locked (TVL) in the Ethereum network reached a 10% increase, signaling growing interest in staking, lending, and yield farming.

- Institutional Adoption: Ethereum’s position as a preferred option for institutional investors is reinforced by substantial spot ETFs, maintaining investor confidence.

Understanding these dynamics can help readers make informed decisions about investing in Ether and navigating the evolving cryptocurrency landscape.

Ether’s Struggles and Competitor Insights Amid Economic Turbulence

The recent downturn in Ether’s value, marking a 13% drop between March 8 and March 11, highlights significant shifts in market sentiment as investors flock to safer assets. Ether is not alone in this turbulent environment; other cryptocurrencies also face similar pressures, yet it has some distinct advantages and challenges that could influence its recovery trajectory.

One of Ether’s key competitive advantages lies in its robust adoption within the decentralized finance (DeFi) sector. Ethereum’s total value locked (TVL) has shown an impressive uptick, reaching levels not seen since mid-2022, which could indicate a strong underlying demand for its ecosystem despite declining prices. Its pioneering status in the smart contract space and the influx of institutional investors, particularly with .9 billion in spot ETFs, underscores its resilience. This institutional interest is not widely matched by competitors like Solana, which still grapples with regulatory hurdles impeding its own ETF ambitions.

However, Ether must navigate several challenges that may be detrimental to its upward momentum. A critical disadvantage stems from the broader economic landscape characterized by fears of a downturn and escalating global tariff disputes. Such macroeconomic factors often lead to risk aversion among traders, fleeting interest in more volatile assets like cryptocurrencies, and triggering panic selling, as observed with recent liquidations of leveraged long positions. Additionally, the competitive environment has intensified, with other blockchains innovating rapidly and siphoning off developer attention and potential user activity from Ethereum.

This scenario creates a dual-edged sword for various stakeholders. For frequent traders and short-term investors, the current fluctuations may present lucrative opportunities for quick profits if they can time the market correctly. Conversely, long-term holders might experience anxiety and drawdown risks as the psychological impact of such volatility can lead to increased selling pressure, especially among those less experienced with the crypto market’s cyclical nature. Furthermore, the network’s existing users might be incentivized to explore layer-2 solutions, which offer reduced fees and increased transaction speeds, potentially diminishing engagement with Ethereum’s base layer.

While Ethereum lays claim to its superiority in the DeFi space, the reality is that its future performance may hinge on macroeconomic recovery and renewed bullish sentiment towards cryptocurrencies as a whole. If previous trends of rapid rebounds in Ether’s price hold, it could reestablish the ,500 mark with sufficient demand from leveraged buyers. However, the current climate suggests that both opportunities for gains and risks of losses are higher than ever, especially amidst growing competition and evolving market dynamics.