Ether (ETH) has recently shown some signs of life, reclaiming the vital ,000 support level on March 24. However, this rebound comes after a significant decline, leaving Ether’s price 18% lower than the ,500 mark noted just three weeks ago. Recent data indicates that Ether has underperformed compared to the broader altcoin market, prompting discussions among traders about the potential factors that could spark a bullish turnaround.

The recent developments in the Ethereum ecosystem, particularly the upcoming Pectra network upgrade likely slated for late April or early June, may hold the key to this potential shift.

This upgrade promises enhancements aimed at addressing some of the ecosystem’s persistent challenges. Among these are the doubling of data capacity per block, which could alleviate some of the high fees that have plagued users, as well as the introduction of smart accounts. These smart accounts could revolutionize wallet functionality during transactions, enabling features like gas fee sponsorship and simplified transaction processes.

Despite the optimism surrounding the upgrade, not everyone shares the bullish outlook. Arthur Hayes, co-founder of BitMEX, recently set a bold price target of ,000 for ETH, yet options traders remain skeptical, as reflected in the price of a ,000 call option. Meanwhile, Ethereum continues to lead the smart contracts arena, holding the distinction of being the only altcoin with a spot-exchange traded fund (ETF) in the U.S., which currently manages .9 billion in assets.

Ethereum’s total value locked (TVL) stands at an impressive .5 billion, significantly outpacing competitor Solana’s billion, with recent growth trends suggesting increased investor confidence.

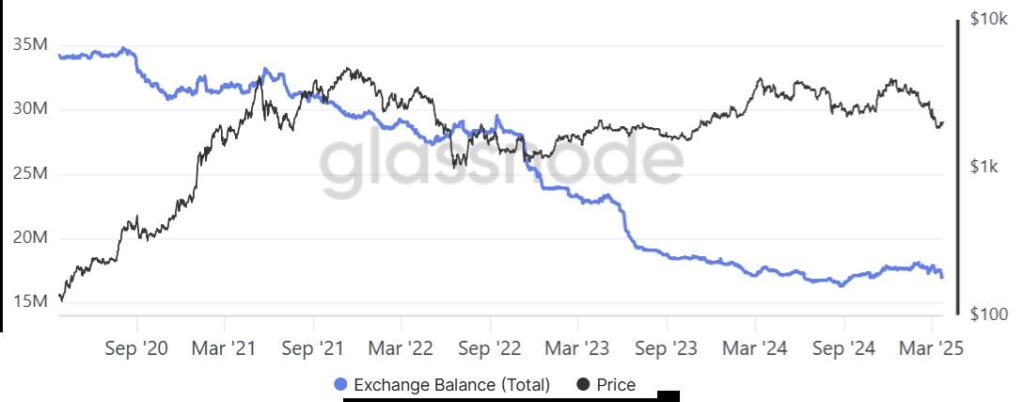

The supply of Ether available on exchanges also signals a trend towards long-term holding, with figures hovering just above five-year lows. This withdrawal from exchanges suggests that investors are increasingly committed to holding their assets rather than trading them, which may indicate a potential for future price increases. Additionally, the Ethereum network is carving out significant space in the Real World Asset (RWA) industry, which further underscores its importance in the decentralized finance (DeFi) landscape.

As traders keep an eye on upcoming developments, including the Pectra upgrade and other advancements, Ethereum’s journey from its recent price lows will be closely watched, especially considering the resilience it has shown in the face of external pressures. The excitement surrounding potential improvements and renewed investor interest could set the stage for a shift in momentum as the cryptocurrency landscape continues to evolve.

Key Insights on Ether (ETH) Price and Future Prospects

Understanding the current situation and future prospects of Ether (ETH) can significantly impact investment decisions and inform readers about potential opportunities in the cryptocurrency market.

- ETH Price Recovery:

- Ether reclaimed the ,000 support on March 24 but remains 18% below the ,500 level from three weeks ago.

- Underperformance against the altcoin market by 14% over the past 30 days raises questions about its bullish momentum.

- Upcoming Pectra Upgrade:

- Scheduled for late April or early June, aiming to address network scalability and improve transaction efficiency.

- Proposed enhancements include doubling data capacity in each block and introducing smart accounts for greater functionality.

- Institutional Interest:

- Strong potential to attract institutional demand and alleviate fears surrounding Ether’s performance and usability.

- Ethereum remains the leader in smart contract deposits and is unique in having a spot exchange-traded fund (ETF) in the US.

- Total Value Locked (TVL) Growth:

- Ethereum’s TVL stands at .5 billion, far exceeding Solana’s billion, reflecting strong ecosystem health.

- Recent growth in deposits indicates increasing investor confidence and commitment to the Ethereum network.

- Supply Dynamics:

- ETH supply on exchanges is at a five-year low, indicating a trend of long-term holding by investors.

- Low exchange supply might suggest a potential price increase due to reduced availability.

- Market Sentiment and Predictions:

- Arthur Hayes set a bullish price target of ,000 for ETH, indicating potential market confidence.

- Contrastingly, low pricing on options suggests that not all traders share this optimistic outlook.

- Real World Asset (RWA) Integration:

- The Ethereum network is showing robust growth in the RWA sector, recently surpassing .5 billion in capitalization.

- Over 80% of RWA market activities are linked to Ethereum, underscoring its dominance in decentralized finance (DeFi).

This analysis highlights trending factors affecting Ether’s price and market position, informing readers about potential investment opportunities and market movements.

Comparative Analysis of Ether’s Market Position and Future Prospects

The current market situation for Ether (ETH) signifies both challenges and potential opportunities, creating a dynamic landscape for traders and investors alike. Despite reclaiming the crucial ,000 support level, ETH’s price stands noticeably lower than its peak of ,500 reached just weeks prior. In contrast, the broader altcoin market has managed to outpace Ether, further stirring debate among investors regarding its ability to regain momentum. Notably, ETH has struggled in comparison to competitors like Solana, which is beginning to attract significant investor interest despite its recent dips.

Competitive Advantages: One of Ether’s most notable strengths is its robust Total Value Locked (TVL), currently at an impressive .5 billion. This figure decisively eclipses Solana’s billion, showcasing Ether’s dominant position in the decentralized finance (DeFi) sector. Furthermore, the anticipated Pectra upgrade is set to enhance network scalability and efficiency—potentially improving the overall user experience that has been called into question by critics. Institutional interest also remains high, fueled by Ether being the sole altcoin with a spot exchange-traded fund (ETF) in the U.S., boasting .9 billion in assets under management.

Disadvantages: However, while Ether shows promise, it faces escalating scrutiny regarding its lagging performance in comparison to traditional altcoins. A lack of scalability solutions and high transaction fees have raised concerns among investors, creating a backdrop of skepticism. Additionally, despite Ether’s institutional backing, options traders appear less optimistic, evidenced by a ,000 price target that carries slim probabilities of realization. This sentiment reflects underlying caution that could impact trading behaviors.

Implications: Investors looking for safer, long-term positions may benefit significantly from holding ETH given its established network and upcoming upgrades, which could attract further institutional interest. However, for risk-averse traders, the present volatility and skepticism in ETH’s potential to reach new highs could create problems. Furthermore, as competitors like Solana capitalize on these concerns—showing growth amid Ether’s stagnation—traders may shift their focus, potentially affecting ETH’s market share.

Against this backdrop, as the Ethereum Pectra upgrade looms, the question remains: will these enhancements ultimately restore bullish sentiment and shore up investor confidence, or will they arrive too late amid fierce competition? Only time will tell how Ether navigates this complicated terrain.