In a notable development within the cryptocurrency landscape, Ether (ETH) has surged by 10% in just 24 hours, now trading at approximately $1,795. This rally has been largely attributed to easing tensions in the US-China tariff wars, which has sparked a wave of optimism among traders. As broader market forces contribute to this bullish sentiment, Bitcoin (BTC) and several other major cryptocurrencies also experienced significant gains, reflecting a rejuvenated enthusiasm among investors.

“Reduced trade tensions often lead to increased investor confidence in riskier assets, as global economic stability encourages capital flow into cryptocurrencies,” explained trading firm QCP Capital.

The recent increase in Ether’s price has been accompanied by a striking rise in daily trading volume, which jumped by 67% to reach $26.6 billion. This surge not only represents heightened demand for Ether but also signals a robust market activity overall. Notably, over $109 million worth of short ETH positions were liquidated in the derivatives market, putting upward pressure on prices and highlighting a marked shift in trader sentiment.

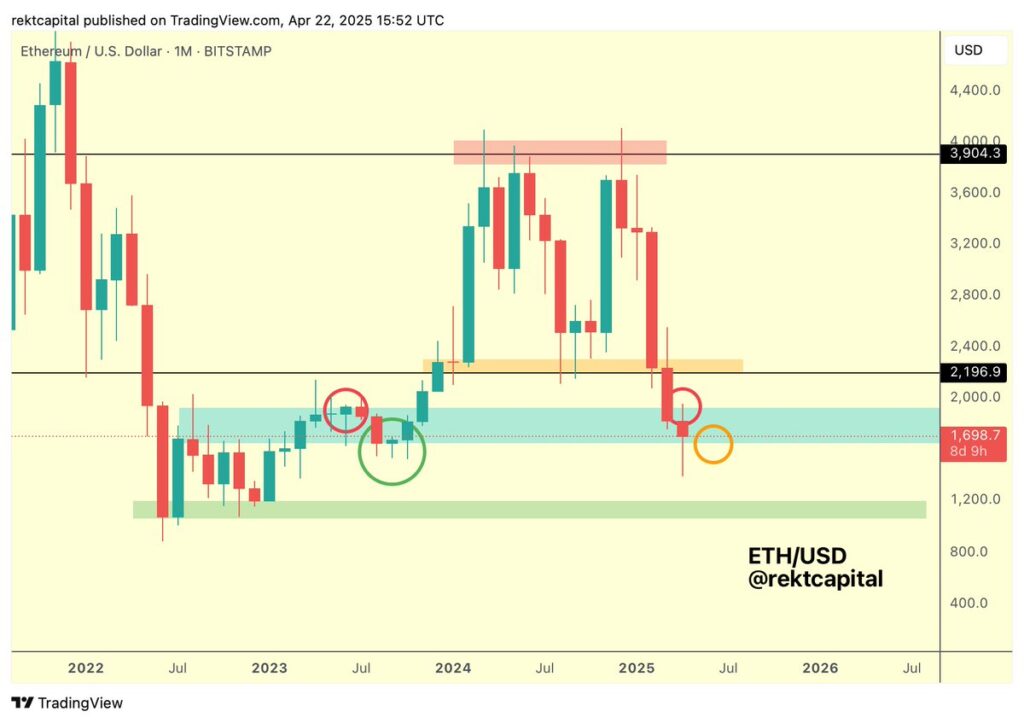

As traders unwind short positions, Ether managed to break out from a narrow range that had held it captive for nearly two weeks, now eyeing the next resistance target of $2,100. Many traders are hopeful that the recent momentum can be sustained, especially as technical indicators have begun to reflect a bullish trend. However, as with any market phenomenon, some analysts caution that an adjustment may be on the horizon, especially if Ether’s price re-enters the lower range between $1,500 and $1,700.

In essence, the interaction between global economic conditions and local market dynamics is shaping the current landscape for Ether and its counterparts, positioning the cryptocurrency space for potential further developments in the days to come.

Key Takeaways on Ether Price Movements

The recent developments in the cryptocurrency market, particularly for Ethereum (ETH), can have significant implications for both investors and casual readers. Here are the key points:

- ETH Price Surge:

- ETH rose by 10% to $1,795, bolstered by optimism over easing US-China tariff tensions.

- Increased trading volume of 67%, reaching $26.6 billion, implies heightened demand and engagement from traders.

- Broader Market Rally:

- Other cryptocurrencies, including Bitcoin and XRP, also experienced notable gains, indicating a market-wide bullish sentiment.

- The de-escalation of trade tensions generally encourages investors to enter riskier assets like cryptocurrencies.

- Significant Short Liquidations:

- Over $110 million in short ETH positions were liquidated, signaling strong upward price pressure as bearish positions were forced closed.

- This occurred amid increasing Open Interest (OI) in the derivatives market, suggesting greater trading activity and interest in ETH futures.

- Technical Breakout and Price Targets:

- ETH must maintain a price above $1,600 to sustain its rally; analysts see potential targets of $1,950 and $2,100.

- Current RSI nearing 78 indicates overbought conditions, suggesting a possible pullback in prices.

- Market Stability and Future Prospects:

- Analysts underline the importance of ETH holding its range for future recovery, recalling previous price movements from $1,600 to $4,093 in early 2024.

- The current market sentiment is optimistic but cautious; sustained support above current resistance levels is crucial for continued growth.

“Crypto markets are heavily influenced by external economic factors, including trade policies. Investors must remain informed and vigilant.”

ETH Price Surge: Analyzing Competitive Trends in the Cryptocurrency Market

The recent surge in Ethereum’s price, as it soared by 10% amidst the de-escalation of the US-China trade tensions, has both reflective and competitive implications for other cryptocurrencies. As investor confidence grows in the face of reducing macroeconomic risks, Ethereum has strategically positioned itself to capitalize on this renewed optimism. Although Ethereum leads with a robust price rally, Bitcoin and altcoins have also seen gains, showing a positive correlation across the crypto market.

Comparative Advantages: Ethereum’s price momentum is bolstered by significant short liquidations in the derivatives market, registering over $109 million in forced closures. This dynamic serves to enhance bullish sentiment and indicates traders’ willingness to jump onto the rapidly rising bandwagon. Moreover, presents of positive funding rates in ETH perpetual futures markets signify an influx of capital and heightened interest in Ethereum, making it a potentially lucrative asset for investors looking to ride the wave of upward price activity.

On the comparative front, Bitcoin also experienced a notable rise, now trading at $94,000 and demonstrating its ability to influence the broader market. Notably, altcoins like XRP, Solana, and Dogecoin mirrored ETH’s performance, showing that Ethereum’s surge could benefit from, and contribute to, a revitalized interest in cryptocurrencies overall—albeit with minor variances in their market dynamics.

Challenges Ahead: Despite Ethereum’s bullish outlook, analysts caution that the RSI level indicates an “overbought” condition, suggesting potential for a price pullback. This warning not only represents a risk for current investors but also introduces volatility that can affect trading strategies across the cryptocurrency landscape. If Ethereum retraces to the $1,500 to $1,700 range, other cryptocurrencies that thrived on soaring prices may encounter similar struggles as investor sentiment shifts in anticipation of Ethereum’s stability.

Implications for Traders and Investors: This volatility could pose challenges for both short and long-term traders. Investors who participated in the recent rally will have to navigate the tightrope of securing gains while mitigating possible losses that may arise from consolidation periods. Conversely, newcomers drawn to the excitement surrounding Ethereum may find opportunities to enter at lower price levels if a pullback materializes, particularly if Ethereum manages to maintain a significant support level above $1,600. The interplay between these factors could create a fluctuating yet promising environment where both existing and new traders can find opportunities—or face setbacks—depending on their strategies and timing.