The cryptocurrency landscape is buzzing as Ethereum (ETH) approaches a pivotal moment with $2.4 billion in options set to expire on May 30. This event could serve as a catalyst for ETH’s performance, particularly as traders watch to see if the coin can hold above the critical threshold of $2,600. Should it do so, a staggering 97% of put options will become worthless, aligning the interests of bull traders seeking gains.

Despite recent upward movements, ETH is down 21% in 2025, contrary to a wider market increase of 5%. Analysts attribute Ethereum’s struggles to intensified competition from other blockchains aimed at decentralized applications. Yet, in a silver lining, ETH stands out as the sole altcoin with a spot exchange-traded fund (ETF) in the U.S., which has drawn $287 million in investments in just over a week, indicating sustained institutional interest.

“While market strategies and macroeconomic factors could limit Ethereal gains, a strong push above $2,700 could dramatically reshape investors’ outlooks.”

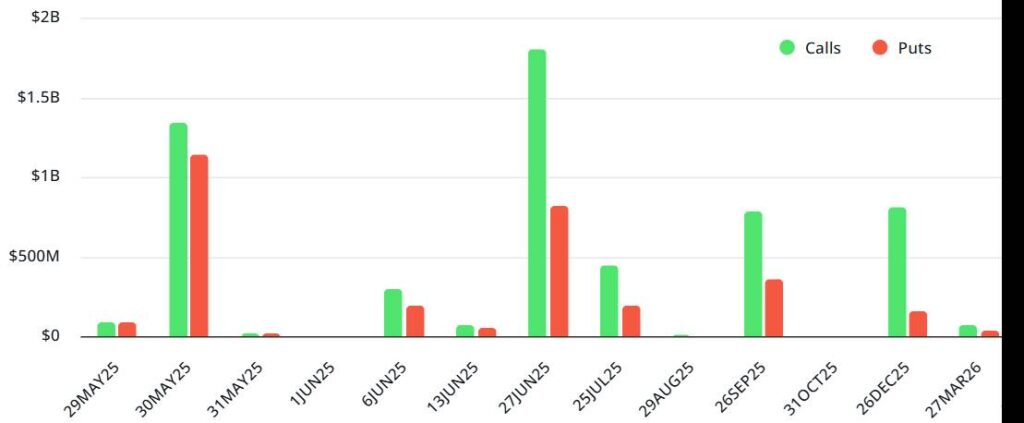

However, the decline in network activity adds a layer of concern, as Ethereum’s positioning in terms of transaction fees has waned, further contributing to inflationary pressure on ETH. Traders are navigating a complex landscape of options, with a dominant $1.3 billion in call options signaling bullish sentiment ahead of the expiry.

Nevertheless, many traders may not reinvest their gains, which introduces uncertainty into the future trajectory of Ethereum’s price. The interdependence of ETH and macroeconomic indicators, especially in relation to the S&P 500, suggests that broader economic forces will significantly influence investor strategies and ETH’s price at the expiry moment. As the countdown continues, all eyes are focused on whether Ethereum can break through the $2,700 barrier amid these mixed signals.

Key Takeaways from ETH Options Expiry

Understanding the recent developments in Ether (ETH) options can impact investment decisions and market strategies.

- 97% of ETH Put Options Expiry Worthless:

If ETH stays above $2,600, most put options will expire worthless, affecting traders’ positions.

- Macroeconomic Factors Limit Gains:

The potential rise in ETH’s price may be hindered by broader economic conditions and trading strategies.

- Significant Options Expiry on May 30:

$2.4 billion in ETH options will expire, which could support ETH’s attempt to surpass $2,700.

- Current Market Performance:

Despite gains, ETH is down 21% in 2025 while the overall crypto market gained 5%, influencing investor sentiment.

- Weak Network Activity:

Declining on-chain activity suggests limited upside potential for ETH, despite bullish intentions.

- Increased Competition Among Blockchains:

Rising contenders in the decentralized applications space may impact ETH’s market share.

- Spot ETFs Attract Institutional Interest:

ETH’s status as the only altcoin with a U.S. spot ETF offering has seen $287 million in net inflows recently.

- Increased Market Share for Rivals:

Platforms like Solana, BNB Chain, and Tron are gaining ground, presenting challenges for Ethereum.

- Potential Outcomes Based on Price Trends:

- Between $2,300 and $2,500: Favoring calls by $200 million.

- Between $2,500 and $2,600: Favoring calls by $370 million.

- Between $2,600 and $2,700: Favoring calls by $555 million.

- Between $2,700 and $2,900: Favoring calls by $770 million.

- Correlation with S&P 500:

The close relationship between cryptocurrencies and the S&P 500 indicates that macroeconomic indicators will heavily influence ETH’s price.

ETH Options Expiry: Competitive Landscape and Market Implications

As the countdown to the major $2.4 billion Ether (ETH) options expiry approaches, the market dynamics illustrate both opportunities and challenges inherent in the crypto ecosystem. While Ethereum currently boasts the advantage of being the only altcoin with a spot exchange-traded fund (ETF) in the U.S., attracting $287 million in institutional inflows, it faces stiff competition from emerging blockchain networks such as Solana, BNB Chain, and Tron. This competition presents a distinctive disadvantage for ETH, as its pricing strategies and market sentiment reflect an ongoing struggle against dwindling on-chain activity.

Investors eyeing the forthcoming expiry are faced with a critical question: will ETH maintain its value above the $2,600 threshold? The majority of put options are set below this level, indicating a potential windfall for bulls should ETH remain strong. However, with Ether’s 21% decrease in 2025 juxtaposed against the broader cryptocurrency market’s 5% growth, this presents a bearish outlook tempered by macroeconomic factors that could potentially limit ETH’s upward momentum. Traders need to consider how these external economic influences, such as corporate earnings and S&P 500 correlations, will play a crucial role in determining investor sentiment leading up to the expiry.

The dynamics of options trading further complicate matters. The heavy dominance of call options indicates a bullish sentiment, but it’s essential to recognize that not all traders will reinvest in new positions even if profitable. Many options strategies involve intricate hedging techniques, which can lead to unexpected market reactions. On the flip side, this creates an opportunity for savvy investors who can capitalize on the volatility surrounding the expiry, focusing on strategic entry points based on market movements.

Those looking to benefit from the looming expiration must also navigate Ethereum’s declining network activity, paired with its fading status in terms of transaction fees. This situation could deter potential investors who seek stronger utility and efficiency before committing significant capital. As such, Ether’s competitive advantages may be outweighed by its disadvantages if the network fails to produce the activity necessary to sustain investor confidence.

In conclusion, while the upcoming ETH options expiry presents potential for traders willing to take calculated risks, it also poses challenges that could hinder Ether’s growth trajectory in a constantly evolving crypto landscape. As institutional interest grows, the question remains: will these strategies bolster Ethereum, or will the weight of competition and market conditions prove too much to overcome?