In recent days, the cryptocurrency market has witnessed a remarkable resurgence, particularly with Ether (ETH) experiencing a whopping 29% gain from May 8 to May 9. This rally seems to signal a potential turning point after a protracted bear market, which saw ETH dip as low as $1,385 on April 9. Interestingly, over $400 million in short positions were liquidated during this uptick, indicating that many traders, including large investors and market makers, were caught unprepared by the dramatic price movements.

Despite this striking performance, the demand for Ether, especially in spot exchange-traded funds (ETFs) and derivatives, remains surprisingly subdued. On May 8 alone, Ether spot ETFs in the US saw net outflows of $16 million, raising flags about the overall confidence in this leading cryptocurrency. The muted enthusiasm could be attributed to a significant 85% drop in Ethereum’s network fees observed from January to April, which has dampened activity and thus, reduced demand for ETH.

“Ether’s recent sharp price surge reflects a complex interplay of market conditions, investor sentiment, and even political influences.”

Adding another layer to the narrative, recent statements from former President Trump regarding altcoins have also caused some shifts in sentiment. After initially promoting various competitors to Ethereum, Trump’s recent changes to his stance could play a role in reshaping perceptions around Ether’s prospects. This political context, combined with Ethereum’s strong fundamentals—including its dominance in decentralization and security—could present a future opportunity for growth, particularly if investor confidence begins to solidify.

While the market remains cautiously optimistic, especially with Ethereum’s total value locked (TVL) standing at an impressive $64 billion, a notable gap has emerged when compared to its closest competitors. Investors seem to be adopting a neutral stance in the derivatives market, with put and call options reflecting similar sentiment levels. As Ether continues to navigate this complex landscape, whether it can reclaim momentum and potentially rally toward the $2,700 mark remains an open question, sparking discussions and speculation throughout the crypto community.

Key Takeaways on Ethereum’s Recent Performance

Understanding the recent developments in the Ethereum (ETH) market can help readers make informed decisions about their investments and financial strategies. Here are the key points to consider:

- ETH Price Rally:

- ETH price surged by 22% on May 8 and an additional 29% by May 9, marking a potential end to a prolonged bear market.

- This surge resulted in the liquidation of over $400 million in short ETH futures, indicating market volatility.

- Muted Demand for Spot ETFs:

- Despite the price increase, there has been limited interest in spot ETH exchange-traded funds (ETFs), with significant net outflows occurring even during the rally.

- On May 8 alone, US-listed Ether spot ETFs saw net outflows of $16 million.

- Market Sentiment:

- Traders exhibit a neutral stance in ETH derivatives, reflecting uncertainty about a genuine trend reversal.

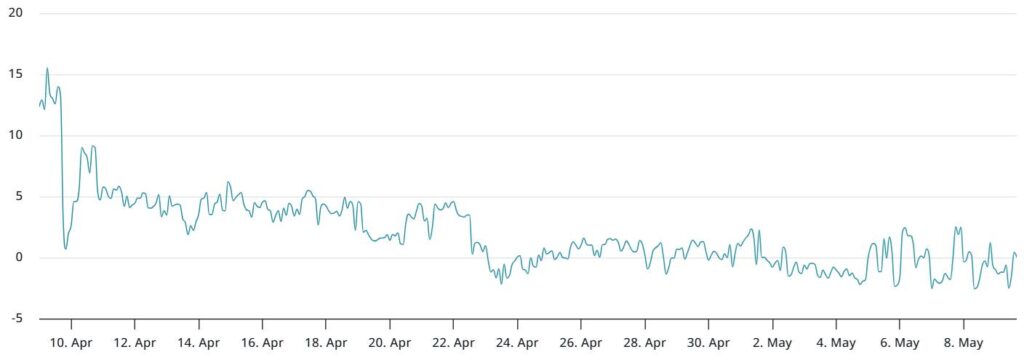

- The ETH futures premium remains below the 5% threshold, indicating limited demand for leveraged bullish positions.

- Ethereum’s Decentralization and TVL:

- Ethereum maintains leadership in decentralization and total value locked (TVL), currently at $64 billion, far surpassing its closest competitors.

- Ongoing network upgrades have improved layer-2 scalability and solidified Ethereum’s status as a secure platform.

- Impact of Network Fees:

- A sharp 85% drop in Ethereum network fees from January to April has reduced overall demand for ETH, affecting staking yields.

- Political Influences:

- Recent comments from US President Trump on altcoins may shift investor sentiment back toward Ethereum, following a period of competing altcoins gaining attention.

The interplay of these factors influences investor confidence and market action, impacting readers’ financial interests in Ethereum and the broader crypto landscape.

Ethereum’s Rally: A Closer Look at the Market Dynamics

The latest surge in Ethereum (ETH) prices by an impressive 29% between May 8 and May 9 marks a significant moment for the cryptocurrency, particularly after enduring a lengthy bear market. However, even amidst this rally, there are distinct challenges and competitive postures that set ETH apart from its contemporaries in the cryptocurrency landscape. While Ethereum’s upswing is noteworthy, its broader implications reveal both opportunities and hurdles that different stakeholders in the market might face.

Comparative Market Sentiment: In contrast to Ethereum, which is currently seeing muted demand for its spot ETFs and derivatives, competitors like Solana and BNB Chain are experiencing greater enthusiasm. While ETH maintains leadership in decentralization and security, its underperformance relative to the broader altcoin market, particularly trailing altcoins by a staggering 17% in 2025, raises questions about investor confidence. The limited excitement around ETH futures, which have not surpassed the 5% premium typically indicative of a bullish market sentiment, points to an investor population that appears cautious or uninspired.

Potential Beneficiaries: Institutional investors and whales, who often look for indicators such as futures premiums and ETF flows, may find themselves at a crossroads. The recent liquidation of $400 million in short positions highlights volatility opportunities, suggesting that savvy traders could exploit this momentum shift for potential gains. Additionally, developers and projects focusing on scaling solutions or layer-2 capabilities might find a fertile ground for growth, given Ethereum’s foundational strengths in these areas.

Emerging Challenges: Nevertheless, Ethereum’s lack of bullish market support coupled with declining network fees—down 85% from earlier this year—poses challenges for both current investors and new entrants considering ETH’s potential. Lower network activity could dampen interest, as reduced competition for data processing not only diminishes demand for ETH but also lowers staking yields. This could discourage long-term investors, especially when contemporaneous projects exhibit superior user engagement and innovative use cases.

Furthermore, the recent political tide with President Trump’s pivot away from certain altcoins could create an unpredictable ripple effect in the crypto realm. If this change affects market perceptions and investor behavior towards Ethereum or its rivals, the ensuing landscape could lead to heightened competition or renewed interest, depending on how stakeholders respond to this shift.

Ultimately, while Ethereum’s strong fundamentals and recent price appreciation are positive indicators, the overall sentiment within the derivatives and ETF markets remains hesitant. This complex interplay may serve to benefit adaptive traders and innovative developers while potentially complicating the outlook for traditional investors and those with a passive approach to cryptocurrency investing.