In recent weeks, Ether (ETH) has faced significant challenges, with its price dipping below ,200 on March 9 and showing a concerning decline of 14% for the month. This downturn comes amidst a broader crypto market that only fell by 4%, suggesting that investor sentiment around Ethereum is particularly bearish. One contributing factor to this sentiment is a notable 34% drop in decentralized exchange (DEX) activity on the Ethereum network over the past week. This slump has not only affected Ethereum but also its layer-2 solutions, including Base, Arbitrum, and Polygon.

“While Ethereum remains the leader in DEX volumes, falling fees are reducing demand for ETH.”

Interestingly, while Ethereum struggles, competitors like BNB Chain have seen a 27% increase in DEX volumes, and Canto’s performance has been remarkable with a 445% surge. Moreover, PancakeSwap, based on BNB Chain, has generated higher fees than Uniswap, traditionally a stronghold for Ethereum. This trend raises questions about Ethereum’s dominance in the DEX arena as its fees decline, signaling a potential shift in market interest.

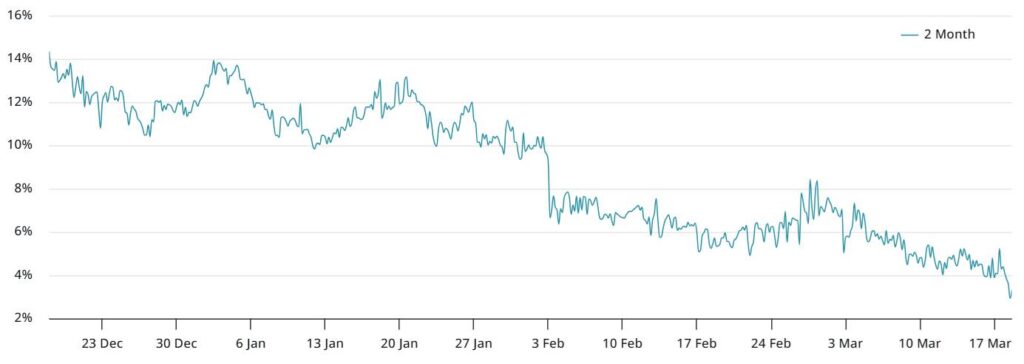

Despite retaining a strong position with .2 billion in total value locked (TVL), Ethereum experienced a 9% decline this week, further narrowing the gap with rival blockchains. Solana and BNB Chain, in particular, have begun to pose challenges to Ethereum’s market share, with Solana capturing attention in the memecoin sphere. Alongside these developments, Ethereum’s futures market reflects diminishing interest, as evidenced by the lowest premium in over a year at just 3%—a significant indicator for traders.

“To regain momentum, Ethereum must showcase a competitive edge.”

As Ethereum prepares for the upcoming “Pectra” upgrade, the pressure mounts to deliver a roadmap that fosters sustainable user adoption. The looming question is whether this upgrade will provide the necessary tools for Ethereum to regain its competitive standing against surging competitors like Solana and BNB Chain. Investors and developers alike are keenly watching as these dynamics unfold in the ever-evolving landscape of the cryptocurrency market.

Current State of Ether (ETH) and Market Dynamics

The price of Ether (ETH) has experienced a notable decline, alongside significant shifts in the decentralized exchange (DEX) market. Here are the key points to understand how these developments may impact investors and the broader cryptocurrency landscape:

- Price Decline:

- ETH fell below ,200 on March 9, marking a 14% drop in March.

- This decline is contrasted with a broader crypto market decrease of only 4%.

- DEX Activity Decline:

- There has been a 34% drop in DEX activity on the Ethereum network over the past week.

- This trend has also affected layer-2 solutions like Base, Arbitrum, and Polygon.

- Competitor Movements:

- Solana’s DEX activity decreased by 29%, while SUI’s fell 17%.

- In contrast, BNB Chain saw a 27% increase, and Canto surged by 445%.

- Fee Dynamics:

- PancakeSwap on BNB Chain generated .3 million in fees, surpassing Uniswap on the Ethereum network.

- This indicates a shift in profitability favoring BNB Chain compared to Ethereum’s DEX protocols.

- Total Value Locked (TVL):

- Ethereum remains the leader with a TVL of .2 billion but has seen a 9% weekly decline, narrowing its lead over competitors.

- Solana’s TVL fell by 3%, while BNB Chain’s deposits increased by 6%.

- Investor Sentiment:

- Ethereum’s on-chain metrics show weakening demand for leveraged ETH futures, with a current premium of 3%, the lowest in over a year.

- Institutional investors have shown waning interest, with ETF net outflows of 3 million since March 5.

- Future Outlook for Ethereum:

- The upcoming “Pectra” upgrade must provide a competitive edge and ensure sustainable user adoption.

- Failure to do so may lead to further declines in Ethereum’s market position against competitors like Solana.

The developments surrounding Ether’s price and its market behavior may greatly influence investor decisions and highlight the importance of adaptability in the rapidly changing cryptocurrency landscape.

The Current Landscape of Ethereum: Challenges and Competitive Insights

The Ethereum network is currently facing a challenging landscape, as its native token, Ether (ETH), has seen a significant drop in price and trading activity. Despite its leading position in total value locked (TVL), the platform is encountering fierce competition from rivals like BNB Chain and Solana, who are steadily eroding Ethereum’s market advantages.

Competitive Advantages of Ethereum

Ethereum undeniably retains its status as a heavyweight in the decentralization space, with a TVL of .2 billion, which still places it ahead of most competitors. Its deep-rooted ecosystem has been a significant factor aiding its competitive stance, with numerous decentralized applications (dApps) built on its network. However, the recent 3 million net outflow from Ethereum-based spot ETFs indicates a concerning decline in institutional interest that could potentially threaten its long-standing dominance.

Disadvantages and Emerging Threats

The decline in activity across decentralized exchanges (DEXs) on the Ethereum network, marked by a 34% drop within a short span, signals an urgent issue for the ecosystem. The notable growth of DEXs operating on competitors like BNB Chain, which saw fees surpass those of Ethereum’s Uniswap, also raises questions about Ethereum’s pricing competitiveness. As Ethereum’s transaction fees trend downward and user activity wanes, projects within its ecosystem, such as Lido and AAVE, are being outperformed by Solana-based counterparts, which may lead to further erosion of Ethereum’s user base.

Implications for Stakeholders

This shifting landscape poses challenges for various stakeholders. Investors who have been riding high on Ethereum are now feeling the pressure as confidence dwindles, while traders who leverage ETH futures are experiencing the lowest demand seen in over a year. The looming Pectra upgrade needs to not just address these concerns but foster a competitive edge that encourages sustainable growth. If it fails to do so, both retail and institutional investors could look elsewhere for their blockchain needs—compounding Ethereum’s struggles amidst the ongoing rise of other platforms.

Furthermore, developers keen on establishing innovative projects might find richer ecosystems in burgeoning competitors, thereby pulling development efforts away from Ethereum. As more options emerge in the crypto space, Ethereum’s historical reliability and robustness will need to be matched by tangible enhancements and improvements, or risk being sidelined in favor of platforms like Solana and BNB Chain, which continue to attract market share with lower fees and higher performance.