Recent shifts in the cryptocurrency market have seen Ether (ETH) drop below the ,600 mark on February 24, leading to a challenging recovery trajectory. As ETH struggles to regain its footing, CoinGlass data indicates that the price correction triggering a plunge toward ,000 resulted in over 8 million in leveraged long positions being liquidated within just 15 days. This decline has raised significant questions among traders about what steps must be taken for Ether to soar above the crucial ,500 threshold.

During this turbulent period, Ether has notably underperformed compared to the broader altcoin market, falling short by 10%. One of the most concerning aspects is the competition from other blockchain platforms, particularly Solana (SOL), as a recent surge in memecoins has seemingly drawn attention away from Ethereum. This shift points to the need for Ether to address a range of underlying issues to regain bullish momentum.

“Ethereum’s upcoming upgrades, including the Pectra update, may not be enough to instigate a strong rebound without significant enhancements to usability and cross-layer integration.”

Market analysts have expressed skepticism about whether the forthcoming upgrades will deliver the transformative changes needed. Even if the upgrades improve user experience, Ethereum still grapples with challenges relating to interoperability among layer-2 solutions, which affects liquidity and accessibility for users. Additionally, developers have reported issues with empty blocks on the Ethereum testnet, raising further concerns in an already cautious market.

The market sentiment remains largely pessimistic, compounded by the lack of institutional interest in recent days. Data shows that spot exchange-traded fund (ETF) flows have suffered greatly, marking negative withdrawals in nine of the last ten trading days, totaling 6 million. Many investors had hoped that future native staking approval for Ethereum ETFs would invigorate demand; however, the outlook now lacks certainty as ETH’s annual supply continues to grow, leading to inflationary trends.

“As competition intensifies, notably from emerging platforms like Berachain and Hyperliquid, Ether must prove its inherent value to maintain its user base and investor confidence.”

To regain its footing and reach that coveted ,500 price point, Ethereum needs to demonstrate clear, sustainable advantages over its competitors while enhancing network usage and addressing supply concerns. As the cryptocurrency landscape rapidly evolves, all eyes will be on how Ethereum navigates these challenges in the coming months.

Current Challenges and Future Prospects for Ether (ETH)

The recent trends in Ether’s price and its implications for traders and investors are critical to understand. Below are the key points regarding Ether’s struggle for recovery and the factors affecting its value:

- Price Decline:

- ETH price fell below ,600 on Feb. 24, struggling to recover significantly since then.

- The price correction toward ,000 resulted in over 8 million in leveraged long liquidations.

- Competitive Landscape:

- Ethereum has underperformed against the altcoin market by 10%, particularly in the wake of a memecoin frenzy benefiting competitors like Solana (SOL).

- Emerging blockchains, such as Berachain, have captured significant market interest with over billion in deposits.

- Network Upgrades:

- The upcoming Pectra upgrade is seen as insufficient for a major market turnaround.

- Concerns exist regarding Ethereum’s interoperability and liquidity across various layer-2 solutions.

- Weak Institutional Demand:

- Negative ETF flows have resulted in 6 million in net withdrawals, highlighting a lack of institutional interest.

- The increasing ETH supply and reduced blockchain processing demand have led to inflationary pressures, diminishing staking rewards.

- Future Market Sentiment:

- Approval of a Solana ETF could intensify competition for ETH, which currently has limited institutional options.

- For ETH to regain bullish momentum, investors seek better evidence of sustainable advantages over competitors.

Understanding these factors is crucial for traders as they navigate the current volatility and consider whether to invest in Ether or alternative blockchain solutions.

Ethereum’s Current Struggles: A Look at Market Positioning and Future Potential

Ethereum (ETH) has seen significant turbulence lately, with its price dipping below ,600 and struggling to build momentum. In comparison, competitors such as Solana (SOL) have capitalized on this struggle, benefitting from a surge in interest and capital. This competitive landscape highlights the vulnerabilities within the Ethereum ecosystem as it grapples with internal upgrade challenges and external market pressures.

Competitive Advantages: One of Ethereum’s key advantages lies in its established network and extensive developer ecosystem. This foundation allows Ethereum to continue innovating, despite recent setbacks. Upcoming upgrades, like the Pectra update, aim to optimize transaction fees and user experience, which could attract back users seeking enhanced functionality. Moreover, Ethereum’s first-mover advantage has historically placed it at the forefront of the DeFi scene, giving it a credibility edge in attracting institutional interest.

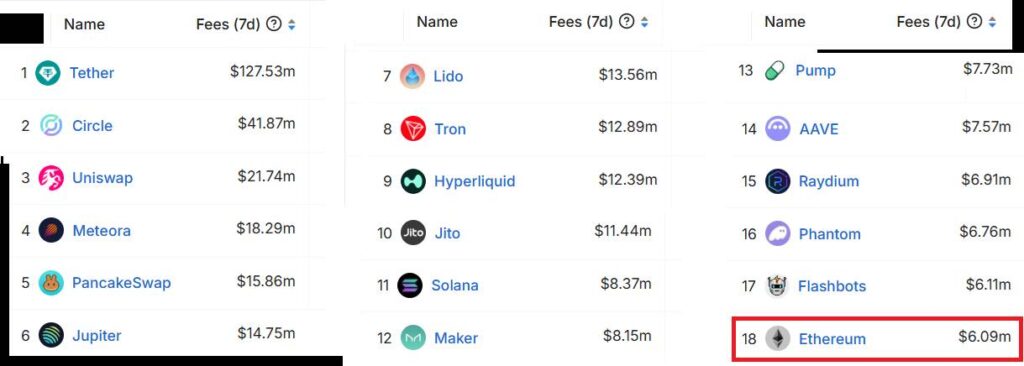

Competitive Disadvantages: However, Ethereum isn’t without its flaws. The recent underperformance—10% behind the altcoin market—raises significant concerns about its adaptability and responsiveness to market demands. As alternative projects like Berachain and Hyperliquid emerge, boasting superior protocol fees and innovative liquidity integrations, Ethereum risks losing its competitive edge. Furthermore, with the SEC potentially approving a Solana ETF in the coming years, the pressure on Ethereum to prove its worth increases dramatically.

The current sentiment surrounding ETH reflects a notable fear and skepticism, echoed by the continuous negative trend in institutional ETF flows. Investors appear wary, and the declining demand coupled with inflationary pressures on Ether exacerbates these anxieties. Consequently, this could hinder any swift recovery that traders might hope for in terms of price, especially in contrast to the liquidity offered by competing platforms.

Beneficiaries and Challenges: The implications of this environment are profound. For traders specifically invested in Ethereum, the struggle could lead to dissatisfaction and potential moves to more promising projects. Meanwhile, competitive platforms could attract those disillusioned by Ethereum’s performance, creating challenges not only for ETH but also for investors confined to traditional offerings. As the DeFi landscape evolves, those seeking innovative solutions and better returns may find opportunities more appealing outside the Ethereum network.