The world of cryptocurrency is buzzing with concerns as Ether (ETH) recently saw its price drop below the ,600 mark on February 24, marked by a struggle to achieve a solid rebound since. In a challenging span of just 15 days, the decline triggered a staggering 8 million in liquidations of leveraged long positions in ETH futures, according to data from CoinGlass. Traders find themselves at a crossroads, questioning what is needed for Ether to pull itself back above the crucial ,500 level.

“Fear remains the dominant sentiment, and for this to change, pressing issues must be resolved.”

Interestingly, Ether has lagged behind its altcoin counterparts, underperforming the altcoin market by 10%. This downturn comes on the heels of a meteoric rise in memecoins that fueled growth in Ethereum’s chief competitor, Solana (SOL). Experts argue that various factors, including Ethereum’s upcoming Pectra upgrade and growing competition, contribute to Ether’s struggles to recover.

While the Pectra upgrade is anticipated to enhance user experience, there are concerns regarding Ethereum’s interoperability across different layer-2 solutions. Recent reports of empty blocks on Ethereum’s testnet have only intensified risk perceptions, leading some traders to question whether these issues could further delay much-needed upgrades.

“Competition is growing beyond the traditional model.”

An emerging competitor, Berachain, has successfully secured over billion in deposits, indicating that alternative blockchain solutions are quickly gaining traction. Moreover, the lack of enthusiasm from institutional investors is primarily underscored by negative flows in exchange-traded funds (ETFs) related to ETH, with withdrawals totaling 6 million over the past trading days.

As the situation evolves, traders are left pondering whether Ethereum can navigate these turbulent waters and reclaim its footing. The expectation is that visible improvements in Ethereum’s network, along with a reduction in supply and enhanced network usage, will pave the way for a brighter future. However, for Ether to once again soar, substantial and tangible advantages over its competitors will be crucial.

Key Insights on Ether (ETH) Price Movements

The recent fluctuations in Ether’s price and market performance indicate several factors that could impact both traders and investors in the cryptocurrency space.

- Price Decline and Market Sentiment:

- ETH price fell below ,600 on Feb. 24, prompting struggles for recovery.

- Over 8 million in leveraged long liquidations occurred in ETH futures within 15 days.

- This decline reflects a 10% underperformance compared to the altcoin market.

- Major Challenges Facing Ethereum:

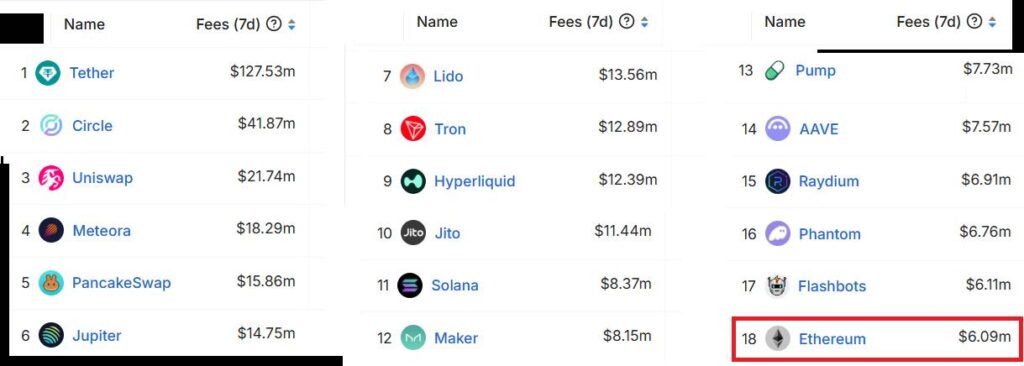

- The upcoming Pectra upgrade may not significantly improve transaction fees or usability.

- Concerns over lack of interoperability between different layer-2 solutions hinder market confidence.

- A perceived failure to deliver could negatively impact investor sentiment and trust.

- Increased Competition from Alternative Platforms:

- New competitors like Berachain are attracting significant investment, indicating a shift in market interest.

- Modules designed for DeFi, like Hyperliquid, are capturing open interest that traditionally belonged to Ethereum.

- Weak Institutional Demand:

- Negative ETF flows and net withdrawals indicate lack of interest from institutional investors.

- The potential future approval of Ethereum staking ETFs is uncertain, affecting long-term demand.

- Ethereum’s increasing supply at 0.7% annually, coupled with a declining burn-fee mechanism, risks pushing ETH prices down.

- Need for Sustainable Advantages:

- For ETH to rise above ,500, investors need clear advantages over competing platforms, beyond just being a first-mover.

- Future growth depends on Ethereum upgrades, increased usage, and enhancements in layer-2 interoperability.

This evolving scenario emphasizes the importance for traders and investors to stay informed about Ethereum’s developments and market dynamics, as they can directly affect investment strategies and financial outcomes.

Ethereum vs. Rising Competitors: A Market Analysis

Recently, Ethereum (ETH) has encountered significant hurdles, particularly evident with its price plummeting under the ,600 mark, prompting notable fear within the trading community. This trend is echoed across the broader altcoin market, which has shown a concerning 10% disparity in performance against ETH. Moreover, the influx of competitive alternatives, particularly the likes of Solana (SOL) and Berachain, has further complicated Ethereum’s recovery attempts.

Competitive Advantages and Disadvantages: One glaring disadvantage for Ethereum is its struggle to maintain investor interest amid rising alternatives that are promising more efficient transaction mechanisms and interoperability. Berachain, for instance, has amassed over billion in total value locked (TVL), signaling strong trust from developers and investors alike. This competitive edge feeds into the narrative that Ethereum is lagging behind. Analysts cite the upcoming Pectra upgrade as a potentially insufficient change, pointing out that mere improvements in transaction fees might not be enough to spark a meaningful recovery for the network that has long been seen as the leader in decentralized applications.

On the flip side, Ethereum’s stronghold as a pioneering platform in the blockchain realm provides it with a historical advantage. Its established network is backed by a robust community of developers and users, which serves as both an asset and a liability; while driven innovation keeps it relevant, the incremental changes may feel stale compared to the aggressive upgrades and developments characterized by its younger competitors.

Impact on Stakeholders: For institutional investors and traders, the current downturn in demand, illustrated by the recent negative trend in ETF flows, poses a significant challenge. The potential advent of a Solana spot ETF could siphon off interest from ETH investors, particularly among those looking for diverse investment vehicles. Moreover, the stalling recovery could deter new participants from entering, especially when other platforms offer higher yields on stablecoin deposits compared to ETH staking, which is currently under 2.5%. This dynamic creates a challenging environment for ETH holders who are hoping for a rebound.

Ultimately, the wave of innovation and strategic advantages showcased by emerging platforms may push Ethereum to reevaluate its offerings and highlight its unique strengths. As it stands, Ethereum has more pressing issues to address to ensure it doesn’t fall deeper into the shadows of its ambitious competitors—underscoring a critical juncture in its evolution as a prominent player in the crypto space.