In the ever-evolving world of cryptocurrency, Ether (ETH) has recently seen a notable decline, dropping below ,600 on February 24. Since then, the digital asset has struggled to mount a significant recovery, leading to increased speculation on what it will take for ETH to regain momentum. Over the past two weeks, this downward trend has resulted in a staggering 8 million wiped out in leveraged long liquidations, as reported by CoinGlass.

Throughout this challenging period, Ether’s performance has trailed the broader altcoin market by about 10%. This downturn comes on the heels of a memecoin frenzy that has catapulted Ethereum’s rival, Solana (SOL), into the spotlight, raising concerns about Ether’s competitive edge. Amid various factors affecting ETH’s price, analysts are pointing to four critical issues that must be addressed for Ether to reclaim its previous market strength.

“Fear remains the dominant sentiment, and for this to change, several pressing issues must be resolved.”

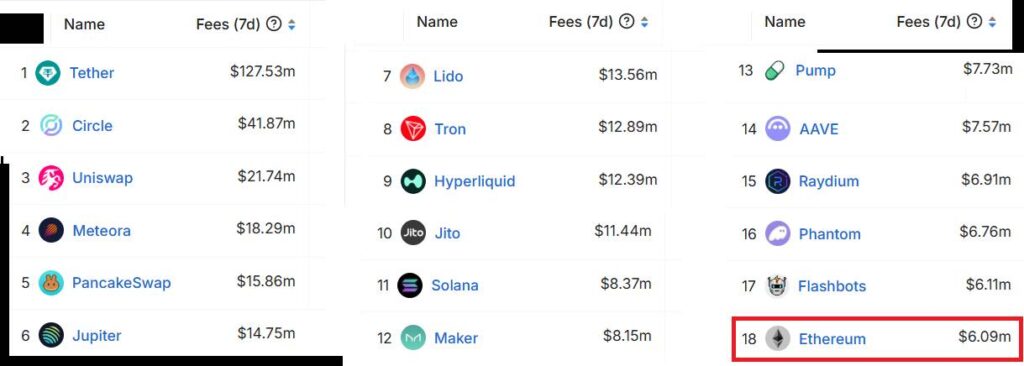

One cornerstone of this discussion is the anticipated Pectra upgrade on the Ethereum network. However, many believe that these changes may be insufficient to catalyze a meaningful turnaround. Issues such as rampant competition from emerging platforms, like Berachain and Hyperliquid, highlight the growing pressure on Ethereum to demonstrate its advantages. As these competitors attract significant investments and users, the pressure mounts for Ethereum to prove its value beyond its established name.

Compounding the challenges is the apparent lack of institutional interest in Ether, as evidenced by recent ETF flows showing significant withdrawals. The ongoing increases in ETH supply are troubling, leading to concerns about inflationary pressure on the asset. With stablecoin yields surpassing traditional returns on staking Ether, the dynamics in the crypto market are clearly shifting.

“For ETH’s price to regain bullish momentum, traders need reassurance that the Ethereum network offers practical and clear advantages.”

As the landscape becomes increasingly competitive, Ethereum’s focus on decentralization and incremental upgrades may not be enough. Traders are keenly observing on-chain activity and ongoing institutional demand, wondering if necessary shifts within the Ethereum ecosystem can revive interest and drive prices back towards the ,500 mark. The path forward appears riddled with complexity, marked by challenges that will require strategic solutions as the industry watches to see how Ethereum adapts and evolves.

Current Challenges Facing Ether (ETH)

The recent fluctuations in Ether’s price and the larger implications for the cryptocurrency market have significant consequences for traders and investors. Below are the key points regarding the current situation of Ether.

- Price Drop and Liquidations:

- Ether’s price fell below ,600 on February 24, triggering concerns among traders.

- Over 8 million in leveraged long liquidations occurred in ETH futures within 15 days.

- Underperformance Against Altcoins:

- ETH has underperformed the altcoin market by 10% during the observed period.

- Competitors like Solana have gained popularity and market share amidst Ethereum’s struggles.

- Upgrade Concerns:

- The upcoming Pectra upgrade may not significantly improve transaction fees or usability.

- Issues with interoperability across layer-2 solutions remain a hurdle for user accessibility.

- Institutional Demand Weakness:

- Negative ETF flow trends show a decrease in institutional interest, with 6 million in net withdrawals.

- Increasing Ether supply and declining staking rewards lead to inflationary concerns for ETH.

- Overall Market Sentiment:

- Fear and skepticism dominate the market, with traders looking for significant changes to restore confidence.

- Potential competition from planned Solana spot ETFs adds pressure to Ether’s market position.

These issues highlight the complexities faced by Ether and the Ethereum network, impacting investor sentiment and market dynamics. Understanding these factors can help readers navigate their investment strategies to mitigate risks and seize potential opportunities in the evolving cryptocurrency landscape.

Ethereum’s Price Struggles Amid Intensifying Competition

Ethereum (ETH) has faced a notable downturn recently, dropping beneath the ,600 mark and struggling to recover. This follows a significant trend where the altcoin market has outperformed ETH by around 10%. The latest price movement has raised eyebrows among traders, not only due to its volatility but also because of emerging competitors that are stealing the spotlight. Critically, there are three primary factors impacting Ethereum’s market position: its network upgrades, competition from other blockchains, and institutional demand.

Competitive Advantages: One of Ethereum’s sought-after features is its first-mover advantage in the decentralized finance (DeFi) ecosystem. The upcoming Pectra upgrade is expected to enhance user experience and potentially reduce transaction fees, which could attract more users back to the Ethereum network. Such updates aim to bolster the platform’s core functionality, which many hope will reignite trader confidence.

Moreover, Ethereum maintains a robust community and developer ecosystem, which are essential for ongoing innovation and sustainability in the face of competition.

Competitive Disadvantages: Despite these strengths, Ethereum has seen a worrying decline in on-chain activity and is struggling to attract institutional interest. Comparatively, newer competitors like Berachain and Hyperliquid have gained significant traction, capturing billions in total value locked and open interest, respectively. Investors are increasingly viewing these alternatives as compelling options, especially as they promise lower fees and greater interoperability than Ethereum currently provides.

Recent reports of empty blocks on the Ethereum testnet add to investor skepticism, raising questions about the network’s reliability and readiness for future scaling.

The turbulent market not only dampens Ethereum’s appeal but may also hinder wider adoption. As ETFs focused on Solana and other altcoins loom on the horizon, the competition intensifies, creating an environment where ETH’s traditional advantages might not suffice. In this context, traders seeking long-term investments or those heavily invested in Ethereum may find themselves at a crossroads. They need convincing evidence that Ethereum can outperform newer models that promise more aggressive upgrades and adjustments to meet current market demands.

As more market players eye alternatives, Ethereum’s path to recovery hinges on clear, demonstrable advantages that not only justify its initial lead but also resonate with both retail and institutional investors. If Ethereum fails to adapt quickly to these challenges, the potential for diminishing demand could stir trouble for its community and investors alike, making it essential for Ethereum to navigate these headwinds with strategic foresight.