The cryptocurrency landscape is undergoing dynamic changes, particularly regarding Ethereum’s standing among layer-1 blockchain networks. Recent insights from Alex Svanevik, CEO of the data analytics firm Nansen, reveal a noteworthy shift: Ethereum’s once-dominant position is being challenged, creating a competitive environment to determine the leading Web3 platform. During a recent panel at the LONGITUDE by Cointelegraph event, Svanevik noted, “If you’d asked me 3–4 years ago whether Ethereum would dominate crypto, I’d have said yes. But now, it’s clear that’s not what’s happening.”

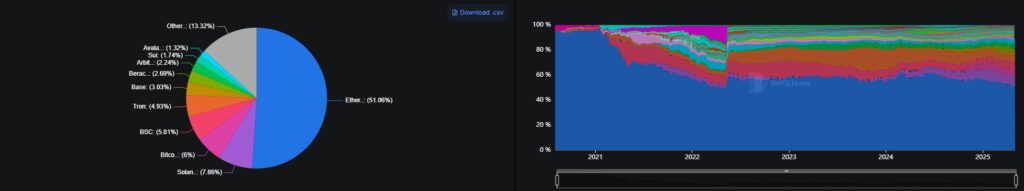

Currently, Ethereum remains the most widely used layer-1 network, boasting approximately $52 billion in total value locked (TVL), which accounts for around 51% of all cryptocurrencies on blockchain networks, according to data from DefiLlama. However, this dominance has significantly waned from its peak in 2021, when it commanded an impressive 96% of the total TVL.

“It’s an open race between multiple L1s for becoming the go-to platform for trading and broader blockchain use,” said Svanevik, highlighting that new challengers are rapidly emerging alongside established entities. He further emphasized the excitement in observing smaller blockchains grow at impressive rates, signaling a shift towards a more competitive era in the Web3 space.

One prominent contender in this race is Solana (SOL), recognized for its quicker transaction speeds and lower fees compared to Ethereum. Svanevik pointed out that Solana has recently surpassed Ethereum on several key on-chain metrics such as active addresses and transaction volume, although Ethereum still leads in terms of TVL and stablecoin issuance. “Solana’s growth is undeniable,” he remarked.

Nonetheless, the expansion isn’t just limited to established platforms like Solana. Several other smaller layer-1 networks are actively seeking to carve out their niche in this evolving market. Vardan Khachatryan, chief legal officer of the trading platform Fastex, commented on the often-volatile nature of growth in this sector, indicating that many chains gain popularity during specific market trends rather than through consistent, long-term adoption.

As the cryptocurrency world continues to evolve, the race to establish a leading Web3 platform promises to reshape how blockchain technologies and services are utilized in the future.

Ethereum’s Evolving Landscape in Web3

The rapidly changing dynamics of Ethereum’s dominance among L1 blockchain networks hold significant implications for the future of Web3 and cryptocurrency investors. Here are the key points to consider:

- Decline in Ethereum’s Dominance:

- Ethereum’s share of total value locked (TVL) has decreased from 96% in 2021 to 51% today.

- This decline indicates an open race for dominance among multiple L1 networks.

- Emerging Competitors:

- New L1s, particularly Solana, are gaining ground with advantages in transaction speed and lower fees.

- Solana has surpassed Ethereum in several on-chain metrics, pointing to its potential as a leading Web3 platform.

- Impact of Smaller Chains:

- Numerous smaller L1s are attempting to carve out market share, although not all are achieving sustainable growth.

- The success of these chains often relies on market hype rather than long-term adoption, as noted by industry experts.

- Implications for Investors:

- Investors need to monitor the evolving landscape of L1 networks to understand where potential growth may be.

- Staying updated with market trends can help investors make informed decisions about their cryptocurrency portfolios.

“It’s an exciting time as smaller chains grow rapidly, with the landscape presenting both opportunities and risks.” — Alex Svanevik

The Shifting Landscape of Layer-1 Blockchain Dominance

The landscape of layer-1 blockchain networks is undergoing a significant transformation, with Ethereum’s once-unassailable dominance waning in the face of burgeoning competitors. As noted by Alex Svanevik, CEO of Nansen, the crypto space is now witnessing an “open race” among various chains, a shift that presents both opportunities and challenges for different stakeholders in the ecosystem.

Competitive Advantages of Emerging Chains

Among these challengers, Solana has emerged as a noteworthy contender, boasting faster transaction speeds and lower fees that appeal to a growing user base. Svanevik’s comments underscore Solana’s potential to take the lead in Web3 as it recently surpassed Ethereum on several key metrics, such as active addresses and transaction volume. This rapid growth suggests that Solana and similar chains may attract developers and projects looking for cost-effective alternatives to Ethereum’s network.

Smaller emerging L1s are also trying to carve out their niches. While their traction may currently hinge on temporary trends, such as the hype of new coins and airdrops, they represent a diversifying blockchain ecosystem that could spark innovation and unique solutions tailored to specific market needs.

Disadvantages and Market Risks

However, the decline in Ethereum’s dominance raises questions about the sustainability of this shift. Smaller chains often lack the robust security features and established user bases that larger networks like Ethereum enjoy. Furthermore, the volatility associated with this dynamic market can deter potential investors and developers wary of fluctuating user interest. Vardan Khachatryan points out that many chains thrive only during market booms, potentially leading to instability when trends shift.

Who Stands to Gain or Lose?

This competitive environment could benefit crypto enthusiasts and developers searching for lower barriers to entry in blockchain technology. It may foster greater innovation and variety in applications available across different platforms. Conversely, Ethereum could face growing challenges in maintaining its loyal developer and user community if competing platforms continue to deliver more attractive propositions. Institutions and seasoned investors may need to reassess their strategies; while the lure of emerging chains is enticing, the long-term viability of these platforms is still under scrutiny.

In a world where crypto evolves rapidly, monitoring the trends and the various players in the arena will be essential for anyone involved in blockchain technology.