In a challenging start to March, the price of Ether (ETH) slipped below ,200, marking a significant 14% decline throughout the month, a stark contrast to the overall cryptocurrency market, which only fell by 4% during the same timeframe. Investor sentiment has turned cautious, exacerbated by a sharp 34% drop in decentralized exchange (DEX) activity on the Ethereum network over the past week. This downturn not only spells trouble for ETH but has also resulted in diminished trading volumes across various Ethereum layer-2 solutions, including popular platforms like Base, Arbitrum, and Polygon.

“The weakening performance of DEX volumes on Ethereum and other blockchain competitors highlights a broader trend in the decentralized finance (DeFi) space.”

During this market slump, Ethereum’s rival networks have seen mixed results. While Solana and SUI recorded declines of 29% and 17% in DEX activity respectively, BNB Chain experienced a substantial increase of 27%, and the Canto network saw an astonishing 445% surge. Meanwhile, some notable Ethereum protocols faced severe drops in fees, with the Maverick Protocol and DODO reporting declines of 85% and 46% respectively, showcasing the overall weakness in the Ethereum ecosystem.

Despite remaining the leader in total value locked (TVL) with approximately .2 billion, Ethereum saw a 9% weekly decline, narrowing its edge over competitors. As concerns grow, there is a visible shift in the landscape, with protocols like PancakeSwap surpassing Uniswap in fees—a significant milestone for BNB Chain’s DEX market.

“Ethereum’s leading position in total value locked is being threatened as the competition ramps up.”

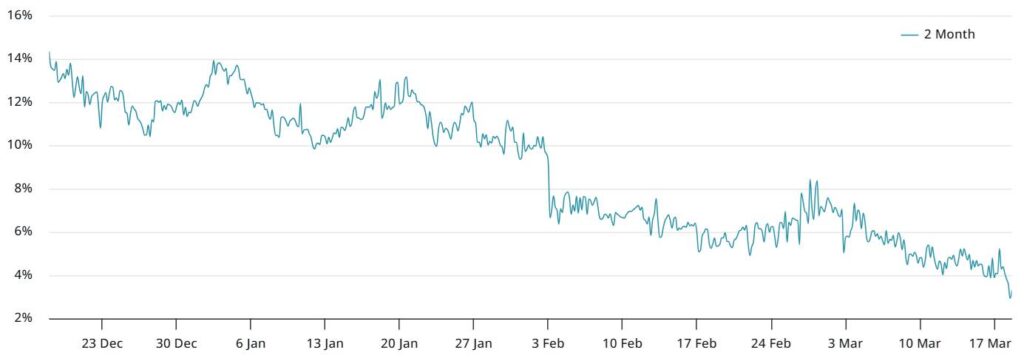

Adding fuel to the fire, recent data indicates that the demand for leveraged long positions in ETH futures has softened, pushing the annualized futures premium below 5%—the lowest level witnessed in over a year. This decline in demand is echoed by the 3 million net outflow in Ethereum exchange-traded funds (ETFs) since early March, underscoring a waning interest from institutional investors.

The pressure on Ether is compounded by fierce competition from platforms such as Solana, particularly in the burgeoning memecoin sector. As Ethereum strives to maintain its dominance, upcoming initiatives, including the crucial ‘Pectra’ upgrade, will need to demonstrate tangible advantages for user adoption to regain lost momentum in a swiftly evolving cryptocurrency landscape.

Ethereum’s Current Challenges and Market Dynamics

The recent decline in Ethereum’s (ETH) price and trading activity has significant implications for investors and the broader crypto market. Here are the key points to consider:

- ETH Price Decline:

- ETH price fell below ,200 on March 9 and has decreased by 14% in March.

- This decline contrasts sharply with a broader market drop of only 4% during the same period.

- DEX Activity Decline:

- Decentralized exchange (DEX) activity on Ethereum has dropped by 34% weekly.

- Other blockchains, including competitors like Solana, also experienced significant DEX activity reductions (Solana’s down 29%).

- Fee Volume Competition:

- PancakeSwap on BNB Chain surpassed Uniswap in fees generated, raising questions about Ethereum’s fee competitiveness.

- Falling fees may reduce ETH demand, impacting investor sentiment.

- Total Value Locked (TVL) Decline:

- Ethereum leads in TVL at .2 billion but experienced a 9% weekly decline, narrowing the gap with competitors like BNB Chain.

- Decreased TVL combined with weak on-chain metrics points to declining user interest in Ethereum.

- Weak Futures Market Demand:

- ETH futures premium has dropped below the neutral threshold, indicating decreased bullish sentiment among traders.

- Institutional outflows from spot Ethereum ETFs reached 3 million since early March.

- Increasing Competition:

- Ethereum faces rising competition from Solana, especially in sectors like memecoins and DEX activity.

- Lower transaction fees on competing platforms are attracting significant stablecoin deposits.

- Future Upgrades:

- The upcoming “Pectra” upgrade is critical for Ethereum to regain user interest and market edge.

- Failure to demonstrate a competitive advantage may hinder Ethereum’s future performance against rivals.

The current market dynamics indicate that investors must stay informed and vigilant given Ethereum’s challenges and emerging competitors.

Ethereum’s Decline: How It Compares and Who It Affects

The recent drop in Ethereum’s price, falling below the ,200 mark and losing 14% in March alone, underscores a critical moment for this leading cryptocurrency. Unlike the slight 4% decline seen across the broader crypto market, Ethereum’s struggles highlight unique vulnerabilities that could shift investor allegiances. The combination of waning DEX volume—down 34% in just a week—paired with an alarming dip in associated layer-2 solutions like Arbitrum and Polygon, indicates a significant erosion of investor sentiment.

Competitive Advantages: Despite the downturn, Ethereum maintains dominance in total value locked (TVL) at .2 billion. This status makes it a primary platform for decentralized finance (DeFi) applications, with its strong developer community continuing to innovate, particularly with the anticipated Pectra upgrade. If successful, this could reaffirm Ethereum’s position and serve to attract new users and investors, mitigating some of the current bearish sentiment.

Competitive Disadvantages: However, as rivals such as BNB Chain grow by 27% in DEX volumes while relatively newer players like Canto surge an astounding 445%, Ethereum faces significant challenges. Its DEX activities and fees are lagging, with PancakeSwap outpacing Uniswap—a stark indication that traders are exploring more lucrative options elsewhere. Such developments could lead to decreased trading volume and less liquidity in the Ethereum network.

Who Benefits and Who Suffers: Investors looking for lower transaction fees and faster processing times may consider shifting their assets to competitors like Solana or BNB Chain, particularly as they leverage Ethereum’s current weaknesses. Additionally, institutions may be tempted to explore these alternatives as Ethereum’s staking yields have not kept pace with inflation. On the other hand, Ethereum loyalists and developers may find the ongoing debates around the effectiveness of layer-2 solutions the impetus needed to innovate and restore confidence. If Ethereum can leverage its existing technological framework to enhance user experience and DEX activity, it might recapture market interest and prevent further setbacks.