The cryptocurrency market is keeping a keen eye on Ethereum (ETH) as traders exhibit a mix of caution and nascent optimism about the leading altcoin’s future. Currently, ETH has been hovering below the $1,900 mark since March, raising questions about whether a previous peak of $4,000 back in December 2024 marked the end of an era for the digital asset. The upcoming Ethereum ‘Pectra’ upgrade on May 7 is seen as a pivotal moment that could rekindle interest among investors, even as recent trading data reflects hesitance in the market.

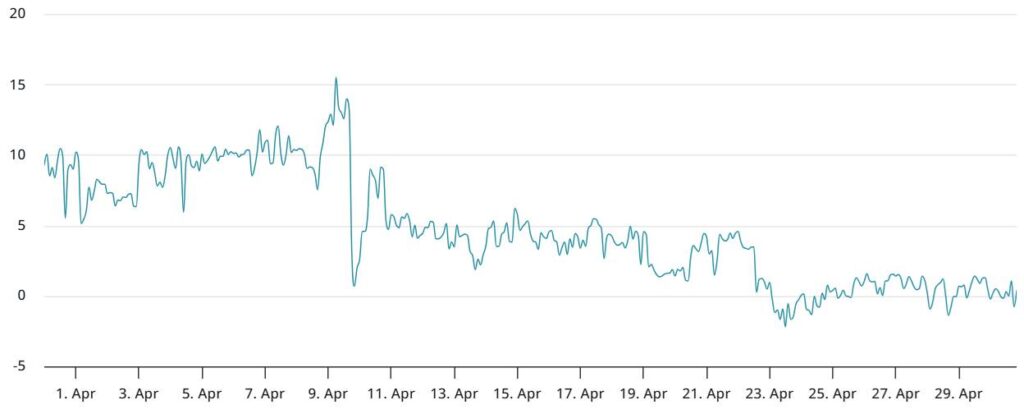

Recent reports indicate that professional traders remain cautious, particularly in the derivatives market. They note that Ethereum’s monthly futures should typically show a premium of around 5% over spot markets, yet current indicators suggest a lackluster performance below this threshold. This hesitance is further compounded by disappointment in regulatory actions, particularly following the U.S. government’s classification of Ether alongside other altcoins in its “Digital Asset Stockpile” Executive Order, which detracted from Ether’s stature compared to Bitcoin (BTC).

“Trading activity for Ethereum has fluctuated significantly, with its market capitalization recently dropping below that of its four closest rivals—Solana (SOL), Binance Coin (BNB), Cardano (ADA), and Tron (TRX).”

Despite a rebound from lows near $1,400, Ether’s market cap now stands at $217 billion. While this figure momentarily overshadows its rivals, continued underperformance could challenge Ether’s market position moving forward. On the institutional front, demand for Ethereum’s exchange-traded funds (ETFs) remains weak compared to Bitcoin’s, where assets have dramatically surged, doubling from $50 billion to $110 billion. This disparity showcases a broader trend of faltering institutional interest in Ethereum despite favorable short-term price movements.

Interestingly, although Ethereum ranks first in total value locked (TVL) within the decentralized finance (DeFi) sphere, it struggles to compete with rivals like Solana in user experience and with Tron in stablecoin adoption. Furthermore, the lack of robust demand for bullish leveraged positions in ETH could indicate underlying reserve concerns among market participants. The current options market data shows an unusual parity between put and call options, suggesting that professional traders are becoming more comfortable with current price levels, despite lackluster sentiment among average traders.

“The upcoming ‘Pectra’ upgrade is seen as a potential watershed moment for Ether, with hopes that it might attract renewed interest and lead to a positive shift in price sentiment.”

With the May 7 upgrade looming, stakeholders are eager to see if it will catalyze an uptick in investor enthusiasm and possibly lead to a reduction in circulating supply through enhanced staking options for institutional players. Historically, such upgrades have previously sparked price spikes for Ethereum, leaving many in the community wondering if history will repeat itself.

Key Takeaways on Ethereum’s Current Market Situation

Investors and traders are closely monitoring Ethereum’s performance and underlying market dynamics. Here are the significant points that could impact both investment strategies and market sentiment:

- Cautious Sentiment Among Traders:

- Traders remain wary of ETH’s price movements, indicating a need for cautious strategies before making investments.

- Optimism is slowly returning, but hesitance persists due to recent price trends.

- Impact of the Upcoming Ethereum Pectra Upgrade:

- Scheduled for May 7, this upgrade has the potential to renew investor interest in Ethereum.

- Historically, upgrades have led to short-term price spikes, which could present buying opportunities.

- Price Concerns:

- ETH has struggled to surpass the $1,900 mark since March 2025, leading to speculation about its long-term viability.

- This price stagnation has raised questions about the previous highs near $4,000 and whether those levels can be reclaimed.

- Market Capitalization Dynamics:

- For the first time, ETH’s market cap has fallen below that of its top four competitors: Solana, BNB, Cardano, and Tron.

- ETH needs to consistently outperform these rivals to improve market sentiment and regain trader confidence.

- Institutional Interest and ETF Performance:

- Weak interest in Ethereum ETFs has been noted, contrasting with Bitcoin ETFs, which have seen significant asset growth.

- The lack of institutional buying in ETH could suggest limited future price support without renewed interest.

- Overall Market Sentiment:

- While the derivatives market does not reflect a strong bullish sentiment, it also does not indicate expectations for further declines.

- Put and call options are trading at similar levels, showcasing a balance in market perceptions of risk.

- Ethereum’s Decentralization vs. Competitors:

- Despite Ethereum’s leadership in total value locked (TVL), it faces challenges in providing a superior user experience compared to rivals.

- Traders are more attracted to faster, efficient platforms for activities involving frequent transactions.

Investors should closely observe upcoming events like the Pectra upgrade, as well as the competitive landscape within the altcoin sector, to inform their trading strategies.

Ethereum’s Current Landscape: Opportunities and Challenges Ahead

The state of Ethereum (ETH) remains a focal point for traders and investors alike, particularly with the impending Pectra network upgrade on May 7. While there’s some optimism about this upgrade potentially turning the tide for investor sentiment, the current trading environment suggests a cautious approach, as ETH continues to linger below the $1,900 mark. This hesitation highlights a stark contrast to the rising fortunes of competitors such as Solana (SOL) and Binance Coin (BNB), which have captivated market attention and strengthened their positions.

One of the significant competitive advantages for Ethereum lies in its robust total value locked (TVL), indicating strong foundational use and investment in decentralized applications. However, this advantage appears to be overshadowed as other platforms, particularly Solana, deliver a more appealing user experience, thereby attracting a different segment of investors. Moreover, while Ethereum may boast decentralization and enhanced security, the market’s current focus appears to be more on user-friendliness and efficiency, areas where Ethereum seems to lag behind.

Furthermore, concerns stemming from the government’s treatment of altcoins do not help ETH’s cause; the classification under the “Digital Asset Stockpile” has left investors feeling disillusioned. Unlike Bitcoin, which continues to enjoy its position as a strategic reserve asset, ETH’s reduced standing could deter institutional investors, especially as evidenced by the lukewarm demand for Ethereum-based exchange-traded funds (ETFs). In stark contrast, Bitcoin ETFs have seen an explosion in investment, rising from $50 billion to $110 billion, making ETH’s relative stagnation even more notable.

For traders and investors, the upcoming upgrade presents both opportunities and potential pitfalls. If successful, the Pectra upgrade could catalyze renewed interest, potentially leading to a decrease in circulating supply through increased staking. Yet, should the market’s ongoing lack of trading enthusiasm persist, Ethereum may find itself unable to reclaim its former glory, particularly as its market capitalization recently fell below that of its four main rivals for the first time. This shift sends a clear message: Ethereum must exceed expectations to regain its competitive edge.

While professional traders maintain a relatively even view on risk, the lack of bullish sentiment in derivatives suggests that many are adopting a wait-and-see approach. The current dynamics do not necessarily foretell further declines, yet they underline an ongoing competition among altcoins that Ethereum must navigate carefully. As the market eagerly anticipates the outcomes of the May upgrade, the shifting landscape may create significant challenges for ETH, while simultaneously offering opportunities for its competitors, particularly those who can pivot effectively to capture the hesitating investor’s focus.