In a rather tumultuous turn of events, Ether (ETH) has recently seen its price tumble below the vital $1,500 support level. This decline has raised eyebrows within the cryptocurrency community, as various technical indicators hint at the potential for a deeper correction before we might witness any signs of recovery. Notably, data reveals that Ether’s current price has dipped below its “realized price,” a significant onchain metric that assesses the market value of a cryptocurrency based on the last price at which each coin changed hands on the blockchain. According to analyst theKriptolik from CryptoQuant, such a situation is often seen as a bearish signal, indicating waning confidence among holders and leading to increased sell-offs.

“Drops below the realized price often mark the capitulation phase, where investors lose confidence and begin selling en masse,” said theKriptolik.

This isn’t the first time Ether has faced such challenges. A similar situation occurred in June 2022 when Ether’s realized price fell beneath the spot price, paving the way for a staggering 51% drop following the catastrophic Terra Luna crash. Another significant decline of 35% was seen in November 2022 after the FTX collapse, highlighting the historical relevance of these market dynamics.

Adding further layers to the narrative, Ether’s spot ETF flows appear weak, with over $3.3 million in net outflows reported on April 8, contributing to a worrying total of $94.1 million in outflows over the past two weeks. This trend raises concerns about the lack of investor interest at a time when institutional demand for Ether was previously seen as a major driver of its value, especially in light of hopes for ETF approval by the U.S. Securities and Exchange Commission.

The derivatives market is also reflecting a lack of enthusiasm, as evidenced by low open interest and negative funding rates in Ether’s perpetual futures markets. Current open interest stands at $16.7 billion, which is nearly 50% below its peak seen earlier in January, indicating reduced speculative activity and investor confidence.

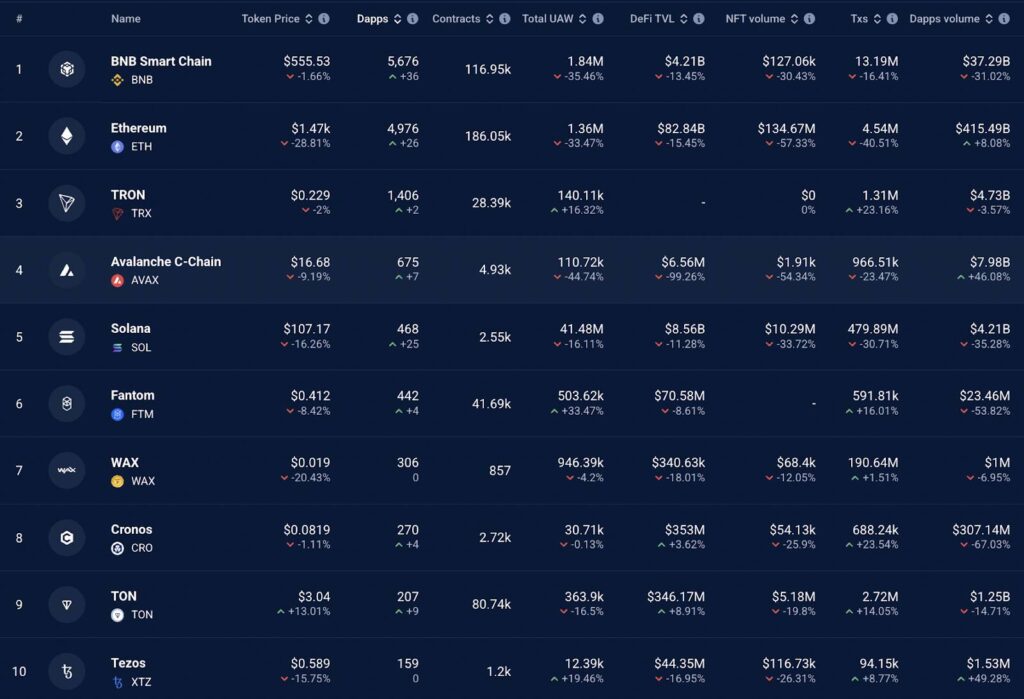

On another front, Ether’s once-dominant market presence is facing stiff competition from other layer-1 blockchains. High gas fees on the Ethereum network have prompted some users and developers to explore alternatives such as BNB Chain, Solana, Avalanche, and Tron. In fact, Ethereum’s unique active wallet addresses engaging with decentralized applications (DApps) have witnessed a striking decline of over 33% within the past month.

“There’s no indication that the factors weighing on Ether’s price will reverse anytime soon,” analysts suggest.

As the narrative unfolds, many are closely monitoring the impacts of declining network activity and dwindling demand for Ether’s spot ETF products. While it remains to be seen whether Ether can rebound from this challenging phase, the current technical setup suggests that a bottom price point near $1,000 may be plausible in the coming weeks.

Key Insights on Ether’s Recent Market Performance

The recent decline in Ether’s market value highlights several critical metrics and trends that may impact investors and market participants. Here are the essential points:

- Loss of $1,500 Support Level:

Ether’s recent sell-off saw it drop below the crucial $1,500 support level, indicating potential further downturns.

- Realized Price Indicator:

Data indicates that ETH is trading below its realized price, a historical bearish sign that suggests a loss of investor confidence.

- Capitulation Phase Warning:

According to analysts, when Ether’s price falls below the realized price, it often marks a capitulation phase where holders sell off in mass.

- Comparison with Past Events:

Past occurrences of ETH trading below its realized price have preceded significant losses—such as a 51% drop following the Terra Luna crash and a 35% drop after the FTX collapse.

- Diminished Spot Ethereum ETF Flows:

Weak demand for spot Ethereum ETFs is evidenced by recent outflows totaling $94.1 million, reflecting a growing investor hesitation.

- Low Open Interest in Derivatives Market:

Current low open interest in Ether futures indicates reduced trader activity, which can further suppress demand and price levels.

- Negative Funding Rates:

Negative funding rates across Ether’s perpetual futures markets indicate prevailing bearish sentiment, as those betting against ETH are compensated.

- Competition from Other Blockchain Networks:

Ethereum faces increasing competition from layer-1 blockchains like BNB Chain, Solana, and Tron, which may attract users due to lower fees and better scalability.

- Decline in Network Activity:

Unique active wallets on Ethereum have dropped by over 33% in a month, coupled with a 40.5% decrease in transactions, intensifying concerns over its market position.

These indicators suggest that Ethereum’s market could see continued pressures, with potential temporary bottoming around $1,000.

Ethereum Faces Challenging Times Amid Market Turbulence

Ethereum (ETH) is currently experiencing significant challenges, highlighted by its recent decline below the critical $1,500 support level. This situation mirrors earlier bearish trends in the market, reminiscent of the dramatic falls following notable crypto crashes, such as the Terra Luna debacle and the FTX scandal. The current bearish sentiment surrounding ETH presents both competitive advantages and disadvantages for various stakeholders in the crypto ecosystem.

Competitive Advantages: For alternative layer-1 blockchains, Ethereum’s struggles provide an opportunity to capitalize on its retreat. Competing platforms like Solana and BNB Chain have seen increased activity while Ethereum’s user engagement declines, with Ethereum’s unique active wallets dropping significantly. This shift could lure developers and decentralized application (DApp) creators toward more efficient ecosystems, potentially bolstering their market positions as users seek lower transaction costs and faster processing times.

Competitive Disadvantages: On the flip side, Ethereum remains a cornerstone of the crypto world, and many investors still hold onto their positions, especially those who previously profited from its substantial gains. The ongoing declines in spot ETF inflows, which have reached notable outflows recently, suggest waning institutional interest—a blow to ETH’s investment attractiveness. Furthermore, the low open interest in ETH derivatives indicates a lack of speculative participation, potentially exacerbating price corrections as traders withdraw from the market. This creates a paradox for traders, where a lack of bullish sentiment could further entice hesitant investors to sell, amplifying downward pressure.

For Who This Benefits or Causes Issues: Investors looking for entry points into the Ethereum ecosystem might find this a buying opportunity, especially if they believe in long-term recovery. However, the current conditions could pose problems for those heavily invested in Ether who are now facing unrealized losses. As negative funding rates dominate the perpetual futures market, short sellers gain ground while long holders could be forced to capitulate, triggering more selling pressure. Additionally, traditional investors attracted to blue-chip assets might hesitate, fearing prolonged bearish trends could destabilize Ethereum’s image as a reliable investment.

This turbulent scenario paints a complex picture for Ethereum’s future in a rapidly evolving market landscape. While its foundational technology and broad user base provide resilience, external competition and internal market dynamics may shape its trajectory in the coming months.