Ethereum, the pioneering platform behind one of the most recognized digital currencies, ether (ETH), is currently navigating a turbulent phase reminiscent of an evolving identity crisis. With the native token’s performance faltering against some fierce competitors, debates are raging among long-time developers about the adequacy of the chain’s technology and the direction of its community focus. The Ethereum Foundation, which manages the network’s ongoing development, has faced scrutiny for its handling of these challenges, leading to significant changes within the organization led by co-founder Vitalik Buterin. However, Buterin’s prominent role in these restructuring efforts is not without its own controversies.

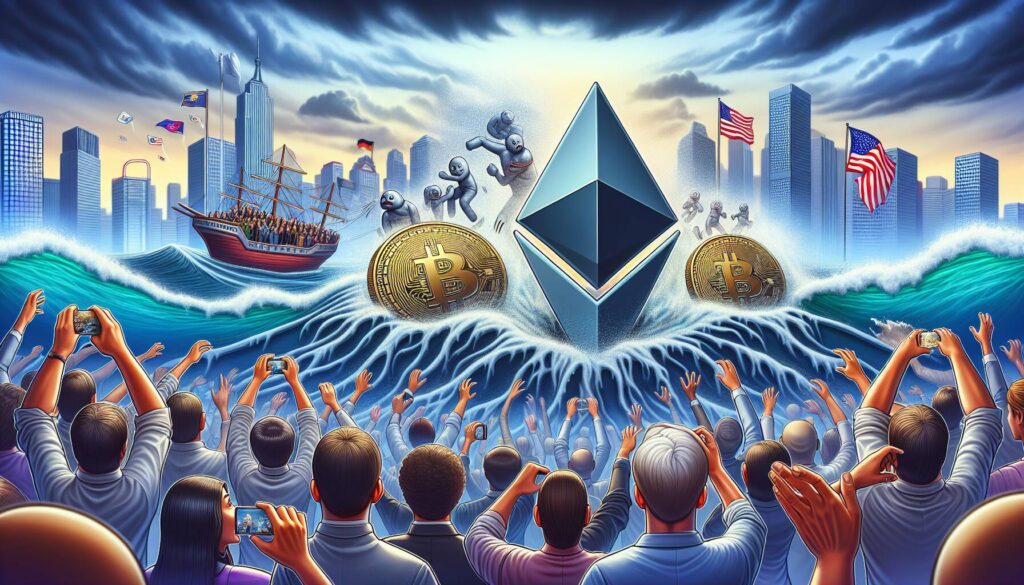

In the midst of this unrest, a new startup called Etherealize is attempting to reposition ETH on Wall Street. Founded by Vivek Raman, who transitioned from a decade in traditional banking to the blockchain realm, Etherealize aims to merge established financial systems with Ethereum’s capabilities. Raman’s journey into the world of crypto began when he encountered Ethereum’s core developers shortly after leaving Wall Street, where he observed the inefficiencies of traditional financial products for ten years. Inspired by the potential of Ethereum, he set out to create a bridge between traditional finance and the innovative opportunities presented by blockchain technology.

In a recent discussion, Raman shared insights about his vision for not just Ethereum but for the entire crypto landscape. He emphasized that while Ethereum is the most widely used platform for creating smart contracts, it has not adequately marketed ether as an essential asset in the larger ecosystem. Many experts believe that Ethereum’s utility is underappreciated since there seems to be more focus on its technological advancements. In contrast, rival platforms such as Solana have gained significant attention, partly through effective marketing of their tokens.

Raman believes that Etherealize plays a crucial role in promoting ETH as an asset worthy of consideration for institutional investors. By delivering educational content and facilitating relationships with key players on Wall Street, he hopes to position Ethereum not only as a leader in the blockchain space but also as a viable option for institutional portfolios. He noted that the current environment presents an opportunity for wall street to engage with Ethereum in unprecedented ways, especially with advancements in layer-2 technologies that promise greater efficiency and customization potential.

The landscape for Ethereum is shifting, with heightened market optimism due to new regulatory changes and the ongoing stewardship from the Ethereum Foundation. However, as Raman puts it, this change won’t necessarily solve everything for Ethereum; rather, it is imperative for different organizations, including Etherealize, to step up and promote this innovative platform and its capabilities to a wider audience. In this dynamic and uncertain climate, the interplay between Ethereum’s future and Wall Street’s interest could potentially reshape the narrative surrounding one of the most influential cryptocurrencies in the market today.

Ethereum’s Identity Crisis and Its Impact on the Market

The current state of Ethereum presents a mix of challenges and opportunities. Here are the key points to consider:

- Ethereum Underperformance:

- Ether (ETH) is struggling against competitors like Solana.

- Longtime builders question the chain’s technology and community focus.

- Leadership Challenges:

- The Ethereum Foundation faces criticism for the network’s struggles.

- Co-founder Vitalik Buterin is spearheading a leadership shake-up, drawing controversy.

- Emergence of Etherealize:

- New project aims to bridge Ethereum with traditional finance.

- Founded by Vivek Raman, who brings a decade of banking experience.

- Etherealize plans to market ETH as a serious asset class.

- Marketing ETH to Wall Street:

- Positioning ETH as a portfolio diversifier alongside Bitcoin.

- Emphasizing Ethereum’s utility as an ‘operating system’ for the financial economy.

- Facilitating Wall Street trading on the Ethereum blockchain.

- Layer-2 Networks Gains Recognition:

- Wall Street sees layer-2 solutions as opportunities rather than threats.

- Companies aim to deploy customized applications and assets using layer-2 technologies.

- Role of Regulation:

- Shifts in regulatory stance provide clarity and allow for greater blockchain adoption.

- Wall Street now recognizes the financial benefits of using Ethereum’s blockchain.

“The best of the best is Vitalik — the best of the best is the EF researchers.” – Vivek Raman

The turbulence surrounding Ethereum could present both risks and opportunities for investors and participants in the crypto market. Understanding these dynamics might influence decisions regarding investments in ETH or related technologies.

Ethereum’s Identity Crisis: A Competitive Landscape Analysis

Ethereum finds itself at a pivotal crossroads, grappling with an identity crisis as its native token, ether (ETH), struggles against robust competitors like Solana. This scenario creates both challenges and opportunities within the crypto ecosystem, particularly as recent developments within the Ethereum Foundation and the emergence of initiatives like Etherealize come into play. While the foundation has faced scrutiny for its management of Ethereum’s evolving technology and community focus, Etherealize is stepping up with fresh prospects aimed at reinvigorating ETH’s appeal within traditional finance.

Competitive Advantages: Etherealize arrives on the scene with the unique advantage of its founder, Vivek Raman, who brings a wealth of experience from the traditional banking sector. His deep understanding of financial systems and the inefficiencies they harbor allows Etherealize to market ETH as a viable asset class to Wall Street, potentially positioning it alongside more established assets such as Bitcoin. With Ethereum’s unmatched adoption as a smart contract platform, Etherealize seeks to leverage this superiority, enhancing the perception of ETH’s utility and value. Moreover, by focusing on education and driving institutional interest, Etherealize can help restore some of Ethereum’s lost confidence during a period of stagnation.

Competitive Disadvantages: However, the tumult within the Ethereum Foundation—which is navigating leadership changes and internal dissent—could undermine Etherealize’s efforts. If the foundational body continues to struggle with its direction, the perception of Ethereum as an innovative leader may falter, allowing rivals like Solana to gain market traction. Furthermore, while Etherealize aims to advocate for ETH, it faces the uphill battle of changing the narrative around Ethereum’s stagnancy and portraying ether as a critical component of the evolving financial landscape.

Implications for Stakeholders: The potential success of Etherealize could significantly benefit traditional finance institutions looking to diversify their portfolios with crypto assets. By bridging the gap between crypto and traditional finance, Etherealize may encourage greater acceptance of Ethereum among institutional investors who have previously shied away due to regulatory uncertainties and market volatility. However, should Etherealize fail to generate the anticipated interest or align with market expectations, it could compound Ethereum’s existing challenges, further distancing it from mainstream financial recognition. This dynamic also poses risks for long-term Ethereum builders and developers whose efforts may become overshadowed by the ongoing controversies surrounding the foundation and its direction.