In a notable shift for the cryptocurrency market, Ether’s supply on exchanges has plummeted to its lowest level since November 2015, according to insights from the crypto analytics platform Santiment. Currently, only 8.97 million ETH remains available on these platforms, marking a significant 16.4% decrease since January. This trend indicates that many Ethereum holders are transferring their assets into cold storage wallets, likely driven by a growing confidence in Ether’s future price potential.

The significant reduction in supply has led analysts to speculate about a potential price rally for Ether. Historically, a shrinking supply often sets the stage for what’s termed a “supply shock,” which can catalyze upward price movements—assuming demand either remains steady or increases. Interestingly, a similar phenomenon was observed with Bitcoin earlier this year when its exchange reserves fell to a seven-year low, coinciding with a sharp price surge shortly thereafter.

“Just a question of time before the big supply shock,” remarked crypto trader Crypto General, hinting at the burgeoning optimism surrounding Ether’s future.

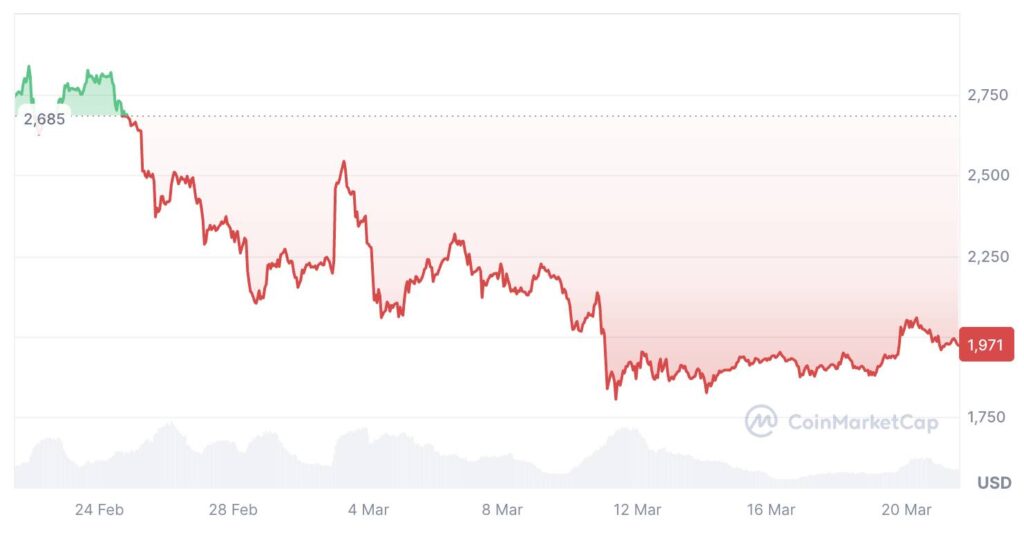

Other traders also echo this sentiment, suggesting that as the supply diminishes, increased competition among buyers might lead to bidding wars, pushing prices even higher. Yet, despite this hopeful outlook, Ether’s performance has faced challenges. It has dipped 26% over the past month, currently trading around ,971, and has seen its weakest performance against Bitcoin in five years. Additionally, spot Ether ETFs have experienced significant outflows, with a total of 0.6 million exiting over a period of 12 days.

“This has been one brutal downtrend,” noted analyst Daan Crypto Trades, providing insight into the current challenges facing Ethereum.

As the narrative around Ether continues to evolve, traders remain divided—some are buoyed by the declining supply, while others caution against the backdrop of recent price declines and bearish sentiment. The coming weeks could prove pivotal for Ethereum as market dynamics shift rapidly, keeping both investors and analysts on their toes.

Ethereum’s Supply Dynamics and Potential Market Impact

Recent developments regarding Ethereum’s supply on crypto exchanges present noteworthy insights into potential market behavior. Here are the key points to consider:

- Lowest Supply Since 2015: Ether’s supply on exchanges has decreased to 8.97 million, the lowest level since November 2015.

- Investor Behavior: A 16.4% reduction in ETH available on exchanges suggests that investors are transitioning their holdings to cold storage, indicating long-term confidence in price increases.

- Supply Shock Potential: The significant decline in ETH on exchanges may lead to a supply shock, which could result in a price surge if demand remains strong or increases.

- Historical Precedent: Similar circumstances were observed with Bitcoin, which experienced a substantial price increase after a significant drop in its exchange supply.

- Market Outlook: Some analysts, including crypto trader Crypto General, suggest that a competition among buyers may escalate, leading to potential bidding wars as supply dwindles.

- Price Predictions: Analyst predictions indicate the possibility of Ether prices reaching between ,000 to ,000, significantly higher than its recent price point of ,971.

- Bearish Signals: Despite the optimistic outlook for a supply shock, Ether is currently facing bearish trends, including a 26% drop in the last month and a poor performance relative to Bitcoin.

- ETF Outflows: Recently, Ethereum spot ETFs have experienced outflows totaling 0.6 million, further complicating the price landscape.

“Either Ethereum bounces here and this is a generational bottom, or it’s over.” – Scott Melker, The Wolf of All Streets

The fluctuations in Ethereum’s supply and overall market sentiment can significantly impact investors’ strategies and decision-making processes. Understanding these dynamics is crucial for anyone engaged in the cryptocurrency market.

Ethereum’s Supply Shock: A Shifting Tide in the Crypto Market

Recent analytics have unveiled a noteworthy trend in the world of cryptocurrency: Ether (ETH) has reached its lowest supply on exchanges since November 2015, heralding speculation of an impending price rally. This sharp decrease, as highlighted by Santiment, indicates that investors are opting to shift their Ether into cold storage wallets, demonstrating increased confidence in the cryptocurrency’s long-term prospects. With available supply falling to 8.97 million ETH, the stage seems set for a “supply shock” — a phenomenon that could lead to heightened demand outpacing the dwindling supply.

In a comparative analysis, this situation is akin to Bitcoin’s (BTC) circumstances, which experienced a similar supply dearth earlier this year. January saw Bitcoin reserves plummet to a nearly seven-year low before a remarkable price surge took place. Such moments have historically been pivotal for price movements, emphasizing the correlation between supply drops and potential market rallies. Yet, Ethereum’s current challenges cannot be overlooked; despite the low supply, ETH is grappling with a bearish sentiment, down 26% over the past month and facing substantial outflows from spot ETFs.

Competitive Advantages: The decreasing ETH supply may serve as a competitive advantage for Ethereum by potentiating a buying frenzy among eager investors, as echoed by various traders predicting bidding wars in the near future. The community’s growing belief in the asset’s future price surge might encourage a stronger long-term holding mentality among existing holders. This could particularly benefit institutional investors looking to secure lower prices before a likely breakout.

Disadvantages: Despite its bullish narrative, Ethereum currently faces significant headwinds that may create friction in its expected ascension. Its performance relative to Bitcoin is at a five-year low, which could deter new investors wary of backing an underperforming asset. Moreover, continuous ETF outflows raise concerns about waning institutional interest, possibly signalling a lapse in market confidence that could hinder recovery efforts.

For seasoned investors strategizing around the forthcoming price movement, staying informed about both supply metrics and broader market conditions will be crucial. New entrants might find themselves at a disadvantage, lacking the historical context and understanding of crypto’s cyclical nature. In particular, those seeking a quick return may need to exercise caution, as the market remains volatile and full of uncertainties.

As Ethereum navigates this precarious balance, stakeholders must remain vigilant; while the potential for a big rally looms, so too do the threats of continued downtrends driven by external market pressures. The evolving narrative around Ether represents both an opportunity and a challenge, ensuring that all eyes remain fixed on this critical cryptocurrency.