In the ever-evolving landscape of cryptocurrency, Ether (ETH) finds itself at a pivotal moment according to a recent report from investment bank Standard Chartered. The bank has considerably lowered its price target for Ether, anticipating it will close 2025 at just ,000, a sharp decrease from its previous estimate of ,000. As of now, Ether is trading around ,903, showcasing a notable disparity between current market performance and future projections.

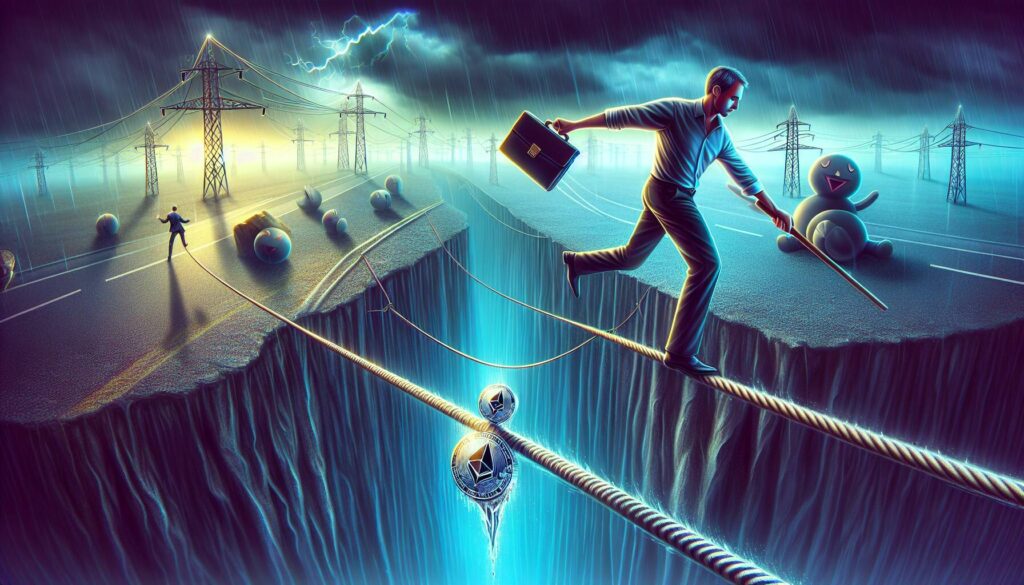

“Ether is at a crossroads,” the report asserts, highlighting the currency’s declining dominance in the crypto market, a trend that has persisted for some time.

Standard Chartered’s analysis notes that while Ether continues to lead in various metrics, it has faced significant challenges, particularly from Layer 2 blockchains designed to enhance the Ethereum network’s scalability. Specifically, the bank estimates that Coinbase’s platform, Base, has diminished Ether’s market cap by approximately billion. This shift suggests a potential continuation of the structural decline unless new market forces intervene, especially if the adoption of tokenized real-world assets takes off.

Geoff Kendrick, the head of digital assets research at Standard Chartered, emphasizes that ETH’s security dominance positions it well for a substantial market share of these new financial innovations. However, he also flags that without proactive measures from the Ethereum Foundation—like implementing taxes on Layer 2 solutions—significant changes to Ether’s trajectory are unlikely.

The bank also predicts a decline in the ETH/BTC trading ratio to 0.015 by the end of 2027, marking a low not seen since 2017.

Despite these challenges, there are glimmers of hope on the horizon. Standard Chartered forecasts a potential rebound in Ether’s price spurred by an anticipated rally in Bitcoin (BTC), which could positively affect the broader digital asset market. However, the report underscores that Ether’s persistent underperformance is expected to carry on amidst these developments.

Impact of Ether’s Structural Decline: Insights from Standard Chartered

According to a recent report from Standard Chartered, the future of Ether (ETH) appears to be declining, which could have significant implications for investors and the cryptocurrency market as a whole. Here are the key points from the report:

- Price Target Reduction:

- Standard Chartered has revised its year-end 2025 price target for Ether from ,000 to ,000.

- This sharp reduction indicates a pessimistic outlook for Ether’s price trajectory.

- Current Price Status:

- As of publication, Ether was trading around ,903.

- This significant drop suggests potential losses for current investors.

- Market Dynamics:

- Layer 2 blockchains are intended to enhance Ethereum’s scalability but are reportedly impacting Ether’s market cap negatively.

- Standard Chartered estimates that Coinbase’s Base has reduced Ether’s market cap by approximately billion.

- Potential for Market Recovery:

- The report suggests that market forces could eventually stop the structural decline, particularly with the growth of tokenized real-world assets.

- Ether’s security dominance might help it maintain an 80% share in this emerging market.

- Need for Industry Change:

- The report emphasizes that a proactive change in direction from the Ethereum Foundation, such as taxing Layer 2s, could be crucial for Ether’s recovery.

- However, such changes are considered unlikely by Standard Chartered.

- Future Price Predictions:

- Standard Chartered predicts that the ETH/BTC ratio may decline to 0.015 by year-end 2027, marking the lowest level since 2017.

- Despite the anticipated decline, there is an expectation of price recovery due to a potential rally in Bitcoin (BTC) lifting Ether and other digital assets.

“Ether is at a crossroads… it still dominates on several metrics, but this dominance has been falling for some time.” – Geoff Kendrick, Standard Chartered

This information is crucial for investors as it highlights the challenges Ether faces, while also presenting a more cautious approach to investment decisions in the cryptocurrency sector. Awareness of these trends may influence strategy adjustments and asset allocation for those involved in or considering entry into the cryptocurrency market.

Standard Chartered Predicts Ether’s Continued Decline: Implications for Investors

In a recent analysis by Standard Chartered, significant challenges loom over the future of Ether (ETH), the second-largest cryptocurrency by market capitalization. The investment bank revised its 2025 end-of-year price target for Ether down to ,000, a notable decrease from its previous forecast of ,000. This startling revision serves as a critical checkpoint in an evolving landscape where Layer 2 blockchains, designed to enhance Ethereum’s scalability, are seen to be impacting Ether’s market cap significantly.

One of the report’s intriguing highlights is the assertion that Coinbase’s Base has negatively influenced Ether’s market presence, contributing to an estimated billion reduction in its market cap. This analysis positions Standard Chartered’s viewpoint as a competitive edge in the market, providing investors with data-driven insights that could inform their decision-making. However, the challenge remains: a lack of proactive measures from the Ethereum Foundation may exacerbate the situation, hindering any potential for recovery. Investors might find themselves at a crossroads, particularly if they hold substantial positions in Ether, as the report suggests that without drastic changes, Ether’s position relative to Bitcoin (BTC) could deteriorate, emphasizing the importance of monitoring market dynamics closely.

On the other hand, Standard Chartered’s report also hints at a potential resurgence for Ether, noting that a rally in Bitcoin could propel the prices of all digital assets, including Ether. Nonetheless, the marked expectation of Ether’s underperformance compared to Bitcoin creates an uncertain landscape for long-term holders. Crypto enthusiasts and institutional investors looking for growth might need to reassess their strategies in light of this cautious outlook.

Ultimately, Standard Chartered’s insights could prove beneficial for those agile investors willing to pivot their strategies in response to shifting market conditions. Conversely, for commitment-heavy investors or loyal advocates of Ethereum, the bank’s analysis may signal potential issues in maintaining investment levels. Whether one favors the bullish or bearish side of the Ethereum story, it’s clear that navigating this evolving landscape requires vigilance and adaptability.