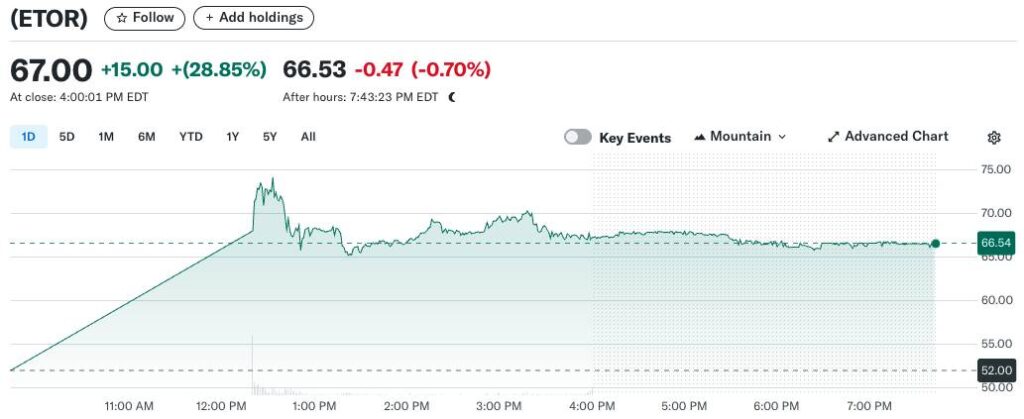

The cryptocurrency landscape is buzzing with exciting developments, particularly surrounding the trading platform eToro, which recently made a splash on the Nasdaq. As of May 15, 2023, eToro Group Ltd (ETOR) experienced a remarkable debut, closing its first day of trading with a share price soaring nearly 30% to reach $67, a significant increase from its initial offering price of $52. This surge valued the company at over $5.5 billion, spotlighting the growing interest in retail investing.

“This is a clear sign that retail investing is not a fad, but a long-term trend,”

stated Robert Francis, managing director of eToro Australia, reflecting the sentiment of many in the industry. eToro’s successful IPO is especially noteworthy considering it boosted its offerings to $620 million, taking advantage of heightened investor enthusiasm.

During its debut, the shares peaked at $74.26, showcasing a strong start before settling down slightly in after-hours trading. The excitement surrounding eToro stands in stark contrast to that of its rival, Robinhood Markets, which saw its stock price fall post-trading. This juxtaposition highlights the competitive dynamics of the market.

“The IPO marks a rebound for public offerings in the US, a trend that had slowed amid market uncertainties,”

noted industry analysts, as eToro navigated through a landscape that had seen many firms pause their public plans due to economic turbulence, especially surrounding tariffs and inflationary pressures. Founded in 2007, eToro’s path to public trading was not without hurdles, having previously attempted an offering via a SPAC in 2021, which it later shelved amidst market declines.

In its recent filings, eToro projected substantial growth in its cryptocurrency revenue, anticipating $12.1 billion in 2024, a leap from $3.4 billion in 2023, indicating a robust future for crypto trading. These figures suggest that digital assets continue to play an integral role in investment strategies, further solidifying eToro’s place in the market.

As eToro and other firms like Kraken and Circle eye potential public offerings, the momentum in the cryptocurrency sector is palpable, paving the way for an intriguing year ahead for investors and industry observers alike.

eToro’s Strong IPO Debut and Its Implications

Key points regarding eToro’s initial public offering (IPO) and the shifting landscape of retail investing:

- IPO Success:

- eToro’s share price surged nearly 30% during its debut on the Nasdaq, closing at $67.

- The company’s market value exceeds $5.5 billion post-IPO.

- Increased Offering:

- eToro boosted its IPO to $620 million, selling over 11.92 million shares, surpassing initial expectations.

- Initial pricing ranged between $46 to $50, showcasing strong demand.

- Institutional Interest:

- Interest from BlackRock-managed funds, signaling confidence from major institutional investors.

- Retail Investment Trend:

- eToro Australia’s managing director emphasized that the IPO reflects a lasting trend in retail investing.

- This could inspire more individuals to engage in stock and crypto markets.

- Market Context:

- The IPO marks a rebound for public offerings after a period of stagnation due to political and economic pressures, including tariffs.

- Prior delays in eToro’s plans highlight the volatility and factors influencing public market conditions.

- Future Projections:

- eToro expects a significant rise in crypto revenue, projecting $12.1 billion in 2024, indicating a growing potential for profit in the sector.

- Crypto is anticipated to comprise 37% of commission revenue by Q1 2025.

- Impact on Competitors:

- Rival Robinhood’s stock has seen a decline following eToro’s successful IPO.

- This might indicate changing investor perceptions and market strength within the trading platform sector.

“The stock and crypto trading house was founded in 2007 and previously bid to go public in 2021 via a merger with a special purpose acquisition company.”

eToro’s IPO Success: A Comparative Analysis within the Fintech Landscape

The recent launch of eToro on the Nasdaq has certainly made waves, with the company’s shares soaring by nearly 30% on their debut. This surge has positioned eToro Group Ltd as a notable player among fintech firms, especially amid contrasting trends displayed by competitors such as Robinhood. Unlike eToro, which enjoyed a strategic last-minute boost in its IPO pricing, Robinhood has been struggling with its stock value, demonstrating a stark contrast in market reception and investor sentiment. While eToro closed its debut at a value exceeding $5.5 billion, the struggles of Robinhood, with a slight downturn post-IPO, indicate potential challenges for companies relying solely on retail trading models.

Potential Competitive Advantages for eToro: eToro’s significant share price increase not only reflects investor confidence but also highlights the platform’s robust business model, which is increasingly appealing to both retail and institutional investors. The presence of major stakeholders like BlackRock, signaling interest, provides eToro with an edge in trust and credibility. Additionally, its projected growth in crypto revenue, anticipated to reach $12.1 billion in 2024, positions it favorably in an ever-expanding digital asset landscape.

Conversely, Robinhood faces some disadvantages as eToro shines. Following its IPO, Robinhood mirrored stock volatility, which could deter new investors seeking stability. The stark difference in performance post-IPO raises questions about Robinhood’s future growth trajectory, particularly as it navigates a competitive environment dominated by platforms that are diversifying their offerings, like eToro.

Who Stands to Gain or Lose? eToro’s dynamic position may benefit younger and less experienced investors eager to enter the trading space. By promoting a long-term investment philosophy, as highlighted by eToro Australia’s managing director Robert Francis, the platform may attract a sustainable user base in a time when retail investing trends are on the rise. However, eToro’s solid performance could inadvertently create challenges for other platforms like Robinhood, which might struggle to retain users who are now drawn to a more lucrative competitor. This evolution highlights the potential for a shift in market dynamics, where platforms need to constantly innovate to keep pace with consumer expectations and competitor advancements.

Additionally, eToro’s successful IPO could inspire other companies in the cryptocurrency and fintech sectors, like Kraken and Circle, to reconsider their IPO strategies amid ongoing market volatility. If they can learn from eToro’s approach—especially in emphasizing the viability of retail investment—they may find opportunities for growth by appealing to a similar audience, capitalizing on newfound confidence in the sector.