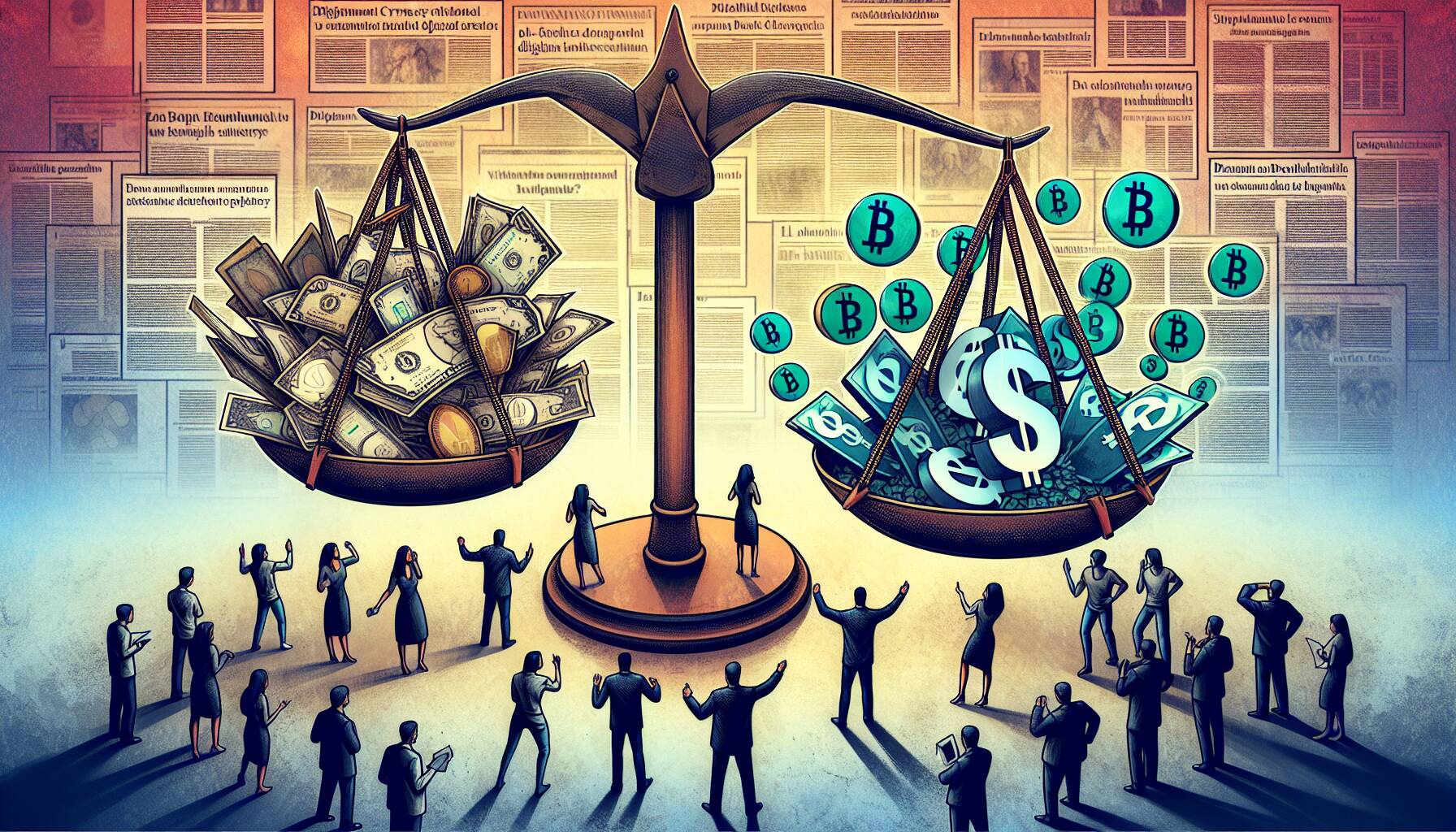

In a significant development within the cryptocurrency landscape, Florida has chosen to pull back on its Bitcoin reserve initiatives, leaving many in the industry speculating about the state’s approach to digital assets. Meanwhile, Arizona is making waves by becoming the first state in the U.S. to approve a Bitcoin reserve, planning to allocate 10% of its impressive $31.5 billion in state assets to this digital currency. This bold move signals Arizona’s commitment to embracing the growing cryptocurrency market, with the legislature now awaiting the governor’s signature to finalize the bill.

However, not all states are moving towards funding reserves in Bitcoin. Just recently, the Arizona governor has vetoed a bill aimed at establishing a state Bitcoin reserve, highlighting the challenges that lawmakers face when balancing the potential benefits of cryptocurrency with the inherent risks involved. Furthermore, institutions are navigating these turbulent waters too; Brown University has recently locked in its own strategies surrounding blockchain investments, illustrating the complexities that come with integrating cryptocurrency into traditional financial systems.

As states like Arizona take pioneering steps forward in the cryptocurrency arena, Florida’s retreat from Bitcoin reserves raises questions about the sustainability and future of such investments, especially amid the current market’s fluctuations.

The juxtaposition of Arizona’s ambitious plans with Florida’s cautious stance reflects a broader trend as states across the U.S. grapple with the evolving nature of digital currencies. As they weigh the potential risks and rewards of investing in Bitcoin and other cryptocurrencies, the outcome of these legislative efforts will undoubtedly shape the future landscape of crypto finance in America.

Recent Developments in Bitcoin Reserves Legislation Across States

Several states have recently taken significant actions regarding Bitcoin reserve bills, impacting potential investment strategies and financial management at the state level.

- Florida Legislative Action:

- The Florida legislature has decided to remove strategic Bitcoin reserve bills from consideration.

- This decision reflects a cautious approach towards cryptocurrency investments in the state, considering the volatile nature of Bitcoin.

- Arizona’s Forward Movement:

- Arizona has approved a groundbreaking bill to invest 10% of its $31.5 billion state assets into Bitcoin.

- This marks the first time a U.S. state has incorporated Bitcoin reserves as part of its official state asset management strategy.

- The approval of this bill signals growing openness towards cryptocurrency among state governments.

- Legislative Trends:

- The Arizona Legislature’s recent actions suggest a broader trend towards acceptance of cryptocurrency in government finance.

- Pending gubernatorial approval on various crypto bills highlights the ongoing debate about state-level cryptocurrency regulation.

- Investment Strategies:

- States like Arizona could see increased state revenue and investment returns through innovative approaches to managing assets.

- Individual investors may look to follow state-level actions to inform their personal investment strategies in cryptocurrencies.

- Recent Vetoes:

- Arizona’s governor’s veto of a state bitcoin reserve underscores the mixed sentiment surrounding cryptocurrency legislation.

- Such vetoes can impact public perception and investor confidence in Bitcoin as a stable investment option.

This dynamic environment of state legislation could influence local economies and individual investment behaviors concerning cryptocurrencies.

Comparative Analysis of Recent Bitcoin Reserve Developments

The ever-evolving landscape of Bitcoin reserves across U.S. states has created a complex narrative, particularly with contrasting approaches observed in Florida and Arizona. On one hand, Florida has strategically opted to withdraw Bitcoin reserve bills from consideration, highlighting a cautious stance towards cryptocurrency investments. Conversely, Arizona is making headlines by not only approving a Bitcoin reserve bill but also committing to invest 10% of its $31.5 billion state assets into Bitcoin. This juxtaposition positions Arizona favorably as a trailblazer, appealing to crypto enthusiasts and institutional investors alike.

The competitive advantage for Arizona lies in its proactive legislation, which may attract tech firms and stimulate economic growth through crypto-related investments. With a state willing to embrace digital currency, businesses may see Arizona as a favorable environment for operations that thrive on innovation. The approval from the Arizona Legislature places it among the forefront states willing to integrate Bitcoin into their financial infrastructure, potentially increasing investor confidence and inflating the state’s economic portfolio.

However, this enthusiasm is tempered by the reality of regulatory hurdles and potential backlash. Arizona’s initiative could face challenges, particularly if federal regulations tighten or if local opposition arises. The veto from the governor regarding a similar reserve bill may signal caution and underline the volatility that can accompany cryptocurrency policies. This has implications not only for the state’s financial decisions but also for pension funds and public resources, as any poor performance of these investments could create deficits that impact taxpayers.

Florida’s decision to retreat from Bitcoin initiatives may resonate with those advocating for more traditional investment strategies, highlighting the risks associated with crypto exposure. This caution could serve as a protective measure for residents, shielding them from the potential turbulence and volatility of the cryptocurrency market. However, it may also hinder Florida’s progress in becoming a tech-centric hub, potentially causing the state to lag behind competitors like Arizona, which could actively foster innovation and attract younger demographics interested in blockchain technology.

In summary, while Arizona’s bold step towards Bitcoin reserves presents a picture of forward-thinking and potential economic uplift, it equally harbors risks that could lead to public scrutiny. Conversely, Florida’s conservative approach reflects a more cautious financial philosophy, beneficial for stability but possibly detrimental in a landscape that increasingly values technological adaptation and crypto engagement.