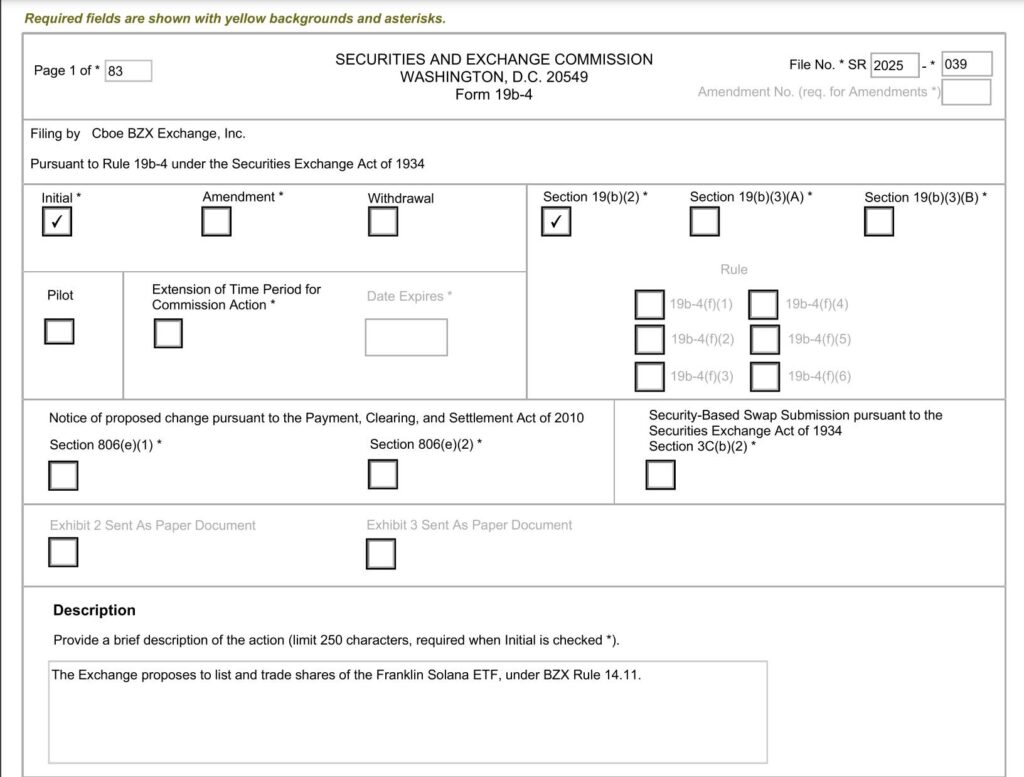

The cryptocurrency landscape is buzzing with excitement as the Chicago Board Options BZX Exchange (Cboe) has officially submitted an application for a new exchange-traded fund (ETF) focused on Solana (SOL). This application, put forth by well-known asset manager Franklin Templeton, marks a significant step in the adoption of digital assets within mainstream finance. The filing, recorded on March 12, outlines plans for the ETF to hold spot Solana, while also advocating for the fund to engage in staking its underlying cryptocurrency to earn extra rewards. The filing argues that not taking advantage of staking opportunities is akin to an equity exchange-traded product (ETP) forgoing dividends, an essential revenue stream for investors.

Franklin Templeton’s recent foray into the crypto world also includes the establishment of a Solana trust on February 10, positioning itself alongside notable firms like Grayscale and VanEck, all vying to launch Solana-based investment options. The push for regulatory approval comes in a climate that many believe is shifting toward more acceptance of cryptocurrency, especially following former SEC Chair Gary Gensler’s resignation in January 2025. This change has coincided with a flurry of crypto ETF filings, initiated by asset managers eager for a more accommodating regulatory environment.

“I do think that it’s likely that ETFs and mutual funds will ultimately be built on blockchain just because it’s an incredibly efficient technology,”

noted Franklin Templeton CEO Jenny Johnson, reflecting optimism regarding the future interplay between traditional finance and digital currencies. However, the journey towards approval is not without its bumps. On March 11, the SEC extended its review period for various altcoin ETFs, including those associated with Solana, citing the need for additional evaluation time. Yet, analysts such as Bloomberg’s James Seyffart see this delay as routine, maintaining that the likelihood of eventual approval remains high, with a final decision deadline stretching to October 2025.

As the realm of cryptocurrencies and blockchain technology continues to evolve, the proposed Solana ETF by Franklin Templeton could signify a pivotal moment in the legitimization and integration of digital assets into the financial mainstream.

Franklin Templeton’s Solana ETF Application and Its Implications

The application by Franklin Templeton for a Solana ETF signals significant developments in the cryptocurrency investment landscape. Here are key points to consider:

- Asset Manager Involvement: Franklin Templeton, a major asset manager, has filed to list a Solana (SOL) ETF, indicating institutional interest in cryptocurrencies.

- Spot SOL Holdings: The proposed ETF is designed to hold spot SOL, potentially providing investors direct exposure to the cryptocurrency.

- Staking for Rewards: The application encourages staking SOL to earn additional rewards, which could enhance the fund’s returns similar to receiving dividends in traditional stock investments.

- Competitive Landscape: Franklin Templeton’s trust registration follows other firms like Grayscale and Bitwise, indicating a growing competitive environment for Solana-based financial products.

- Regulatory Delays: The SEC has delayed decisions on several ETF applications, including those for altcoins like Solana, which may affect investor timelines and market dynamics.

- Potential Policy Shifts: Franklin Templeton’s CEO expresses confidence that U.S. crypto policies will evolve favorably under future administrations, potentially benefiting crypto investments.

- Technology Efficiency: The belief in blockchain’s efficiency for financial products suggests that traditional finance may increasingly integrate with cryptocurrency markets.

“I do think that it’s likely that ETFs and mutual funds will ultimately be built on blockchain just because it’s an incredibly efficient technology.” – Jenny Johnson, CEO of Franklin Templeton

Overall, these developments may impact investors by offering more avenues for cryptocurrency investment while influencing market perceptions and regulatory actions in the future.

Franklin Templeton’s Solana ETF: Navigating the Landscape of Crypto Fund Approval

Franklin Templeton’s recent initiative to launch a Solana (SOL) exchange-traded fund (ETF) is sparking interest in the financial sector. Amid increasing applications from various asset managers, the entry of Franklin Templeton through the Chicago Board Options BZX Exchange positioned it as a notable contender in the competitive cryptocurrency ETF landscape. However, this bold move comes with its own set of advantages and challenges compared to similar news within the category.

On the positive front, Franklin Templeton’s approach includes staking the fund’s SOL, potentially maximizing returns by capitalizing on the advantages of the underlying cryptocurrency. This strategy enhances the ETF’s appeal to investors who are looking for innovative ways to generate additional rewards, which can be a significant selling point compared to other asset managers like Grayscale or Bitwise, who have submitted similar proposals without staking provisions. Franklin Templeton’s reputation as a well-established asset manager also instills a sense of trust and security, a key advantage in a market often viewed as volatile and speculative.

However, there are notable disadvantages, primarily stemming from fluctuating regulatory approval timelines. The recent SEC announcement regarding the delayed decisions on several crypto ETFs—including those based on Solana—underscores a cautious regulatory environment. The extended deliberation period puts a damper on the excitement surrounding these applications and creates uncertainty for potential investors who may be looking for timely market entry. This delay can also hinder Franklin Templeton’s competitive edge, as other firms may strategize differently in anticipation of a less favorable regulatory climate.

Investors who might benefit from Franklin Templeton’s proposed Solana ETF include those already inclined towards crypto assets looking for a credible entry through a regulated fund. Institutional investors, in particular, could find this offering attractive due to the assurance of a recognized asset manager backing their investments. Conversely, the extended decision timeline could potentially dissuade retail investors who prefer the risk-reward dynamic of quicker allocations while remaining wary of regulatory hurdles. Furthermore, uncertainty surrounding current market conditions, influenced by former SEC Chair Gary Gensler’s departure and the mixed signals coming from regulatory bodies, creates an unpredictable environment that could lead to hesitancy among potential backers.

In summary, while Franklin Templeton’s Solana ETF proposal possesses promising aspects, its success will heavily depend on regulatory outcomes and market reactions, posing both opportunities and challenges for various stakeholders in the crypto investment space.