In a notable development in the world of cryptocurrency, American asset manager Franklin Templeton has officially entered the competitive XRP exchange-traded fund (ETF) market. The firm recently filed for a spot XRP ETF in the United States, aimed at closely mirroring the price movement of XRP. According to Franklin Templeton’s submission to the US Securities and Exchange Commission (SEC) dated March 11, the XRP assets are set to be securely stored with Coinbase Custody Trust.

This announcement came on the same day that the SEC chose to delay decisions on several other cryptocurrency ETF applications, including a prominent proposal from Grayscale. Grayscale is looking to transition its existing XRP Trust into a fully-fledged ETF, further highlighting the growing excitement and interest around XRP ETFs in recent months.

As of March 12, a total of nine companies are vying for a piece of the XRP ETF market in the U.S., with well-known names like Bitwise, ProShares, and 21Shares each putting forward their proposals. Bitwise was the first to enter the race when it submitted its Form S-1 for an XRP ETF back in October 2024, and a multitude of firms have followed since then, each bringing their unique offerings to the table.

“The influx of XRP ETF filings signals a growing confidence in digital assets, as various firms attempt to tap into the market potential of XRP,”

noted industry experts. Other notable ETF contenders include CoinShares and Volatility Shares, the latter of which recently filed for multiple XRP ETF variations. Despite the surge in interest from smaller players, heavyweight firms like BlackRock, which is known for managing the largest spot Bitcoin ETF, have yet to announce any XRP-related plans.

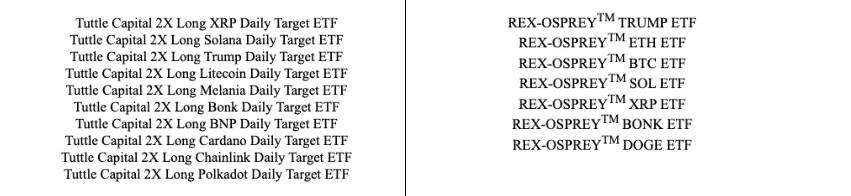

Additionally, several asset managers have already included XRP in broader crypto-focused ETF offerings. For instance, REX-Osprey and Tuttle Capital Management have filed proposals featuring XRP alongside other digital currencies, further expanding the varieties available to investors.

While enthusiasm around XRP ETFs is palpable, the SEC’s recent decisions underscore the regulatory complexities surrounding cryptocurrency products. As the landscape continues to evolve, observers will be keenly watching how these developments play out against the backdrop of the ever-changing crypto ecosystem.

Franklin Templeton Enters the XRP ETF Race

Franklin Templeton has made a significant move by filing for a spot XRP ETF in the United States, joining a growing list of firms eager to capitalize on the cryptocurrency market. Here are the key points surrounding this development:

- New ETF Filing: Franklin Templeton filed for an XRP ETF designed to track the XRP price, with holdings stored at Coinbase Custody Trust, as noted in a filing with the SEC on March 11.

- SEC’s Postponements: On the same day, the SEC delayed decisions on multiple crypto ETF filings, including Grayscale’s proposal, reflecting ongoing regulatory scrutiny.

- Market Competition: A total of nine companies have filed for XRP ETFs in the US, highlighting increasing competition in the crypto ETF space.

- Notable Filers: Major firms like Bitwise, ProShares, and 21Shares are among those that have submitted filings, indicating institutional interest in XRP as an investment vehicle.

- ETF Composition: Some asset managers are including XRP in broader crypto ETF products, which could influence diversification strategies for investors.

- Remaining Firms: Notably, BlackRock and other significant asset managers have yet to file for XRP ETFs, suggesting potential future shifts in market dynamics.

This surge in XRP ETF filings could provide investors with diverse and regulated exposure to digital assets, impacting investment strategies and market access.

Franklin Templeton Enters XRP ETF Race: A New Contender Among Giants

Franklin Templeton’s recent foray into the XRP exchange-traded fund (ETF) market adds a noteworthy twist to a rapidly evolving narrative in the world of cryptocurrency investments. With major firms like Bitwise and ProShares already in the mix, Franklin Templeton’s entry signifies a competitive shift where traditional financial institutions are increasingly recognizing the potential of cryptocurrencies as viable investment assets. This movement is underscored by the ongoing filings and interest surrounding XRP ETFs, particularly significant given the SEC’s postponement on related decisions that could reshape the landscape for crypto ETFs.

Competitive Advantages: Franklin Templeton benefits from its established reputation as a leading asset manager, lending credibility to its XRP ETF proposal. By utilizing Coinbase Custody Trust for asset storage, it also gains a layer of security and trust in an industry often criticized for volatility and lack of regulatory oversight. The company’s experience and infrastructure can attract both institutional and retail investors looking for reliable exposure to XRP, positioning them favorably against competitors who may lack such a robust backing.

Competitive Disadvantages: However, the flood of XRP ETF filings raises concerns about market saturation. With nine companies already competing—even without the backing of industry giants like BlackRock—it may dilute interest and investment in these products. Additionally, market fluctuations and the uncertain future of XRP, especially under current SEC scrutiny, might also pose risks that dissuade investors from committing to Franklin Templeton’s new offering.

This development could profoundly impact various stakeholders. For retail investors, the variety of XRP ETFs makes it challenging to navigate choices, as each new offering competes for visibility and interest. Meanwhile, institutional investors might benefit from increased competition as more options can lead to better pricing and innovative features. However, the crowded field may also lead to some firms struggling to attract significant capital, potentially resulting in a few ETFs failing to gain traction.

The broader implications for organizations that have yet to file for an XRP ETF, like Invesco and Fidelity, are evident. The urgency to enter the race could escalate, as they risk being left behind in a potentially lucrative market segment. Additionally, their strategies might pivot to differentiate themselves from existing and incoming products, which could lead to creative, hybrid offerings or enhanced marketing tactics to capture attention amidst the noise of numerous filings.