In a bold move signaling a shift in strategy, GameStop, the video game retailer that captured the spotlight during the meme stock phenomenon, is set to close a “significant number” of its retail locations as part of a major restructuring effort. This announcement comes alongside the company’s plans to substantially invest in Bitcoin, an asset that has drawn increasing interest from various sectors. In fact, GameStop aims to raise an impressive .3 billion to bolster its cryptocurrency investment ambitions, a development that has sent its stock on a roller coaster ride.

“GameStop invests in Bitcoin, shares surge 11.6% before post-market drop,”

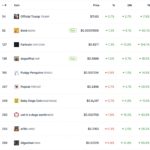

While initial reactions to the news saw GameStop’s stock surge by 11.6%, the excitement was short-lived, as shares experienced a post-market drop. This rollercoaster response highlights the volatile nature of both the stock and cryptocurrency markets. The company’s pivot towards Bitcoin comes at a time when many traditional businesses are looking to embrace digital currencies, reflecting a broader trend in the financial landscape.

Investing in Bitcoin can be a complicated decision, but for GameStop, it represents an opportunity to leverage a burgeoning digital economy. As cryptocurrency continues to gain traction among investors, the retailer’s move suggests a strategic shift that could redefine its market position and appeal to a younger, tech-savvy clientele.

“Buckle Up—Bitcoin Price Suddenly Braced For A ‘Cambrian Explosion’,”

As the excitement around Bitcoin persists, some experts are predicting significant price movements, dubbing what lies ahead a “Cambrian explosion” for the cryptocurrency. Such predictions further underline the potential volatility surrounding Bitcoin and how it might influence companies like GameStop that are entering this space.

As GameStop navigates the complexities of both closing stores and investing heavily in Bitcoin, its future will likely depend on how well it adapts to these dramatic changes in the retail landscape and cryptocurrency market. The coming months will be pivotal for this new chapter in GameStop’s history, illuminating the intricate relationship between traditional retail and the burgeoning world of digital currencies.

GameStop’s Strategic Shift: Store Closures and Bitcoin Investment

GameStop’s recent decisions reflect a significant transformation in its business model, impacting both the company and its shareholders. Here are the key points:

- Store Closures:

- GameStop is closing a ‘significant number’ of stores as part of its restructuring efforts.

- This move may lead to reduced operating costs but could also impact local economies where stores are a source of employment.

- Heavy Investment in Bitcoin:

- The company has announced plans to raise .3 billion to heavily invest in bitcoin.

- This marks a bold shift toward cryptocurrency, which could attract new investors looking for exposure to digital assets.

- Market Reaction:

- Following the announcement, GameStop’s stock experienced a surge of 11.6% before a post-market decline.

- Such volatility in stock prices may affect investor sentiment and confidence in GameStop’s long-term strategy.

- Industry Implications:

- The phrase “Buckle Up” reflects industry analysts’ predictions of a potential “Cambrian Explosion” in bitcoin prices.

- A surge in bitcoin could impact not only GameStop’s financial health but also alter the competitive landscape within the retail sector.

- Financial Position:

- Reports indicate that GameStop currently has a ‘pile of cash’, providing the company with flexibility to explore new ventures.

- However, their bitcoin strategy’s success hinges on market conditions, which could influence shareholder value.

These developments highlight the evolving nature of retail business models and underscore the importance of adapting to technological advancements and market trends. For readers, understanding these shifts may provide insights into investment opportunities and the future of retail.

GameStop’s Bold Move: Shuttering Stores and Diving into Bitcoin

In a dramatic shift within the gaming retail landscape, GameStop has announced the impending closure of numerous physical store locations as it pivots towards investing heavily in Bitcoin. This strategic move mirrors broader trends in the market where traditional retail is grappling with e-commerce giants, while cryptocurrencies are gaining traction among investors seeking new growth avenues.

Comparative analyses of recent developments in the retail and cryptocurrency sectors highlight GameStop’s competitive advantage in taking a bold stand amid adversity. By reallocating resources from declining brick-and-mortar sales to the volatile yet promising cryptocurrency sector, GameStop aims to position itself as a forward-thinking entity that embraces digital transformation. This can attract tech-savvy investors and younger demographics keen on evolving investment opportunities, particularly in the gaming and tech spaces.

However, the downside of this approach is evident. While the initial response showed a surge in their stock price by 11.6%, there are inherent risks in betting on Bitcoin’s fluctuating value. Investor confidence may wane if Bitcoin does not deliver consistent returns, especially given the unpredictable market nature. Moreover, closing physical stores might alienate loyal customers who prefer in-person shopping experiences, potentially leading to a decline in overall brand loyalty.

This intriguing strategy not only impacts GameStop but also reverberates throughout the retail sector. Competitors in the gaming industry might feel pressured to innovate or pivot similarly to avoid being left behind. Conversely, established cryptocurrency players could view GameStop’s move as a threat, drawing more attention to an already competitive market. Investors scrutinizing GameStop’s approach should weigh the potential rewards against the backdrop of risk and volatility inherent in crypto investments.

In a world where tech companies are consistently reinventing themselves, GameStop’s decisive leap into Bitcoin could inspire both hope and apprehension. For investors eyeing growth in unconventional spaces, this could signal a unique opportunity, but for traditional retail fans, it could highlight an unsettling shift in the future of gaming commerce.