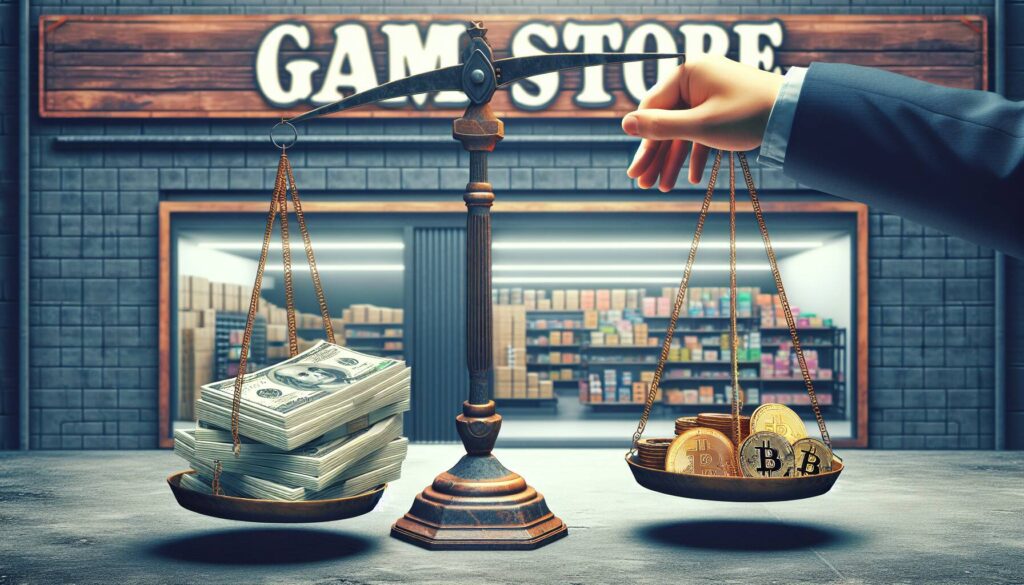

In a surprising turn of events, GameStop, the well-known meme stock that became famous for its rapid price surges during the pandemic, is facing a notable drop in its stock value. The company announced plans to raise a staggering .3 billion by issuing convertible debt, which it intends to use primarily for investments in Bitcoin. This decision has sent ripples through the market, prompting analysts and investors alike to reassess the future trajectory of both GameStop and the cryptocurrency landscape.

The announcement follows the company’s recent strategy shift, which includes the closing of a significant number of its retail stores. As GameStop looks to pivot from its traditional business model, it appears poised to embrace the rising trend of digital currencies—a move that has garnered mixed reactions from the investment community. Some see this as a bold step forward, while others express concern over the volatility of Bitcoin, which has been notoriously unpredictable.

“Buckle Up”— Bitcoin Price Suddenly Braced For A ‘Cambrian Explosion’

As Bitcoin continues to capture the attention of institutional and retail investors alike, there are strong sentiments within the market that this moment could lead to substantial price fluctuations. The phrase “Cambrian Explosion” suggests a rapid diversification and expansion in the cryptocurrency market, indicating that significant changes may be on the horizon. With GameStop’s latest maneuver, the intertwining of traditional retail and modern digital assets is more evident than ever, marking a noteworthy chapter in the evolving story of both the company and the cryptocurrency industry.

GameStop’s Strategic Shift Towards Bitcoin

GameStop, once the focal point of retail trading frenzy, is now taking significant steps to adapt to the evolving market landscape. The company’s recent announcements signify a drastic transformation in its business model.

- Stock Decline: GameStop’s stock has experienced a notable drop following the announcement of their plans to raise .3 billion.

- Debt Financing: The company intends to issue convertible notes to finance the purchase of Bitcoin, indicating a shift towards cryptocurrency investments.

- Store Closures: GameStop is closing a substantial number of retail locations, which reflects a transition away from traditional retail operations.

- Bitcoin Investment: Heavy investments in Bitcoin suggest a focus on digital assets, aiming to capitalize on the growing crypto market.

- Market Reactions: Analysts anticipate increased volatility in Bitcoin prices due to such significant purchases, potentially leading to a ‘Cambrian Explosion’ in the asset’s valuation.

These developments not only reshape GameStop’s identity but also have far-reaching implications for investors and consumers alike:

- Impact on Retail Investors: Gamers and retail investors must reevaluate their perceptions of GameStop as a gaming retailer, as it pivots to cryptocurrency.

- Market Volatility: Increased buying in Bitcoin by major companies can cause erratic price movements, which can affect individual investment strategies.

- Future of Meme Stocks: GameStop’s evolution may influence other meme stocks, pushing them to explore unconventional assets and investment strategies.

- Financial Literacy: This shift raises the need for enhanced understanding of cryptocurrencies and the risks associated with them among traditional investors.

As GameStop embarks on this uncharted path, its approach could redefine the landscape of retail investing and cryptocurrency adoption.

GameStop’s Bold Move into Bitcoin: A Double-Edged Sword

The latest buzz surrounding GameStop’s strategic decision to raise .3 billion through the issuance of convertible notes has sparked both excitement and concern among investors and analysts alike. The decision reflects the company’s pivot from traditional retail operations to a more speculative venture into cryptocurrency, namely Bitcoin. While this bold move presents GameStop with potential competitive advantages, it also raises several red flags that could affect its standing in the market.

One of the primary advantages of this strategy is the alignment with current market trends. The cryptocurrency space has experienced an explosive interest, particularly among younger investors who have shown a penchant for ‘meme stocks’ and tech-driven investments. By harnessing this enthusiasm, GameStop could potentially tap into a new, lucrative revenue stream that aligns with the digital economy’s growing importance. Additionally, the infusion of cash from the convertible notes could bolster GameStop’s ability to innovate and invest in emerging technologies, such as blockchain, enhancing its appeal in a competitive landscape.

However, the decision is not without its drawbacks. GameStop’s stock has already seen a notable decline following the announcement, indicating a level of skepticism from the market regarding the company’s ability to pivot effectively. The heavy dependence on Bitcoin’s volatile nature could expose GameStop to significant risks, especially if the cryptocurrency market experiences sharp downturns. This financial gamble could alienate traditional investors who might prefer a more stable approach, undermining confidence in GameStop’s core business operations.

This shift towards Bitcoin could particularly benefit younger, tech-savvy investors who are keen on engaging with companies that reflect their interests in digital assets and innovative business models. However, it could create challenges for longstanding investors who may not share the same enthusiasm for cryptocurrency. Furthermore, the decision might also prompt competitors to rethink their strategies. Other companies in the retail sector may feel pressured to adopt similar high-risk, high-reward tactics, leading to market volatility and an unpredictable playing field.

In this rapidly evolving environment, GameStop’s dramatic pivot showcases the duality of opportunities and risks present in the intersection of retail and cryptocurrency. Watchful investors will undoubtedly be keen to see how this gamble unfolds in the coming months, as GameStop endeavors to reclaim its status while navigating the highs and lows of the Bitcoin market.