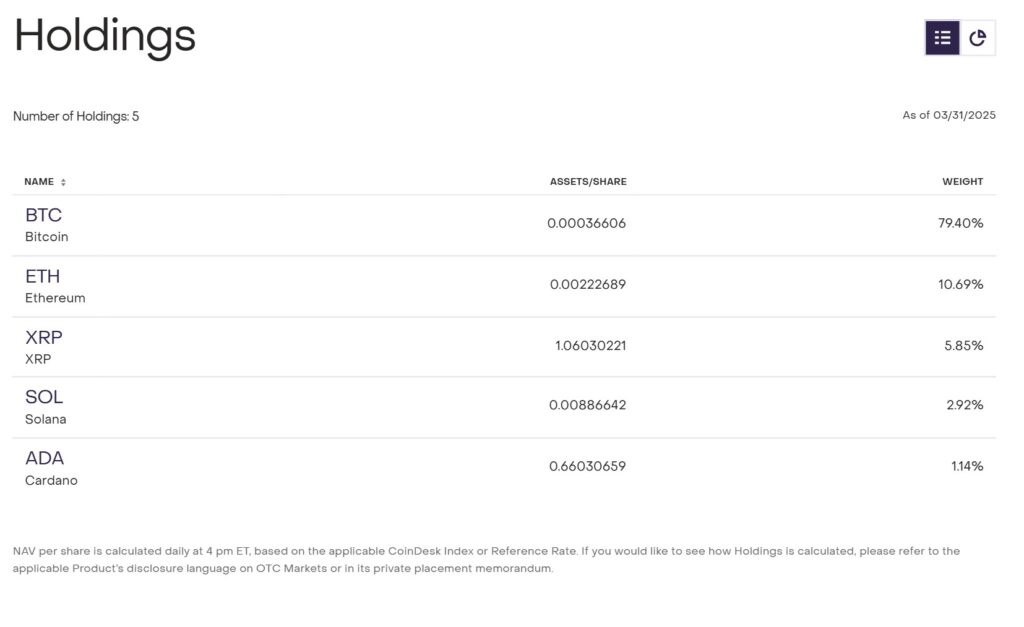

In a significant move in the cryptocurrency landscape, asset manager Grayscale has taken steps to launch an exchange-traded fund (ETF) that would provide investors with exposure to a diverse range of spot cryptocurrencies. According to recent filings with the US Securities and Exchange Commission (SEC), Grayscale submitted its S-3 regulatory application on April 1, aiming to transform its existing non-listed fund, the Grayscale Digital Large Cap Fund, into an ETF. This fund, which commenced in 2018, boasts a basket of cryptocurrencies including Bitcoin, Ether, Solana, XRP, and Cardano, and currently manages over 0 million in assets.

The intent behind this filing aligns with a broader trend within the cryptocurrency sector as ETF issuers are ramping up product launches, particularly following a more lenient regulatory environment in the US. Recent actions by the SEC have opened the door for mixed crypto index ETFs, with approvals given to funds from notable players like Hashdex and Fidelity. However, these funds have primarily focused on Bitcoin and Ether, and their performance has seen modest inflows since their introduction in February.

“The next logical step is index ETFs because indices are efficient for investors—just like how people buy the S&P 500 in an ETF. This will be the same in crypto,”

noted Katalin Tischhauser, head of investment research at Sygnum, illustrating the anticipated evolution in cryptocurrency investment vehicles. The surge in ETF filings, including an acknowledgment from the SEC of over a dozen related to cryptocurrency, highlights the industry’s growing mainstream acceptance and Wall Street’s eagerness to offer diverse cryptocurrency investment options.

As Grayscale moves forward with its ETF ambitions, the financial community is watching closely to see how this will shape the future of cryptocurrency investments, especially for accredited investors seeking a more structured and regulated approach to digital asset exposure.

Grayscale Files for a Diverse Cryptocurrency ETF

Key aspects of Grayscale’s recent ETF filing and their potential impact on investors:

- ETF Conversion Filing: Grayscale has submitted an S-3 regulatory filing to the SEC to convert its non-listed fund, the Grayscale Digital Large Cap Fund, into an exchange-traded fund (ETF).

- Asset Management: The fund currently holds over 0 million in assets under management, making it a significant player in the crypto asset space.

- Eligible Investments: The ETF will feature a diverse portfolio that includes well-known cryptocurrencies such as:

- Bitcoin (BTC)

- Ether (ETH)

- Solana (SOL)

- XRP (XRP)

- Cardano (ADA)

- Opening to a Wider Audience: Currently, the fund is only available to accredited investors, but the ETF listing could potentially open it up to a broader market.

- Regulatory Environment: The filing reflects a shift in US regulatory attitudes towards cryptocurrency under the recent administration, which may lead to more crypto products being launched in the future.

- Market Trends: With ETFs focused on Bitcoin and Ether already launched, the introduction of index ETFs indicates a growing interest in diversified crypto investment options similar to traditional index funds.

“The next logical step is index ETFs because indices are efficient for investors — just like how people buy the S&P 500 in an ETF. This will be the same in crypto.” – Katalin Tischhauser, Sygnum

These developments may impact investors by providing more accessible, regulated investment options in the cryptocurrency market, which is rapidly evolving.

Grayscale’s ETF Filing: A Game Changer or Just Another Drop in the Bucket?

The recent filing by asset manager Grayscale to launch an exchange-traded fund (ETF) comprising a varied basket of spot cryptocurrencies could potentially shake up the market. With over 0 million in assets and a diverse portfolio that includes leading cryptocurrencies like Bitcoin (BTC) and Ether (ETH), this move signals a growing momentum in the crypto ETF space. However, when comparing Grayscale’s initiative to other recent ETF offerings, there are both advantages and disadvantages worth noting.

Competitive Advantages: One of the standout features of Grayscale’s ETF proposal is its diversification. While other crypto ETFs, such as those introduced by Hashdex and Fidelity, focus primarily on Bitcoin and Ether, Grayscale’s inclusion of altcoins like Solana (SOL), XRP, and Cardano (ADA) makes it a more attractive option for investors seeking exposure to the entire cryptocurrency landscape. This broad appeal positions Grayscale favorably in a market increasingly interested in a wider array of digital assets. Additionally, the shift towards a regulatory-friendly environment under recent federal guidelines can further bolster investor confidence, providing a more stable platform for these kinds of investment vehicles.

However, challenges remain. The existing crypto index ETFs have seen tepid interest, struggling to attract significant inflows since their launch. One key disadvantage for Grayscale’s offering could be the cautious sentiment lingering among retail investors who may still be skittish about regulatory issues and market volatility. Moreover, unless Grayscale can effectively communicate the unique benefits of their diversified portfolio, there’s a risk of lost visibility in an already cluttered market.

Beneficiaries and Those at Risk: The proposed Grayscale ETF stands to benefit a variety of stakeholders. Institutional investors looking for diversified exposure to several cryptocurrencies without direct management can find this ETF particularly valuable. It may also appeal to accredited investors who are more willing to test the waters in newer digital assets. However, for those already invested in the more conservative Bitcoin and Ether-focused ETFs, the aggressive diversification strategy might be seen as unnecessary risk, potentially causing some to reconsider their current holdings. Furthermore, any delays or complications in the SEC approval process could create frustration for legacy investors waiting for a more balanced crypto product.

As Grayscale’s filing invites scrutiny, it’s important for investors to remain informed about the shifting dynamics of crypto ETFs and their regulatory landscape. The willingness of traditional finance to pivot toward crypto assets reflects a broader acceptance that could either pave the way for future innovation or create hurdles that impact market stability.