A recent survey conducted by CoinGecko has revealed an optimistic outlook among cryptocurrency enthusiasts regarding the future of AI-related tokens. With nearly half of the 2,632 respondents feeling bullish about these tokens, a sense of enthusiasm surrounds the .6 billion sector tailored to integrate artificial intelligence into cryptocurrency.

“Of the participants, 25% identified as ‘fully bullish’ and 19.3% as ‘somewhat bullish’ about the prospects for crypto AI tokens by 2025,” noted CoinGecko’s research analyst Yuqian Lim.

This energy mirrors sentiments expressed towards crypto AI products, with many participants indicating that the real-world applications of these technologies have begun to gain traction. Lim suggests that the growing enthusiasm indicates a shift, with industry players moving beyond initial concepts and embracing the potential for maturation within the crypto AI sector.

The survey highlighted significant interest in top artificial intelligence coins, including Near Protocol (NEAR), Internet Computer (ICP), and Bittensor (TAO), which are leading the market capitalization in this niche. Additionally, a separate category of AI agent coins, such as Artificial Super Intelligence (FET) and ai16z (AI16z), commands a combined market cap of around .5 billion.

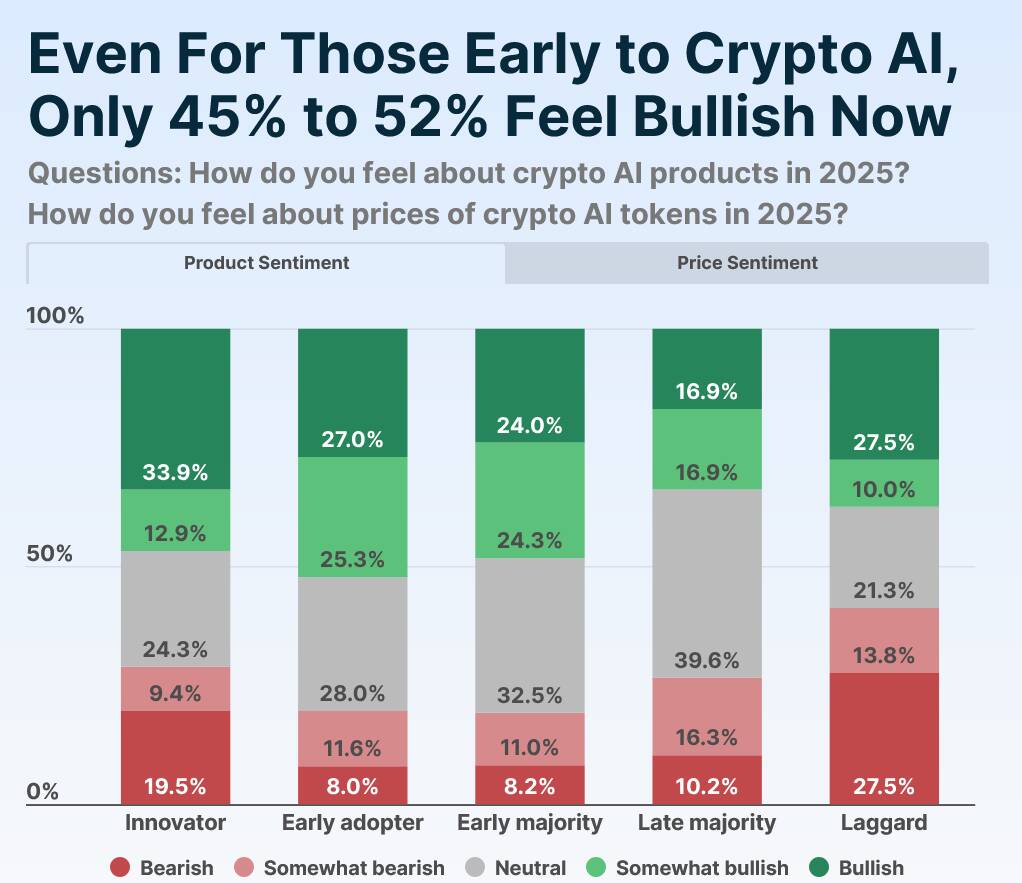

“Responses revealed that early adopters, referred to as ‘innovators,’ exhibited a higher level of bearish sentiment compared to their later counterparts,” Lim explained, emphasizing the varying levels of confidence across different groups.

Experts, such as Spencer Farrar from Theory Ventures, have acknowledged the current experimentation with crypto AI tokens, describing the market as somewhat “frothy.” He anticipates that continued exploration may eventually lead to more substantial applications in this emerging space. Farrar mentioned potential areas of growth, such as decentralized GPU and data provider protocols, which could transform the landscape of how AI interacts with blockchain technology.

As institutional interest continues to rise—with reports indicating that a significant percentage of institutions plan to increase their crypto allocations in 2025—the landscape for crypto AI tokens appears to be shaping up as a crucial niche worth watching. The evolving intersection of cryptocurrency and artificial intelligence presents an exciting frontier, and many are eager to see how these trends will unfold in the coming years.

Survey Insights on Crypto AI Tokens

Recent survey results indicate a growing optimism among crypto investors regarding AI tokens and their potential market impacts. Here are the key points:

- Market Sentiment:

- Approximately 44.3% of respondents are bullish on crypto AI tokens for 2025.

- 25% of respondents are “fully bullish”; 19.3% are “somewhat bullish”.

- Only 26.3% are either somewhat bearish or bearish.

- Sector Growth:

- The crypto AI sector is valued at .6 billion, dominated by tokens like Near Protocol (NEAR), Internet Computer (ICP), and Bittensor (TAO).

- AI agent coins hold a separate market cap of .5 billion, including projects like Artificial Super Intelligence (FET) and Virtuals Protocol (VIRTUAL).

- Investor Differentiation:

- Participants identified as “innovators” show more bearish sentiment compared to “late adopters,” with laggards being the most pessimistic.

- Responses suggest that early adopters are wary as the market matures, reflecting a cautious approach to investing in emerging technologies.

- Future Utility & Market Trends:

- Experts like Spencer Farrar believe that the current crypto AI landscape is “a bit frothy” but anticipate utility may increase as more applications emerge.

- Potential areas for growth include decentralized GPU provider protocols and infrastructure for AI agents, suggesting innovative uses for crypto.

- Implications for Investors:

- Investors may have opportunities to capitalize on smaller market cap ideas that are not prevalent in the traditional stock market.

- Concerns about the speculative nature of these investments can influence decision-making for both short-term traders and long-term investors.

Understanding these trends can help investors navigate the evolving landscape of crypto AI, recognizing both the potential benefits and risks associated with these technologies.

Analyzing the Growing Enthusiasm for Crypto AI Tokens in the Cryptocurrency Landscape

The recent survey by CoinGecko reveals a notable level of optimism towards crypto AI tokens, with nearly half of respondents expressing bullish sentiments. The implications of this data are multifaceted, revealing both competitive advantages and potential pitfalls in the ever-evolving cryptocurrency space.

Competitive Advantages: The survey illustrates a burgeoning interest in the integration of artificial intelligence with cryptocurrency. Not only does this signal a maturation of the sector, but it also aligns with broader tech trends where the demand for innovative applications is surging. The fact that a significant portion of respondents categorizes themselves as “fully bullish” suggests a readiness among investors to embrace speculative opportunities. Furthermore, the endorsement by industry experts, like Spencer Farrar from Theory Ventures, lends credibility to the potential of these tokens, fostering confidence in their future utility and applications. These factors combined may lead to enhanced public interest and greater market liquidity as individuals and institutions alike explore the fusion of AI and cryptocurrency.

Disadvantages: Conversely, the survey’s findings also suggest lingering skepticism, particularly among early adopters, who appear to be more bearish on these tokens. This discrepancy indicates a possible division within the market, as some participants perceive the current enthusiasm as exaggerated or “frothy.” The varied sentiments reflect deep-seated concerns regarding the sustainability of these innovations and the speculative nature of smaller market cap investments. Furthermore, the substantial presence of neutral and bearish respondents could point to apprehension about potential volatility and market manipulation, which could deter some investors from entering the crypto AI domain.

This situation could particularly benefit those investors who are ready to capitalize on market trends and possess a higher risk tolerance, potentially leading to significant returns as the technology matures. On an institutional level, organizations poised to integrate crypto AI solutions into their operations could unveil new efficiencies and operational capabilities. However, it could pose challenges for conservative investors and traditional finance stakeholders who might be slow to adapt or perceive this intersection of AI and crypto as speculative, thus missing potential growth opportunities.

In essence, the intersection of AI and cryptocurrency is a double-edged sword, poised to reshape how we perceive investments while also standing as a cautionary terrain for the less adventurous.