The cryptocurrency landscape is seeing a significant shift as Circle’s Euro Coin (EURC), a euro-pegged stablecoin, is gaining traction amid a backdrop of escalating trade tensions between the U.S. and Europe. In a recent analysis, Alex Obchakevich, founder of Obchakevich Research, noted that as the U.S. dollar depreciates, interest in the euro has surged, leading to a robust increase in EURC’s market capitalization. The stablecoin’s value has jumped from below $84 million at the end of 2023 to over $198 million by mid-April, marking a remarkable 136% increase this year.

As trade tensions loom large, the euro has been gaining strength, currently valued at approximately $1.13, its highest since February 2022. This growth comes as the dollar sees a notable decline, dropping nearly 9.3% against the euro since the end of 2024. With a potential trade deal on the horizon between the U.S. and the European Union, analysts predict that the euro could stabilize around $1.11. However, Obchakevich believes EURC will continue its upward trajectory through deeper integration within various payment systems and blockchain networks.

This bullish outlook is further supported by EURC’s recent deployment on multiple blockchain platforms, including Ethereum and Avalanche, which has enhanced its supply and accessibility. As the stablecoin market becomes competitive, Circle’s strategic compliance with the European Union’s Markets in Crypto-Assets (MiCA) regulation positions EURC favorably against its rivals like Tether, whose stability is being tested by regulatory pressures.

Circle’s achievements in the stablecoin sector are evident; the company holds the distinction of being a leading euro and U.S. dollar-pegged stablecoin issuer, even as the market leader Tether maintains a significant market cap of $144 billion for its USDt stablecoin. However, with ongoing developments and compliance issues, the gap is expected to narrow, particularly as Tether’s reach in Europe faces obstacles.

“I predict EURC to grow to 400 million euros by the end of this year.” – Alex Obchakevich

The evolving dynamics of the cryptocurrency market highlight the substantial impact of global economic conditions on digital assets, with Euro Coin emerging as a notable player during times of fiscal uncertainty.

Growth of Circle’s Euro Coin Amid Trade War Dynamics

The market capitalization of Circle’s Euro Coin (EURC) is rapidly increasing due to the weakening US dollar amid ongoing trade tensions. Below are the key points that highlight this trend and its potential impact on readers.

- Significant Market Growth:

- EURC’s market cap surged from under $84 million to over $198 million in 2024, showing a 136% increase year to date.

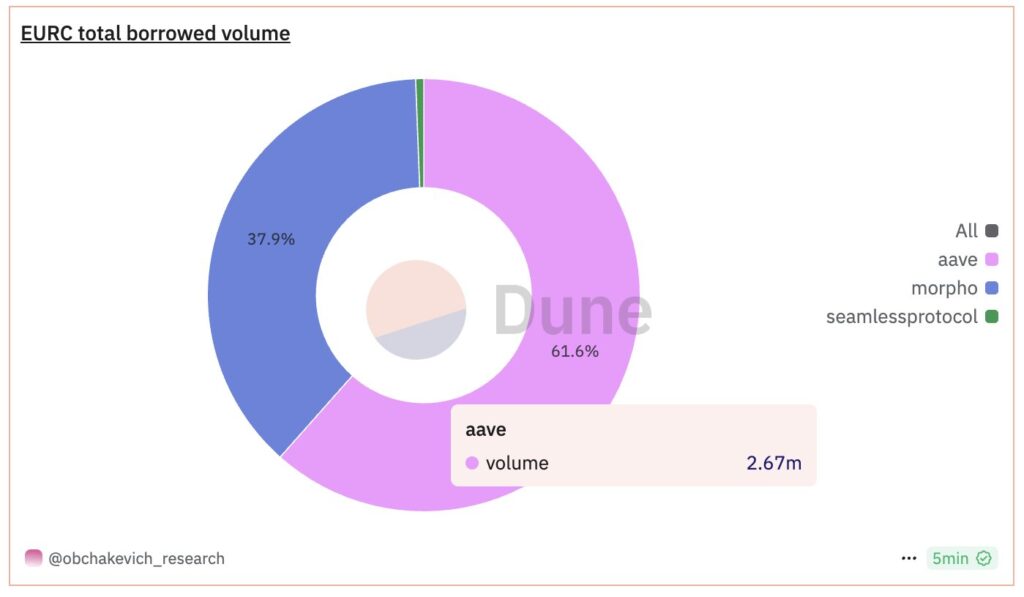

- DeFi protocol Aave received €2.3 million in Euro Coin inflows, indicating growing investor interest.

- EURO vs. USD:

- The Euro has appreciated by 2.2%, reaching $1.13, as the US dollar declines.

- Dollar’s value has decreased by 9.3% against the Euro since December 2024.

- Regulatory Support:

- Circle’s regulatory compliance with EU’s Markets in Crypto-Assets (MiCA) positions EURC favorably compared to other stablecoins.

- Expectations that the USDt may lose ground in the EU market due to non-compliance with MiCA regulations.

- Future Predictions:

- Analyst forecasts EURC’s market cap could reach €400 million by year-end.

- The integration of EURC within various payment systems and blockchains is expected to continue driving its growth.

“The euro’s recent rally comes as the US dollar weakens on the back of escalating trade tensions.” – Alex Obchakevich

This growth in the Euro Coin market capitalization could impact readers by creating more investment opportunities and influencing their financial strategies, especially for those involved in the cryptocurrency and DeFi sectors. Additionally, as stablecoins gain regulatory clarity, users might see increased stability and trust in euro-pegged assets.

The Rise of Circle’s Euro Coin: Analyzing Competitive Dynamics in the Stablecoin Market

The rapid ascent of Circle’s Euro Coin (EURC) reflects a larger shift within the stablecoin ecosystem, particularly as geopolitical tensions influence currency values. As the US dollar weakens due to the escalating trade war, investing interest pivots toward the euro, positioning EURC as a prime beneficiary of this trend.

Competitive Advantages of EURC

One significant advantage for EURC comes from its compliance with the European Union’s Markets in Crypto-Assets (MiCA) regulation. Unlike USDT, which struggles to maintain regulatory adherence, Circle’s strategic alignment with MiCA bolsters its standing as a trusted stablecoin within the EU market. This regulatory favor could propel EURC’s competitiveness, especially as other players such as Tether may find their options limited due to compliance issues. Additionally, Circle’s integration with a diverse range of blockchain platforms like Ethereum, Avalanche, and Solana enhances EURC’s utility and accessibility, driving adoption in decentralized finance (DeFi) spaces.

Current Challenges Facing EURC

However, the road isn’t entirely clear for EURC. The overarching dominance of USDT, with a formidable market cap of $144 billion, can overshadow EURC’s rapid growth. The entrenched user base and liquidity of USDT provide it with significant competitive leverage. Furthermore, market sentiment can pivot quickly based on economic or political climates, presenting volatility that could impact EURC’s trajectory. If the proposed trade agreement between the US and the EU stabilizes the dollar, it may temper the euro’s momentum, influencing investor sentiment and inflows into EURC.

Who Could Benefit or Face Obstacles?

Investors looking for a hedge against a depreciating dollar or those keen on compliant, secure stablecoin options will find EURC particularly appealing. Such interests might lead to increased capital flowing into the euro-based ecosystem, thus fostering growth for decentralized finance projects that utilize EURC. Conversely, US-based traders and projects relying on USDT may encounter challenges as regulatory pressures mount; they might need to pivot toward compliant altcoins like EURC, fostering competition in spaces traditionally dominated by USDT holdings. Additionally, platforms focused on regulations, including exchanges and DeFi protocols, will need to navigate user preferences, which could tilt towards EURC as the market evolves.

In this fluctuating economic landscape, the emergence of Circle’s Euro Coin serves as both a response to current market dynamics and a potential harbinger of a more diversified stablecoin ecosystem. As sentiments shift and regulations evolve, the competitive landscape for stablecoins will likely become even more intricate.